Retail prices ease as exports cool off

Plenty has changed in the space of two years. Unprecedented export demand, which diverted beef from the domestic market, has eased; US production has recovered from a cyclical trough and there is greater competition across a range of key export markets. Meanwhile, Australian cattle slaughter has contracted from a four decade high to a two decade low.

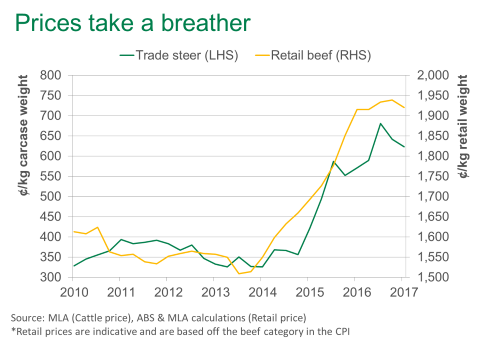

With respect to the domestic market, the former of these forces has overshadowed the latter. Indicative retail prices during the first quarter of 2017 eased for the first time since 2013. As illustrated below, cattle prices declined over the same period but remain historically high.

Subsequently, after bottoming out mid-2016, domestic beef utilisation (a measure of production less exports) increased up to the end of March this year. Over the twelve months ending March, the domestic market accounted for 30% of production, above the 25% recorded in 2015 and in-line with the five-year average.

While there has been a short term strengthening of the US domestic market since the start of the year, prices still remains below the 2014-2015 peak, and growth in US beef production will continue to place competitive pressure on Australian product around the world. Meanwhile, Australian beef production is expected to begin increasing in the latter half of 2017 and continue over the next few years, providing further support for the domestic market.