Gaining a greater market share in the UAE

Key Findings

- Key to success in the UAE market is to understand the unique local environment: the stratified society, the retail landscape, and the regional idiosyncrasies.

- Australian lamb and beef providers need to be willing to address local needs and differentiate from the competition on key factors.

- The True Aussie brand has strong recognition, especially amongst respondents in the top income bracket, and Western Expats.

A unique melting pot

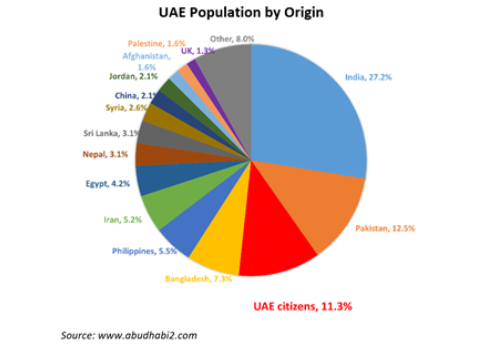

In less than fifty years of existence, the United Arab Emirates (UAE) has established itself as one of the key transport, tourism and trade hubs of the Arabian peninsula. It’s a market with unique conditions, one of them being the fact that the majority of residents are expatriates, and not citizens.

It’s a highly stratified society, with many workers drafted from subcontinental Asia to fulfil the booming demand for construction and civil works with management roles filled by professionals from all corners of the world.

In MLA’s 2017 Global Consumer Tracker, we focus our attention on three main sub-groups of the middle-class population: local Emirati, Expat Arabs from elsewhere in the region, and Western Expats. These groups exhibit many differences in their meat purchase and consumption habits and attitudes, but also many similarities.

Lamb is a premium protein choice

As is common in the region, in UAE lamb is the “prime” meat choice for most consumers. Although beef and chicken are consumed more often, these meats are seen more as staples; lamb is seen to have advantages on taste, premium perceptions, and it is more likely to be a family favourite. This is especially the case amongst local Emirati.

Australian lamb and beef are well-known and well-regarded

UAE residents are used to many food products being imported (up to 85% of all food), and so are well aware of imported lamb and beef, with Australian product leading other importing countries. However, local product is generally preferred, largely due to a preference for freshly slaughtered meat that is guaranteed Halal, although numbers of locally bred sheep are low and a minimal supply of beef comes from the local dairy industry.

The True Aussie brand has strong recognition, especially amongst respondents in the top income bracket, and Western Expats.

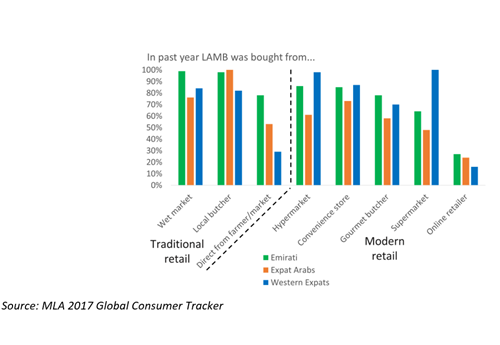

Fresh is best

Given a choice between frozen, chilled, or freshly slaughtered lamb and beef, most consumers would prefer what they perceive to be freshly slaughtered. This stems from a rich tradition of wet markets and both traditional and modern butchers, amongst both local Emirati and Expat Arabas. Western Expats prefer chilled or frozen, but they will also visit wet markets to make their purchases.

An opportunity to differentiate based on what makes Australian lamb and beef special

The UAE market offers great opportunities for Australian lamb and beef for providers willing to address local needs and differentiate from the competition on important factors. For instance, many shoppers are looking for ‘natural’ cues when purchasing. There is a general preference for meat to be a little pinker than in Western and Asian markets. Many consumers are suspicious of large cuts, and there is a preference for lean meat.

Australian meat, like all other imports, needs to communicate to the consumer the freshness of chilled product and the benefits of frozen product. An emphasis on food safety, traceability, and the Australian Halal certification systems is crucial to market development.

The key to success in the UAE market is to understand the unique local environment: the stratified society, the retail landscape, and the regional idiosyncrasies - and to plan accordingly.