Australian beef gains strong momentum in Vietnam

Key points

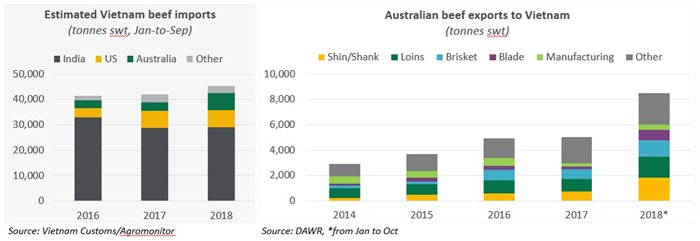

- Australian boxed beef exports to Vietnam are starting to ramp up, following the elimination of 5% tariffs on all beef product lines under the ASEAN-Australia-New Zealand Free Trade Agreement (AANZ-FTA) commencing in January 2018.

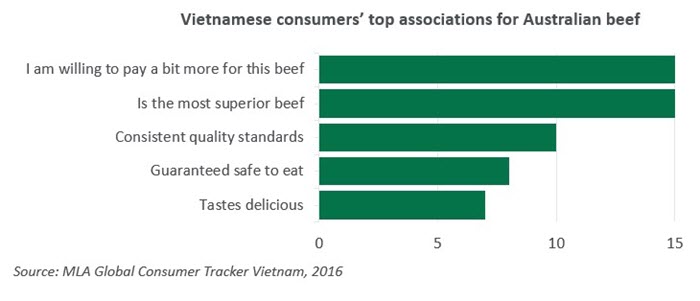

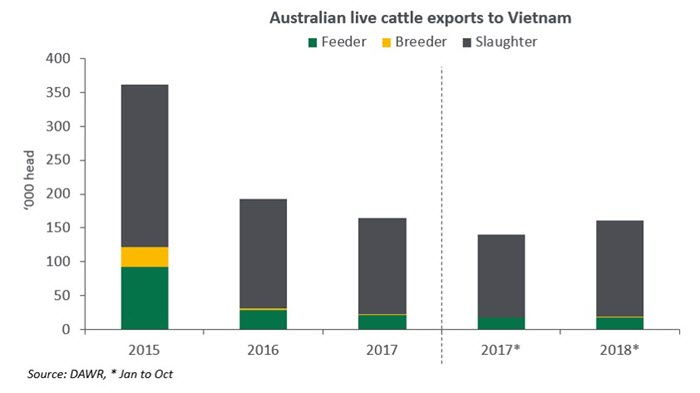

- Local consumers’ strong preference for hot, fresh meat continues to support live cattle export growth, while increasing consumer demand for quality, safe food products creates opportunities for Australia to explore the higher-end segments for both boxed beef and higher quality beef produced locally from Australian cattle exports.

- Australian boxed beef exports to Vietnam jumped 112% to a record 8,500 tonnes swt in the year-to-October 2018. Live cattle exports grew 15% year-on-year to 160,588 head in the same period.

Vietnamese consumer demand for safe, high quality food products increases

Vietnam is a rapidly changing market with evolving consumer demands, underpinned by the fact that it’s one of the world’s fastest growing economies. The population in Vietnam is large, with significant growth in the number of young people with rising incomes, a rapidly increasing number of middle-class consumers, continued urbanisation and modernisation, an open economy and a stable one-party Government.

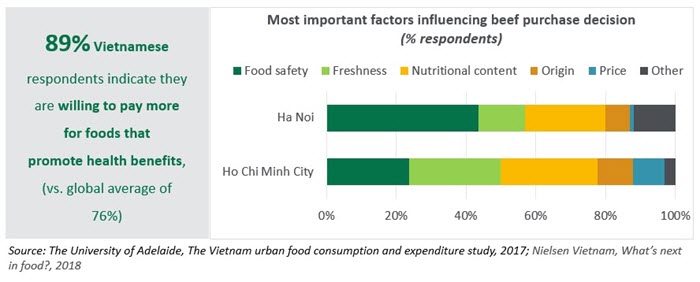

Vietnamese consumers are quite ‘health and nutrition’ conscious. Health and nutrition, along with safety and quality, are major influences on decision making when it comes to beef purchases.

Vietnam should not be considered a purely price-driven market. There is an industry risk in trading low price, low quality products into Vietnam if the industry is expecting to position Vietnam as growth market in the future. There has been a recent influx of large volumes of cheap low quality, short-dated frozen products from many sources, which is decreasing product price but also quality.

Vietnamese consumers are becoming more discerning and the recent increase in number of food incidents, such as ‘fake beef’ (pork or buffalo meat claimed as beef), has resulted in consumers being more conscious of the food they consume. These are driving increased consumer demand for good quality beef products with proven safety credentials, especially in urban cities where consumers have higher levels of purchasing power and greater access to modern shopping channels.

Beef has a special place in the Vietnamese cuisine and is an essential part in the nation’s diet. Believed to have abundant nutritional values, beef is typically eaten for health benefits rather than for daily consumption like pork, chicken or fish. Therefore, the strong desire for trusted food products driven by increased consumer concerns over food safety and hygiene represent great opportunities for Australia to grow in Vietnam by capitalising on its competitive advantages and the positive attitudes towards Australian beef of local consumers.

Leveraging change from an important live export market

Vietnam is Australia’s second largest live export market and has seen 15% growth year-on-year in the past 10 months after a period of subdued volumes as the market adapted to new trading systems.

Although only accounting for about 15% of the beef market in Vietnam, Australian cattle represent the majority of all commercially-produced cattle through Vietnamese feedlots. This has resulted in rapid changes in the industry from a largely fragmented market to a market that is now producing competitive chilled beef products from Australian cattle in only four years. This impact has presented the Australian industry and Government a unique opportunity to work closely with both the Vietnamese Government and cattle industry to direct this development.

The continued expansion of modern retail and foodservice offers good platforms for Australia to grow penetration and brand awareness. While wet markets remain the main channel for beef purchases owing to the culture of grocery shopping in Vietnam, shopping habits are changing, underpinned by the increased footprint of modern retail chains, which are perceived as guarantors of quality. The foodservice sector is also undergoing modernisation, driven by both local and multinational players.

With the Vietnam beef market maturing, there is opportunity for the Australian cattle and beef industry to explore options through the entire supply chain to capitalise on the evolving consumer demands.

Stronger Australian competitiveness with 0% tariffs

Although India is the largest supplier in the imported boxed beef market, their product is generally utilised in institutional settings including factory canteens or mixed into wet markets. It’s generally rejected by consumers and the consumption volume has been decreasing over the last three years. Australian boxed beef competes closely with US beef in both commodity market and higher-end foodservice, modern retail sectors. With tariffs eliminated, Australia has much greater access to the Vietnam beef market compared to the US, which still faces 14% to 30% tariffs.

Unlike other developing markets in South-East Asia where the bulk of Australian beef exports are manufacturing, Vietnam demands higher-value products from Australia. Manufacturing cuts account for only 10% of total Australian beef exports to Vietnam, compared to the region average of 50%. This means that the removal of import tariffs creates further growth opportunity for Australian high value beef exports to Vietnam.