Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Enticing times for Australian sheep producers

28 February 2017

Weather permitting, there’s rarely been a time when sheep producers have had a stronger incentive to retain ewes. Why?

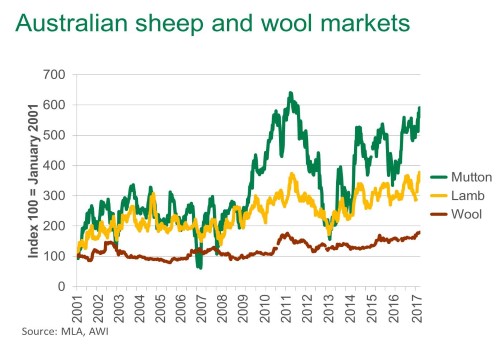

To begin with, lamb prices started the year in one of the strongest fashions on record as a result of limited availability. This is likely to remain an influential factor for the duration of 2017 in the wake of poorer lamb markings in 2016, with current expectations for only 22 million lambs to be processed, down 1 million head from the year before. Adding to the competition for the lighter spectrum of the lamb market is low feed grain prices, which is tempting some producers to opportunistically feed, and in turn exacerbating the short term tight supply situation.

Similarly, and as a combined result of limited lamb availability, mutton prices have also had an extraordinary beginning to the year, which like lamb, is more than likely going to continue for the duration of 2017 – potentially only accentuated by producers retaining more ewes than previously.

In addition, wool prices are at near record levels, with the wool Eastern Market Indicator last week edging up to 1,449¢/kg, largely on the back of limited availability and strong Chinese buyer interest. As reported by Australian Wool Innovation (AWI), prices are expected to remain buoyant as this past week’s purchasing was dominated by local traders and it is widely expected that the large Chinese indent operators can ill afford to “sit out” for too long, particularly in the quality Merino sector.

Finally, assisting the Australian sheep and lamb markets and incentivising producers to retain ewes in anticipation of the strong market conditions to prevail is New Zealand’s low lamb slaughter (Agrifax HQ), meaning competition from the only other major sheepmeat exporter will remain subdued.

With all of these market conditions at play, it’s quite clear why producers that can retain ewes are doing so, however, there are of course risks to the outlook, and more immediately is the three month rainfall forecast. For the autumn months across the largest sheep producing regions of Australia there is a high probability of receiving below average rainfall, which if it comes to fruition will more than likely taint the market.

Of further concern is the sustainability of the high sheep and lamb prices along the supply chain, and the potential pressures placed on processers, exporters and consumers. While there has been one NSW plant closure recently, and a considerable number of shifts reduced, it does pose some concern over capacity once supplies eventually recover.

In the interim, sheep and lamb availability is likely to remain constrained for the duration of 2017, likely seeing a continuation of the strong sheepmeat and wool prices, and greater number of ewes retained. This will probably eventually result in a greater lamb crop, accelerating the replenishment process in 2018.