Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Red meat prices reflecting supply

01 August 2017

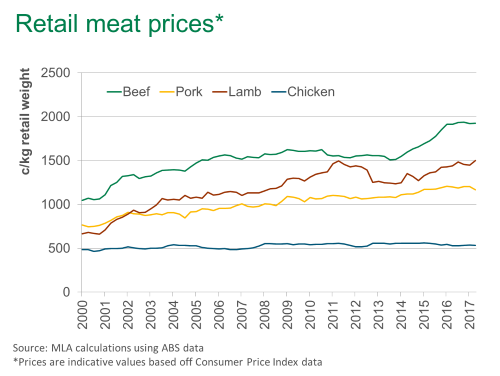

A range of retail price trends can be teased out of the June quarter Consumer Price Index data. They highlight the ongoing supply-side price pressure on red meat during the first half of 2017 and the current competitiveness of chicken and pork.

After easing for the first time in two years in the first quarter, indicative retail beef prices picked up marginally during the second, to $19.26/kg retail weight (rwt). Meanwhile, indicative lamb prices jumped to surpass the previous peak in 2011, to $15.01/kg rwt. However, given the timing of the series and stickiness of retail prices, what is not reflected in the aforementioned indicators is the subsequent fall in cattle and lamb saleyard prices over the past six weeks.

The figure below illustrates indicative retail meat prices in Australia.

What is also clear is that chicken retail prices have failed to budge while pork has not increased at the same rate as beef and lamb. In fact, under the weight of growing pig supplies, retail pork prices have eased for the last two quarters.

The current retail market is being heavily influenced by the lack of supply. However, MLA forecasts beef supplies to begin to pick up in the second half of this year and lamb to recover in 2018. This will go some way to alleviating the current high price multiples of beef and lamb over pork and chicken.

June quarter meat production (across all species) will be published in the next two weeks and will be very telling of shifts in competing protein levels over the last financial year.