Herd, flock recovery driving shift in protein production

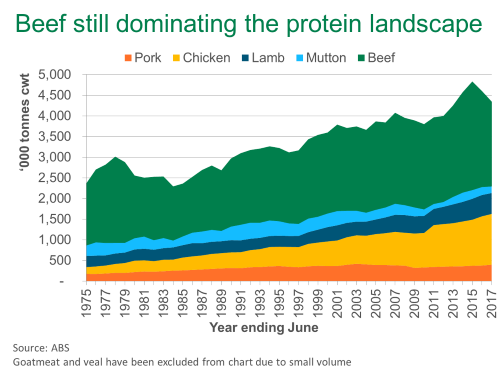

Growth in chicken and pork production over the past twelve months is a stark contrast to the fall in red meat production.

Supported by lower grain prices, pork production increased 5% year-on-year in 2016-17, to 397,000 tonnes cwt (still shy of the 420,000 cwt recorded in 2002-03). Chicken production increased 3% to a record 1.23 million tonnes cwt, marking the ninth consecutive year of back-to-back production growth.

Far more sensitive to seasonal conditions, Australian red meat (beef, sheepmeat and goatmeat) production declined for the second consecutive year, after peaking at an unprecedented 3.41 million tonnes cwt in 2014-15. With evidence of the sheep flock and cattle herd in rebuild phase, both species registered a contraction in production.

While still dominating the protein landscape, in 2016-17 red meat accounted for 63% of total Australian meat production – well below the 87% recorded during the height of herd liquidation in 1977-78.

In 2016-17:

- Beef production declined 12% year-on-year, to 2.05 million tonnes cwt;

- Veal production was back 27%, at 20,100 tonnes cwt;

- Mutton production fell 17%, 163,000 tonnes cwt;

- Lamb was back just 2%, at 506,000 tonnes cwt;

- While goatmeat declined just 1%, to 33,000 tonnes cwt.

Looking ahead, red meat is expected to recover from the current trough. Beef and sheepmeat production in 2018 (calendar year) are both expected to increase 3% year-on-year.

Click on the links below for the latest release of MLA’s cattle and sheep industry projections: