US imported beef prices march on

US imported beef prices lifted this week, as a result of limited offerings from overseas suppliers, in particular the availability of spot supplies from both Australia and New Zealand.

Australian cattle slaughter has eased in recent weeks, following improved pasture conditions off the back of widespread rain across key cattle producing regions. Indeed, the rain-induced tighter availability has supported prices, as the EYCI (Eastern Young Cattle Indicator) increased 65A¢ during October. Furthermore, the prospect of holiday plant closures in the coming weeks has seen overseas packers in no rush to secure orders from US end users.

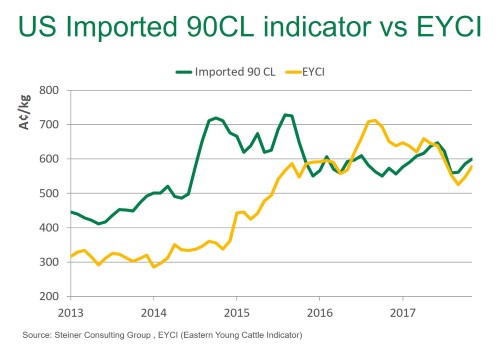

The correlation between the EYCI and 90CL beef indicator over the last 6 weeks is evident, as export prices have been reinforced by an increase in domestic cattle prices.

The imported 90CL beef indicator moved 4.5US¢ higher from week-ago levels, to 213.5US¢/lb CIF (up 18A¢, to 618.18A¢/kg CIF).

The outlook for US beef demand heading into the new year remains robust. The market sentiment is that demand will to continue to improve and this should offer support to fed cattle prices and overall beef prices through 2018.

Highlights from the week ending 17th November:

- US feedlots responded to improved profitability outlook by increasing placements 10% in October

- Fed cattle placements during September and October were up by almost half a million head year-on-year, assuring ample beef supply availability next spring

- Fed cattle futures declined another 1.5% this week following lower cattle prices and slumping wholesale beef values

- Fed cattle slaughter for the week was 509,000 head, 1.6% higher than a year ago. Non fed slaughter at 128,000 head was unchanged from a year ago.

Click here to view Steiner Consulting US imported beef market weekly update