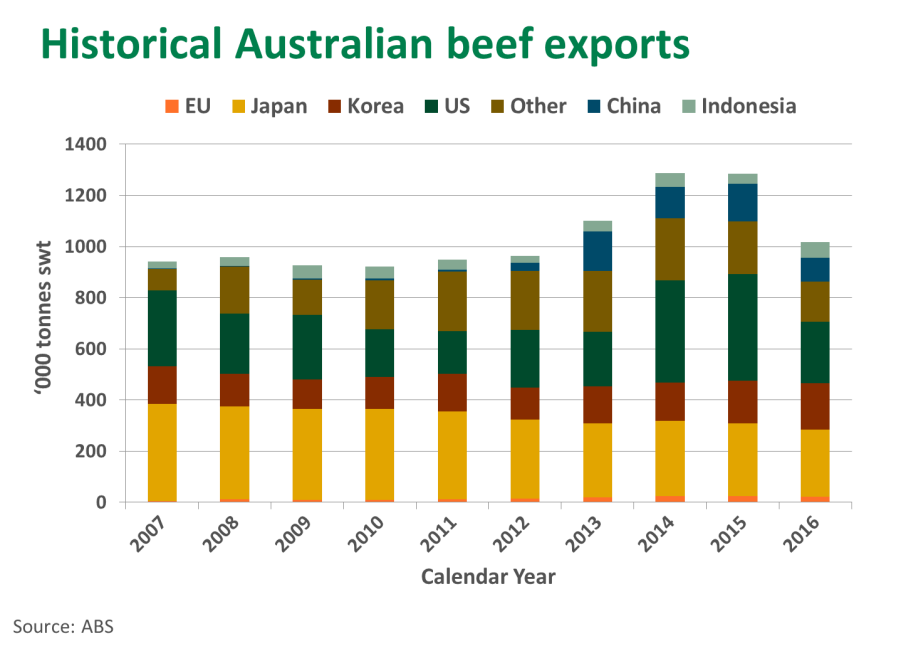

Beef export volumes decline during 2016

Total beef exports for 2016 were down 21% year-on-year, influenced by constrained supplies, currency fluctuations and diverging production trends in major importing countries. The latest global beef exports summary for December reports 89,351 tonnes shipped weight (swt) during this period, bringing the 2016 total to 1.01 million tonnes swt. Despite the decrease, 2016 was the fourth consecutive year beef exports exceeded one million tonnes.

Supply synopsis

Although demand for Australian beef has not waned, limited supply throughout 2016 affected export figures. Australian beef production as of October totalled 1.77 million tonnes cwt, 18% lower than the year-to-October 2015 total (2.17 million tonnes cwt). Domestically, the cattle herd reached a twenty year low of approximately 26 million head, creating strong competition between restockers, feedlots and processors for the limited availability; reflective in the Eastern Young Cattle Indicator (EYCI) breaking through the 700¢/kg cwt. Year-to-October slaughter numbers were back 21%, - albeit off a high base following the extremely high cattle turnoff seen in both 2014 and 2015 as significant drought affected the cattle producing regions. However, the 6.6 million head of cattle slaughtered year-to-October in 2016 still tracks 10% lower than the 10-year average, underlining the tight supply.

Currency movements

The Australian dollar has seen upward trends against most major trading partner’s currency across the entirety of 2016. A$/US$ moved 3US¢ higher over the course of the year, currently trading at 73US¢. A number of key political outcomes throughout 2016 created an element of volatility in the market; the US election triggered the dollar to rally into the New Year, pulling the Australian dollar lower. A$/YEN moved just shy of 10¥ higher from October until December, stimulated primarily by the strengthening US$. A$/KRW peaked at 903₩ in March; economic down turn in South Korea offered some yield to the Australian dollar however the impeachment of the South Korea president at the close of 2016 provided some resistance – currently trading 883₩. ‘Brexit’ caused shockwaves across the European Union, as the United Kingdom voted to the leave; creating an extremely attractive proposition for Australian exporters if trade access can be granted. Since the vote was confirmed the Australian dollar has moved 20% higher against the GBP. For exporters a strong Australian dollar means a less attractive product for import destinations as it drives prices higher and creates a more expensive commodity.

