How is 2017 shaping up?

For the first six months of 2017, the Australian cattle market has remained at historically high levels, supported by short supply and strong restocker demand as a result of sporadic rainfall.

Restockers have been a driving force in the market this year. The national saleyard restocker yearling steer indicator averaged 372¢/kg lwt for the first six months of 2017 – holding, on average, a 31¢ premium above its processor-purchased counterparts and at times reached a 62¢/kg lwt difference.

The prime market, however, has seen some disparity develop between that of the store market. While young store cattle have attracted strong support, the medium cow saleyard indicator has eased 16¢/kg lwt from the start of 2017. This is despite US 90CL import prices following an upward trajectory since January. Similarly, processor purchased yearling steers closed June 12¢ cheaper from where it started the year, while restocker yearling steers were 2¢/kg lwt dearer than in January.

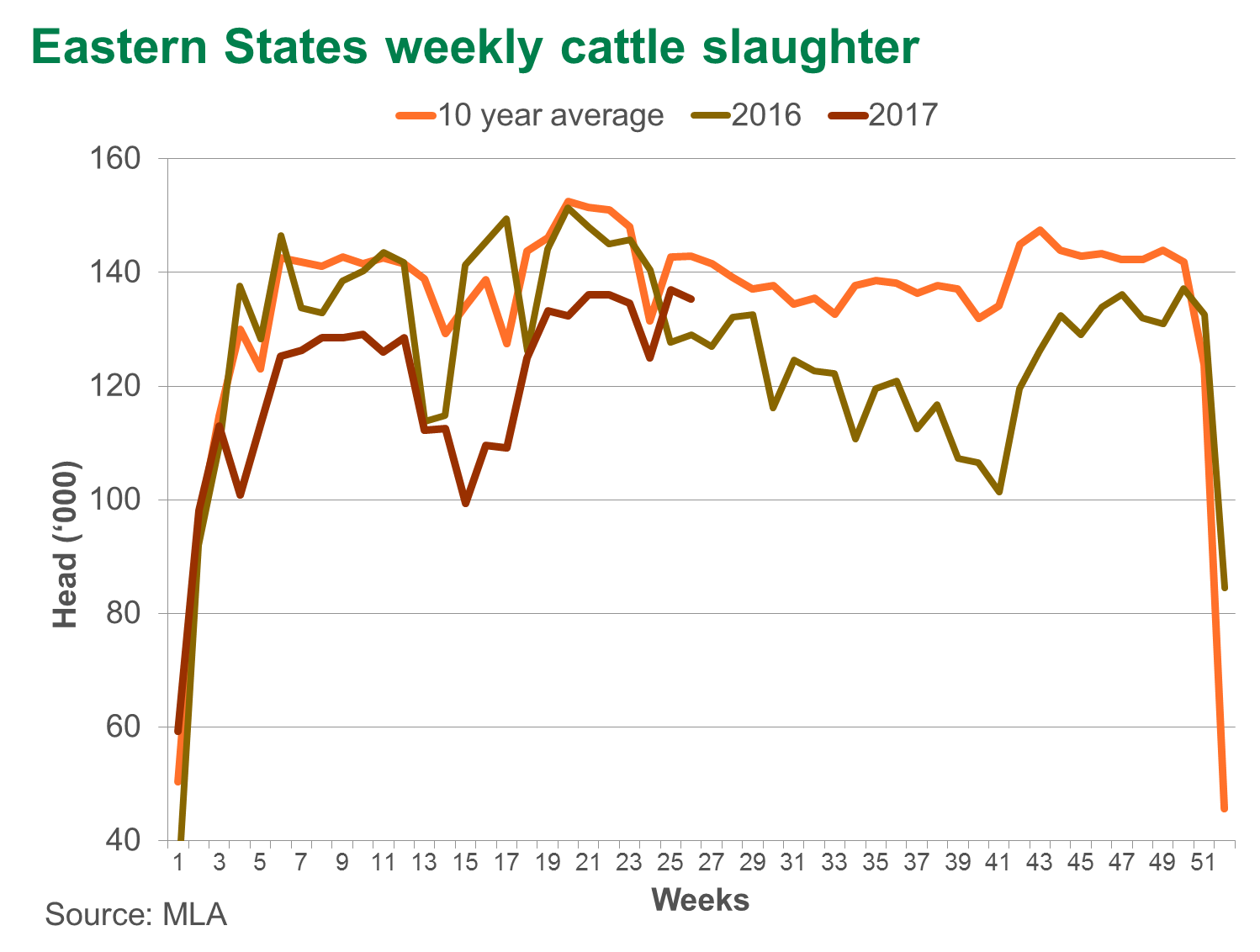

With the herd rebuild underway, weekly eastern states slaughter consignments have remained well-below long-term average levels. However, in June, the eastern states cattle kill surpassed year-ago levels for the first time in three years, with over 137,000 head and 135,000 head processed in the last two weeks of the month, respectively.

The lift in processing coincided with cattle prices falling to below year-ago levels. The EYCI eased to 633.25¢/kg cwt on the 22nd of June, registering the first negative year-on-year change since 2014. The benchmark indicator closed June on 621¢/kg cwt.

A dry to start to winter and a poor rainfall outlook for the July to September period, along with a slowly building herd, will likely see available supplies continue to mount through the remainder of the year. This is expected to put downward pressure on prices.

While the market has seemingly started to come off the boil, it is still at historically high levels. Restocker activity, continual growth in export markets and reducing tariff regimes, along with a favourable A$, should underpin the Australian cattle market to remain above the long-term average.