Feeders ease

Feeder cattle prices have been a key driver of the Australian cattle market, albeit a sharp lift in grain prices over the last few months did see indicators soften in July, as lot feeder margins were squeezed. As at 31 July, the national feeder yearling steer indicator was 321¢/kg lwt, a decline of 5% (16¢) month-on-month and almost 50¢ lower year-on-year.

Darling Downs (Queensland) wheat prices averaged $324/tonne in July, 11% higher month-on-month and a considerable 44% increase since the beginning of the calendar year (Profarmer). Seasonal conditions and global grain price movements have played a fundamental role in this price shift. Click here for more information on global grain price movements.

Deteriorating seasonal conditions over the last couple of months, combined with a poor rainfall outlook has resulted in restocker demand subsiding somewhat, which has seen stronger feeder cattle buyer activity.

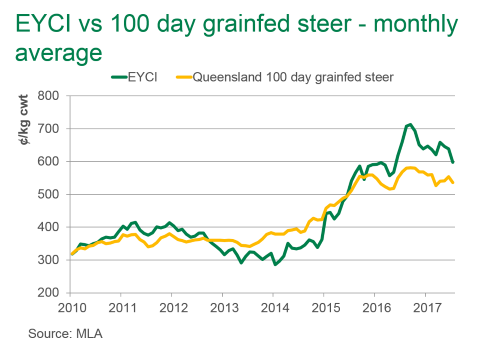

However, the dry conditions have placed downward pressure on the cattle market. The Eastern Young Cattle Indicator (EYCI) averaged 598.31 ¢/kg cwt in July, some 62¢ below year-ago levels. The Queensland 100 day grainfed steer over-the-hook indicator averaged 536¢/kg cwt in July, down 32¢ compared with last year.

The EYCI currently carries a 62¢ premium when compared against the Queensland 100 day grainfed steer over-the-hook indicator, however this margin is narrowing – in August 2016, the EYCI held a 128¢ premium. The higher premium last year was driven by extremely tight supplies of store cattle. A year on, increasing store supplies have started to erode the premium.

The Queensland 100 day grainfed steer indicator has been afforded some shelter from the downward pressure, however, as demand from overseas markets for grainfed product is robust. For the 2016-17 fiscal year, the proportion of Australian grainfed beef exports of total beef exports reached 27% – the equal highest fiscal year share on record with that of 2006-07.