Lamb prices resist spring lull

Key Points:

- The lamb market has bucked the typical seasonal decline through spring.

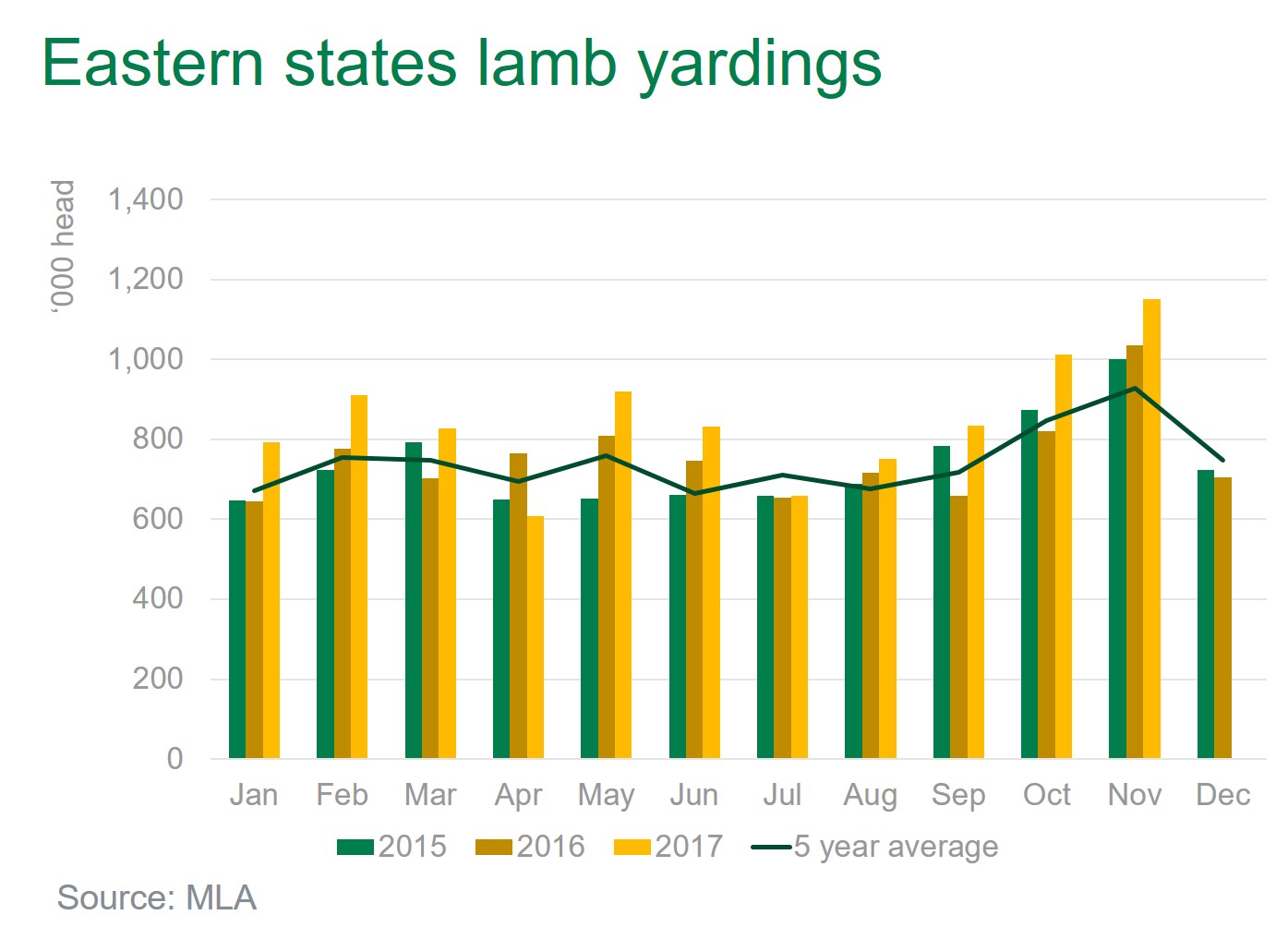

- September through to November lamb yardings totalled almost 3 million head across the eastern states, about 500,000 above the five-year average and 2016 levels.

- Tighter small stock slaughter supply is keeping the pressure on lamb prices this late in the year.

Eastern states lamb prices have started summer at the highest levels on record, following the trade lamb indicator tracking sideways since July (between 580–630¢/kg cwt) and closing Tuesday's markets at 616¢/kg cwt – up 96¢/kg cwt year-on-year.

The lamb market has bucked the typical seasonal decline through spring and summer when southern new season lamb supplies hit the market. So how is this year's spring lamb crop shaping up?

Weather impacting winter-spring yardings

Above-average rainfall was recorded across Victoria over winter and much of the state received average falls across spring. Meanwhile, parts of NSW experienced some relief with a much needed seasonal break in October after a largely dry autumn and winter.

Poor feed conditions have pushed increased lamb numbers through NSW saleyards since May and supplies peaked in September, with 620,000 lambs yarded across the month. NSW yardings eased across October and November, but remained above year ago levels.

In contrast, good seasonal conditions in Victoria and parts of SA have meant lamb supplies have largely followed a normal seasonal trend, but some marketing decisions may be pushed back due to feed availability and some producers opting to get a wool clip off Merino lambs prior to selling in the New Year. Yardings across Victoria and SA peaked in November, with 500,000 and 173,000 yarded across the month, respectively.