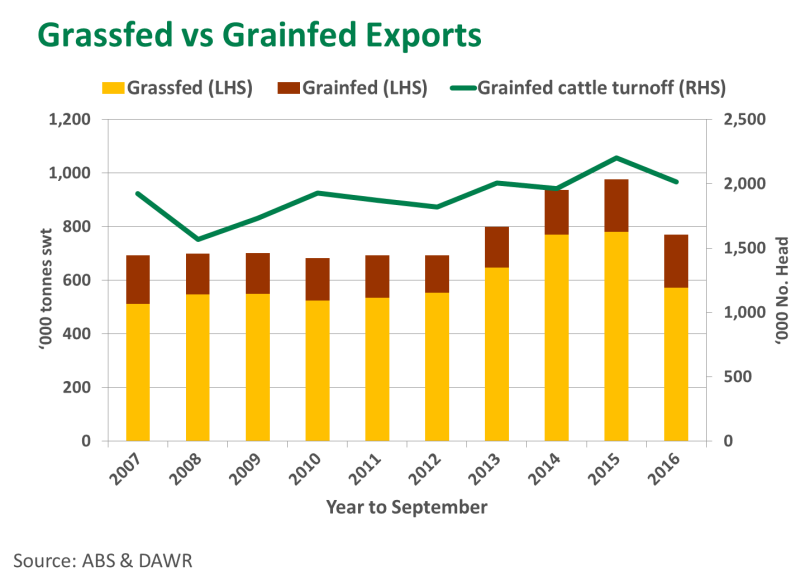

Grassfed / Grainfed trends

Grassfed exports declined 27% year-on-year, as opposed to grainfed cattle which remained in line with the volumes exported in previous years. Total grainfed exports for the year reached 260,386 tonnes swt; year-to-September grainfed exports were 196,096 tonnes swt, around 1% higher year-to-date from the previous year. Higher global grain availability resulted in lower feed grain prices and fodder prices also moved lower as a result of extensive rainfall. Feedlot cattle turn-off for the year-to-September were a little over 2 million head, despite being down 8% year-on-year; with favorable feed and demand for grainfed product in some major export markets high, cattle marketing’s were 6% higher than the 10-year average for the year-to-September.

Exports to the US

Beef exports to the US declined 42% year-on-year, underpinned by tight domestic supply but also a recovery in US production which increased 6% for the year-to-October. It should be noted that the lower exports are compared to a high base, having reached quota for the first time the previous year. The 90CL indicator has been under supply pressure throughout 2016, with exports for manufacturing 90CL beef down 48% to 48,503 tonnes swt. Imported prices for 90CL beef topped 609A¢/kg CIF in July this year, compared to 728A¢/kg CIF in 2015, as a consequence of higher domestic availability.

Exports to South Korea

Korea has been a growth market for Australian beef, with shipments moving 8% higher year-on-year. Total beef exports reached 179,854 tonnes swt, with grainfed beef attributing 55,576 tonnes swt, a 26% increase year-on-year. Grassfed beef exports to Korea were up 1% year-on-year at 124,098 tonnes swt. Favorable market conditions in Korea helped Australian export volumes during 2016. High priced domestic Hanwoo beef coupled with low production resulted in reduced consumption of domestic beef. Increased beef imports with higher price competitiveness against the local Hanwoo beef made up for the shortage in domestic beef supply.

Exports to Japan

Total beef exports to Japan declined 7% year-on-year, with both grass and grainfed exports fallings by the same margin, beef exports to Japan for 2016 reached 264,325 tonnes swt. Since Japan has removed import restrictions on US beef following the BSE outbreak, the US has started to reclaim a greater share of the market. Despite a favorable tariff rate for Australian producers over the US, prices for Australian beef remain high globally, especially for chilled beef. Indicative Australian export prices to Japan for cube roll moved from 1,184 A¢/kg in April 2015 upwards to 1,922A¢/kg in October 2016.

Other markets

Beef exports to Indonesia increased 58% year-on-year as the Indonesia government sought to bring domestic prices lower, import quotas on beef were increased as a result with the majority of beef coming from Australia and New Zealand. Total beef exports to Indonesia reached 61,676 tonnes swt.

Beef exports to China finished 2016 at 129,953 tonnes swt – down 30% year-on-year. The expansion of Brazilian product into China, particularly for frozen beef facilitated a reduction in Australian frozen beef exports. However, higher quality grainfed beef exports to China increased 9%.

Exports to the MENA region totalled 30,798 tonnes swt – a 42% decline year-on-year. Volumes to Saudi Arabia witnessed the majority of the decline, as imports from Brazil continue to increase following the re-introduction of Brazilian beef imports in 2015.

Grainfed exports to the EU remained stable throughout 2016, declining only 1% year-on-year. Demand for Australian grainfed product has been stable ever since access was gained to the EU grainfed quota in 2010. Total beef exports to the EU totalled 20,841 tonnes swt, an 11% year-on-year drop, with grassfed volumes moving 34% lower year-on-year.