Argentina to re-enter US beef market

Argentina is now eligible to export chilled and frozen beef to the US, following reinstated access announced last week. Argentina’s inspection systems for beef slaughter and further processing has passed necessary audits for approval by the USDA Food Safety and Inspection Service. Previously, Argentine access to the US market was limited to cooked and ready-to-eat processed beef.

Argentina will have a 20,000 tonne swt country specific quota on beef exports to the US, identical to that of Uruguay, and out of quota trade will incur a 26.4% tariff. Australia may face increased competition in the US market from Argentine manufacturing beef but 20,000 tonnes swt is a drop in the ocean when compared to the entire one million tonne imported beef market or the 12 million tonnes consumed annually by Americans. Uruguay regularly fills its allocation of the country-specific quota.

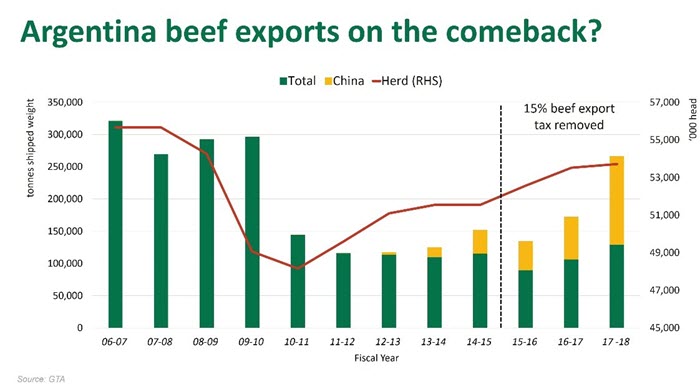

Next year, Argentine beef production is forecast to increase 2% to 3.0 million tonnes carcase weight. Export markets will benefit from the increased supply, while soaring levels of inflation and a severely devalued peso have hit domestic purchasing power. Argentine beef as a result has become extremely attractive to global markets – beef exports totalled 289,000 tonnes shipped weight for the year-to-October, an increase of 71% compared with the same period last year and almost all of which has gone to China. The reintroduction of a beef export tax – four pesos per dollar – has not been enough to limit to outflow of product into global markets.

However, shipments to the US may be muted and limited to manufacturing beef in the short-term, given China is currently sucking up any available beef out of Argentina, and the rest of South America. The high dependence on China – which has accounted for over 50% of Argentine beef exports so far this year – leaves the country somewhat exposed to any significant downturn in demand in China.

While shipments may be capped at 20,000 tonne swt, gaining access to the US market does reflect a move forward for the Argentine beef industry in expanding access globally despite some regions still being FMD-free with vaccination (as opposed to the whole country being declared free of the disease). Next on the Argentine access agenda will be high-value trade opportunities in Japan (Patagonia, a FMD-free region in southern Argentina, gained access earlier this year but only 174kg has since been shipped), Korea and an expansion of its EU footprint as part of the on-going FTA negotiations within the Mercosur block.