What’s ahead for the NZ lamb season?

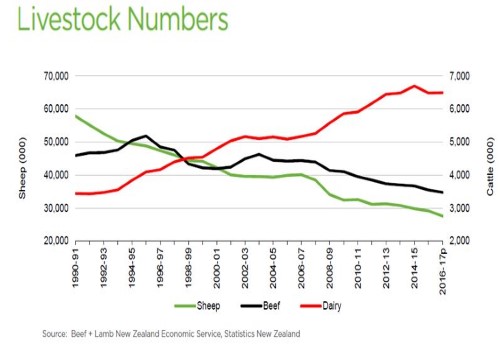

New Zealand’s (NZ) sheep numbers have continued on a downward trajectory this year. In their Mid-Season Update, Beef + Lamb NZ report a provisional 27.6 million head sheep flock for the opening of the 2016-17 season – a 5.3% decrease year-on-year. The anticipation of dry El Niño summer conditions saw a greater cull of breeding ewes in 2015-16, which has had flow-on effects to lamb and hogget numbers in the current season. The decrease in the national flock is in line with the long-term downward trend, as the dairy sector has grown steadily over the last 15 years, as seen in the figure below.

NZ’s lamb crop, as of spring 2016, was provisionally 5.4% lower year-on- year, at 23.2 million head – due to fewer breeding ewes. Reflective of the smaller lamb crop and a reduction in the number of replacement ewe hoggets on hand at the start of 2016-17, Beef + Lamb NZ projected a 3.6% decrease in lamb slaughter from the previous season, to 19.2 million head. Lamb production is expected to decrease, in line with slaughter, by 3.2% to 353,400 tonnes cwt in the year ending September 2017.

The volume of NZ lamb exported is expected to ease 3.2% year-on-year, on the back of reduced lamb availability from fewer ewes. However this may be somewhat moderated by higher carcase weights, as feed availability has improved.

Globally, demand for sheepmeat remains strong, due to tighter supplies from the two largest sheepmeat exporters – Australia and NZ. Although there is strong competition from other meat types in the EU and US, consumer demand for sheepmeat reportedly remains firm. NZ is the major supplier of sheepmeat to China, and exports are forecast to remain relatively stable in 2017. However, Beef + Lamb NZ indicate there are signs consumer demand for sheepmeat China has begun to cool slightly, and local production has increased in recent years – although production growth is expected to moderate in the medium term.

Beef + Lamb NZ reports that economic growth in NZ is expected to remain strong in 2017 with a strengthening dairy sector, strong tourism industry and increases in household spending. For the year ending September 2017, the NZ dollar is estimated to be stronger than last year against all major currencies in which NZ red meat is traded (USD,GBP, EURO).

Key points from Beef + Lamb New Zealand’s Mid-Season Update for the beef industry will be summarised next week.