Positive outlook for the US beef industry

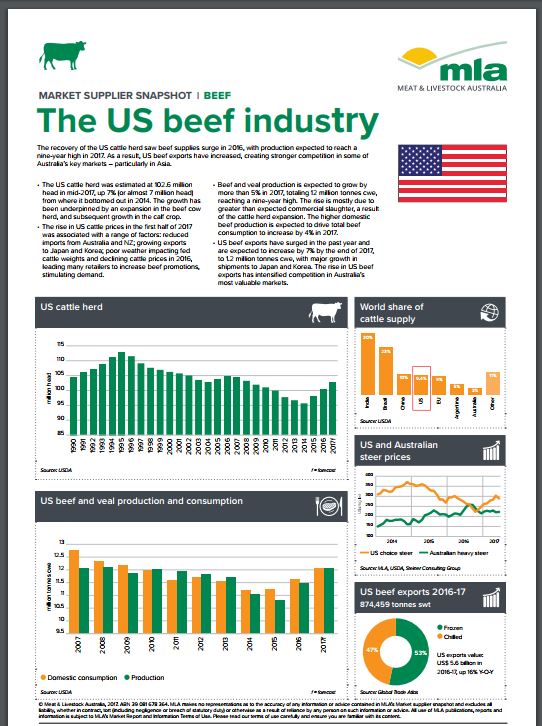

The US cattle and beef industry enters the 2017–2027 decade having gone through a very volatile period in terms of pricing and production. Cattle and beef prices reached record highs in 2014–15 after hitting 50 year lows in inventories, coupled with diminished slaughter levels. However, the outlook for the US beef industry indicates production is set to continue to expand, which is likely to create stronger competition in some of Australia’s key markets – particularly Asia.

According to GIRA, the US cattle herd will continue to recover in the coming years before it begins to contract with lower cattle numbers expected for 2022, until it expands again to reach 106 million head by 2027. US beef production will follow the cattle herd cycle, reaching 12.2 million tonnes cwt by 2027. The production forecast for 2027 represents an increase of 7% from 2016 production (11.4 million tonnes cwt). This rise will be mostly driven by the expected growth in slaughtered cattle, as average carcase weights are forecast to remain relatively steady.

The cost of livestock production in the US is likely to grow (albeit modestly) in the next decade with labour, veterinary, energy, material and transport costs all expected to increase slightly but less so than other key beef producing regions. Meanwhile, the US beef industry will continue to be highly dependent on (and exposed to) volatility and fluctuation in the cost of feed – overwhelmingly the largest component of the cost of production for US producers.

US total beef consumption is expected to have consistent growth over the next decade, driven by production stability and improved domestic demand. Beef imports are also forecast to grow with Australia, Canada and New Zealand to remain the main suppliers, as imports from South America are not expected to have a notable increase due to quotas, slower adoption by importers and competition from existing suppliers.

This story is written by MLA’s Global Industry Insights & Strategy Team. If you have any queries or feedback, please let us know: globalindustryinsights@mla.com.au.

To view MLA's US Global snapshot, please click here.