Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Are surging lamb prices out of step globally?

28 August 2018

In a matter of two months, east Australian lamb prices have crashed through the 700¢ and 800¢/kg cwt mark, breaking records and grabbing headlines along the way.

So has Australia remained competitive in the global market following the latest surge?

In part, yes. Lamb prices in major exporting and consuming countries have rallied in 2018 and that is on top of consistent year-on-year growth since 2013 – Australia is not alone in this. However, in comparison to competing proteins, global lamb prices risk being out of reach to many consumers.

Who is leading the flock?

When it comes to the global sheepmeat market, Australia and New Zealand drive supply and account for 70% of global product traded. As discussed in the recently released New Zealand Competitor Snapshot, New Zealand has limited capacity to expand sheepmeat exports. Pending seasonal conditions, Australia has greater growth potential, particularly in lamb, underpinned by steadily increasing lambing rates and carcase weights. Nevertheless, neither country is in a position to take on the entire growing global appetite for lamb and mutton.

The other cog driving global markets is China: the world’s largest producer, consumer and importer of sheepmeat. While local production and import demand is cyclical, there has been a long-term divergence between how much the country can produce and what it would like to consume. This growth is adding to demand pressure from Australia’s longstanding traditional sheepmeat markets – such as the US, EU and UAE – and emerging ones – such as Japan, Korea and Iran.

New Zealand slaughter is currently in the midst of a seasonal trough. Meanwhile, the old-season lamb supply in Australia is ever-shrinking and the onset of the early spring lamb crop out of NSW is delayed due the failed season and spiking grain prices. The two global lamb exporters are short on supply and prices are reacting on both sides of the Tasman, as illustrated below.

And it’s not just Oceania. The UK, the largest producer in Europe, and the US, Australia’s largest prime lamb market, also experienced price spikes mid-way through 2018 and broken records over the last twelve months (although the UK has hit a dry spell and, faced with Brexit uncertainty, come off the boil hard in recent weeks). Although at record levels, Australian lamb prices are not too far off from the typical spread to other global players, on a currency-adjusted basis. The Australian trade lamb indicator so far in August has averaged a 6% premium to its New Zealand counterpart – typical for this time of year – and averaged a 17% discount and 5% premium to the national indicators in the US and UK, respectively – neither of which are bounds unheard of.

What could derail the market?

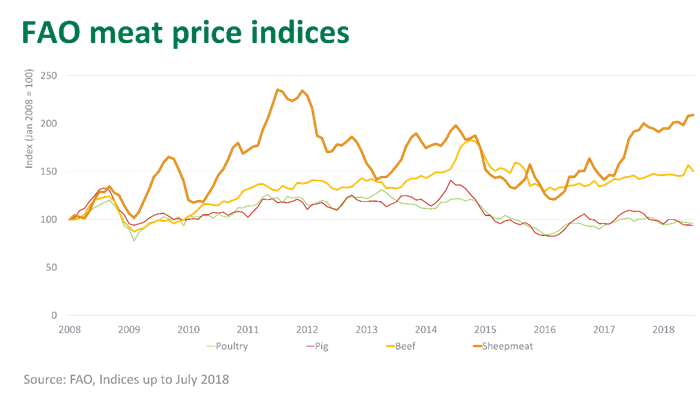

While sheepmeat is largely a niche component in diets across the world, its popularity is growing and global consumption is forecast to increase 2% annually in coming years. However, as highlighted below, the FAO sheepmeat price index has begun to surge above other meat proteins, particularly pork and poultry, and there is a risk consumers will begin to push back on price.

Currency fluctuations will also play a role in Australia remaining competitive, and recent weeks have highlighted the current volatility in global markets – namely, the unfolding Turkish lira currency crisis and the overflow it has had on other emerging market exchange rates. However, Australian exports have so far benefitted from currency swings as capital has shifted to the safety of the US – the A$ is currently trading at 73US¢, down 1.1US¢ from where it opened in August.

And then there’s China. Demand from China has largely underpinned price growth over the last four years, which could be partly reversed if it were to pull back. This withdrawal could take a couple of forms.

Firstly, as outlined last week, the China sheep industry is cyclical in nature – with opportunistic small-scale producers entering and exiting depending on the market. Given 95% of consumption is domestically produced, small shifts in local supplies can lead to major swings in import demand. However, pre-empting the cycle is difficult due to a broad range of interconnecting factors – from Chinese government policy on food security and rural development, to ongoing drought and resource constraints in Inner Mongolia.

Secondly, sheepmeat demand in China could fall victim to the on-going trade war with the US, a devaluation of the yuan and slowdown in economic growth. The tit-for-tat continues, with China imposing a fresh round of tariffs from 23 August on $60 billion of US goods, which Trump may feel obliged to respond to. While the sheepmeat trade is unlikely to be directly impacted by new tariffs – China did slap 25% tariffs on some US sheepmeat products but they reflect little traded volume – the sharp decline in the Chinese yuan may eventually make imports less appealing. More broadly, the Chinese economy has shown signs of stuttering. During the last six months, the Shanghai stock exchange has fallen 17% and is now close to 2015 levels. This market volatility could overflow into the rest of the economy and hurt demand. Given its premium positioning, an economic slowdown would hurt sheepmeat demand.

For now, demand from China has not been affected. China has been Australia’s best performing export market so far this year, with sheepmeat shipments up 43% to record levels (54,600 tonnes swt) in the first seven months of 2018.

The wild card in China, unfolding over the last week, is African Swine Fever (ASF) and outbreaks reported across the north and south country. The severity and wider coverage of the outbreaks are yet to be established, but ASF could lead to significant culling of hogs and place a huge dent in supply of the world’s largest producer and consumer of pork. That could lead to an increased demand for imported pork and other meats, including Australian mutton and lamb, to cover the shortfall.

The season ahead

Australian sheepmeat supply will hinge on the unfolding poor season, and the timing and quality of the new season lamb crop will largely dictate prices throughout the rest of 2018. However, the current Australian lamb market is not too far out of step with major sheepmeat competitor and consumer countries. This largely reflects the limited pool of, particularly high quality, sheepmeat globally and growing demand in key markets. There are risks that could act as brakes but it is likely supply and demand fundamentals will continue to underpin the market over coming years.