On balance, September through to November lamb yardings totalled almost 3 million head across the eastern states, about 500,000 above the five-year average and 2016 levels. Sheep yardings were also above the five-year average, though comparable to numbers observed in 2015.

Slaughter yet to lift

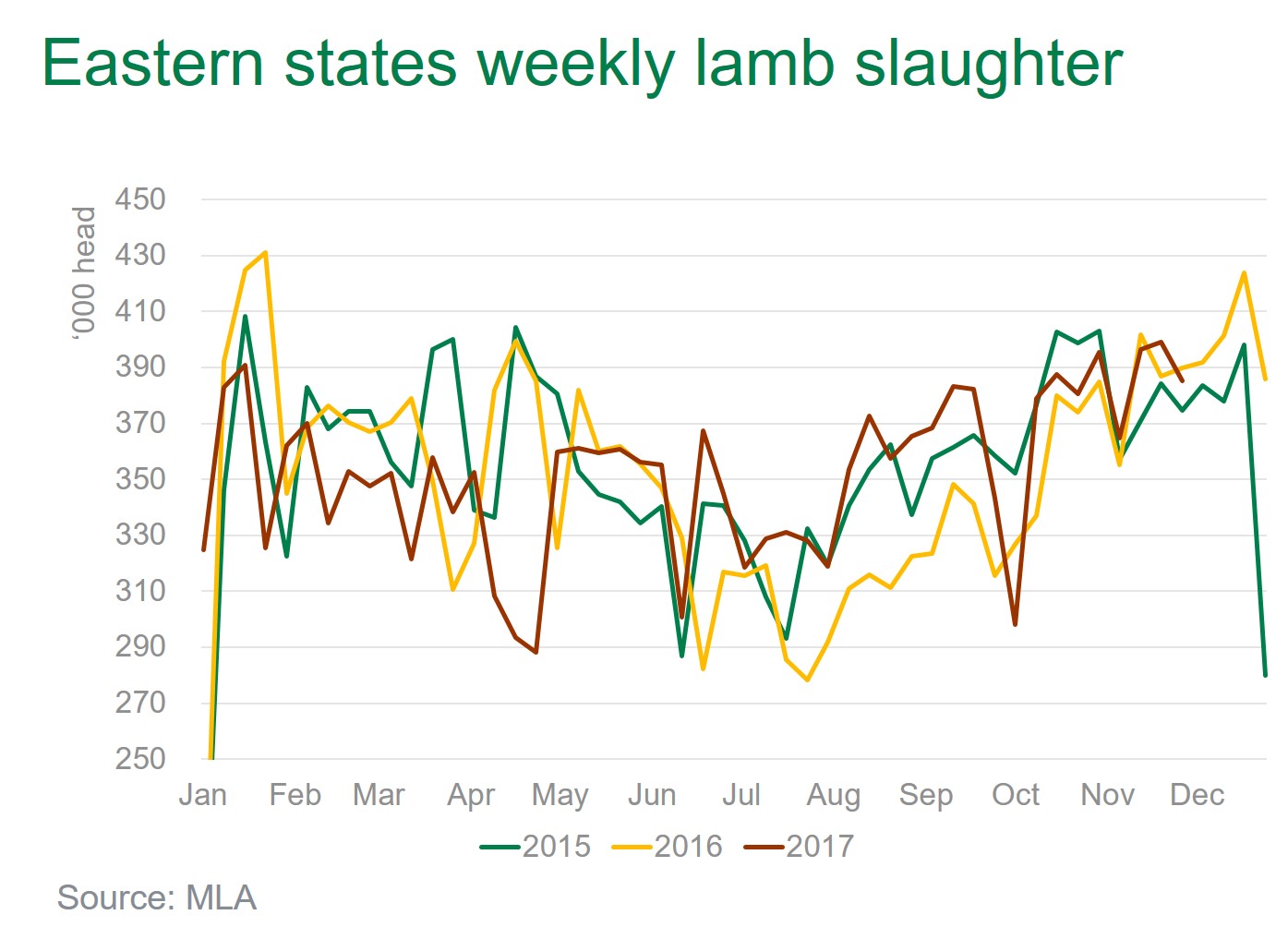

September through to November weekly eastern states lamb slaughter averaged 373,000 head, roughly in line with the five-year average. This implies producers are pushing increased numbers through the physical market this season instead of direct sales, and larger yardings are not necessarily indicating a major lift in overall slaughter lamb availability.

Furthermore, lamb supply is not the complete picture. While mutton slaughter has lifted above year-ago levels over the last two months, goat supplies remain tight. In fact, average weekly small stock slaughter during the 2017 spring – a good indicator of how busy kill floors are – was 13% below where it peaked in 2014 and 5% below 2015 levels (partly affected by plant shutdowns over that period).

Tighter small stock slaughter supply is keeping the pressure on lamb prices this late in the year.

NZ market tracking closely

New Zealand, Australia's largest global sheepmeat competitor, has been unable to boost production over the past three years, and has also experienced strong lamb prices.

New Zealand sheepmeat exports totalled 326,000 tonnes swt during the first 10 months of the year, up 3% year-on-year but below volumes shipped across 2013–2015. While both Australia and NZ have registered some sheepmeat export growth this year, increasing prices in both countries indicates demand for sheepmeat globally is outpacing supply.

New Zealand lamb prices (17.5kg carcase weight) have posted solid gains since March, averaging 652A¢/kg cwt in November, providing further support to the Australian lamb market.