Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

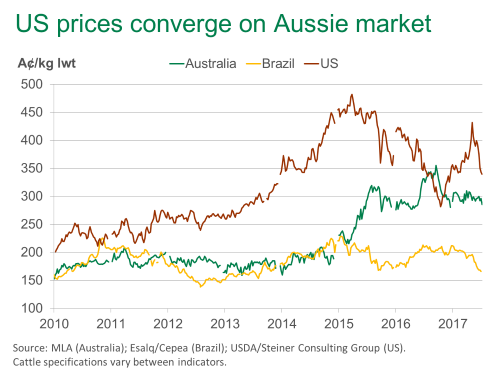

US cattle prices converge on Australian market

18 July 2017

Declining US cattle prices and a stronger Australian dollar, now at 78US¢, has seen markets on both sides of the Pacific move closer to one another.

Heavy saleyard grassfed steers across Australia eased 15¢/kg lwt over the past four weeks; east coast grids have followed a similar trend. However, the decline has been far more spectacular in the US, exacerbated further by recent currency movements. As illustrated below, US Choice Fed steers have declined 92A¢/kg lwt since they peaked at 432A¢/kg lwt in May 2017.

Recent market shifts place US finished cattle prices, on a currency adjusted basis, about 19% above their Australian counterparts. This is a stark contrast to the 2010-2013 average premium of 41%, or the 134% premium when US prices peaked in November 2014.

Brazilian cattle prices have also been lacklustre; the market has been impacted by recent industry scandals and market access changes.

Australian beef enjoyed some respite in Japan and Korea from a surging US cattle market. However, it appears supply fundamentals have come home to roost and the US market is now far more reflective of the growing beef production coming through the supply chain.

In the July edition of the World Agricultural Supply and Demand Estimates, the USDA revised forecasts for 2017 beef production higher, to 12.0 million tonnes cwt, up 5% on 2016. In contrast, recent MLA projections have forecast just a modest increase in 2017 Australian beef production, to 2.2 million tonnes cwt, up 2% year-on-year but off a very low vase.