Australian premium lamb opportunities in the Middle East

The growth story of Australian lamb exports to the Middle East

The Middle East[1] has grown to become one of Australia’s most important sheepmeat markets over the last twenty years. When considering lamb by itself, Australian export volumes to the region grew eight times between 1995 (at 8,176 tonnes swt) to an all-time peak in 2015 (at 68,355 tonnes swt). The Middle East now accounts for almost a quarter of all Australian lamb exports, including 3 of our top 10 markets in United Arab Emirates (UAE), Qatar and Jordan.

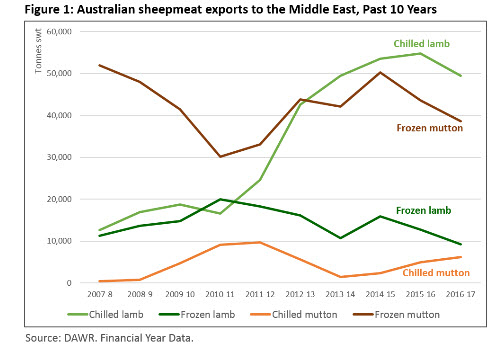

Over the past 10 years, Australian sheepmeat exports to the region have evolved dramatically from being chiefly a frozen mutton market to being more of a chilled lamb market (see Figure 1). The average unit price of Australian sheepmeat exports reflects this significant shift, almost doubling from A$3.50 per kg in 2006-7 to A$6.70 per kg in 2016-7.

Figure 1: Australian sheepmeat exports to the Middle East, Past 10 Years

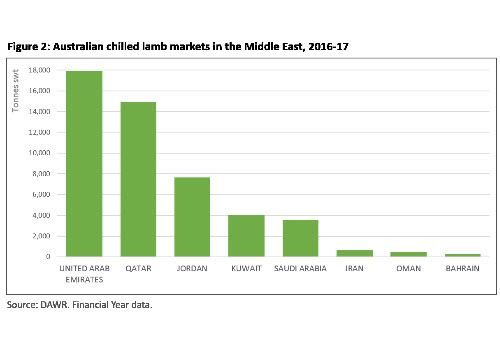

Looking at Australia’s premium chilled lamb export markets, half of the top 10 markets are Middle East countries, with the region as a whole accounting for 47% (by volume) of Australia’s total chilled lamb exports in 2016-17. Within Australia’s Middle East markets for chilled lamb, the largest volumes are going to the UAE, Qatar and Jordan, followed by Kuwait and Saudi Arabia (see Figure 2).

Figure 2: Australian chilled lamb markets in the Middle East, 2016-17

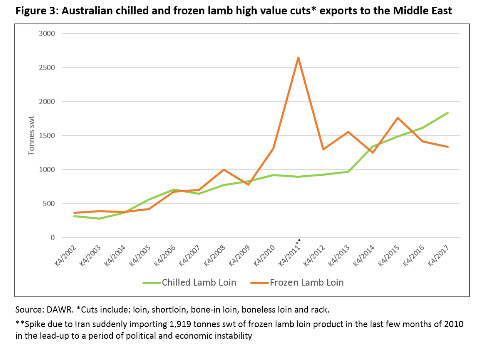

Not only are we seeing a shift in the Middle East from frozen to chilled lamb, but also towards high value cuts. In 2016-17, Australia’s chilled lamb exports to the region were comprised mostly of whole carcase (75%), legs (11%) and shoulders (8%). However, the mix of cuts has been evolving over time. Focusing on the key high value cuts – loin cuts and rack – the combined chilled and frozen volume exported to the Middle East has increased almost 5 times over the past 15 years from 681 tonnes swt in 2001-2 to 3,163 tonnes in 2016-17.

High value chilled lamb cuts are less impacted by price variability and competition, with consistent growing demand as highlighted below (Figure 3). To give some perspective of the high value nature of this market, in 2016-17 the average unit price of Australian lamb exports to the UAE was A$7.96 contrasted with China at just A$3.91.

Figure 3: Australian chilled and frozen lamb high value cuts* exports to the Middle East

** After 10 years of no trade, Australian exports to Iran resumed in Feb 2010 but volumes have been quite variable, significantly impacted by political and economic factors in the country.

In the last 12 months, the bulk of the chilled cuts were exported to the UAE (60%), Saudi Arabia (31%) and Qatar, with smaller (though mostly frozen) volumes going to Oman, Bahrain, Jordan, Kuwait and Egypt.

What is driving this growth of Australian sheepmeat in the Middle East?

Sheepmeat has a long history of consumption within the Middle East and constitutes a major dietary protein in the region. In fact, the key Middle Eastern markets, such as Saudi Arabia, UAE, Bahrain, Oman and Qatar, are among the few markets in the world where sheepmeat consumption is actually higher than beef. In many of these markets, lamb is considered the “prime” meat rather than beef or seafood - it is the most superior, delicious and tender protein that’s a family favourite and worth paying more for. In many countries throughout the Middle East, lamb plays an important and unique role in religious events, family celebrations and gift-giving.

Although trade in the region is impacted by oil prices and conflict, growth in consumer demand for premium imported lamb has been driven by a combination of increasing disposable incomes, urbanisation, westernisation, young populations, large expat professional populations and developing tourism sectors. The place of Australian lamb varies by country but in markets such as UAE and Saudi Arabia, MLA’s Global Consumer Tracker indicates that Australian lamb has the strongest awareness and consumption of all importing countries among the middle class consumers surveyed.

Building a profile for Australian premium lamb in the Middle East

Whilst country of origin labelling at the point of sale is not mandatory in the GCC[2], all modern retailers have adopted it across their fresh category, including meat products, which are clearly labelled - as consumer preference by origin is significant and premium meat shoppers generally want to know their meat’s provenance.

The purchase channels for Australian lamb vary by market. There is a presence in all retail throughout the region with varying volumes and cuts by country, but overall a strong retail presence in UAE, KSA, Jordan and Qatar, along with a growing demand for loin cuts in foodservice, predominantly in UAE, Saudi Arabia, Oman and Egypt. Looking at foodservice within the UAE (Australia’s largest regional market for premium chilled), chilled raw packaged lamb will be among the fastest value growth lamb segments from 2017 to 2021 in both the Full Service Restaurant (+45.6%) and Quick Service Restaurant (+45.8%) sectors (Source: GlobalData).

Despite consumers generally having a strong preference for what they perceive as lamb that is raised locally, Australian lamb has quite a strong and positive profile. At the higher value end of the sheepmeat market, Australian lamb mostly competes with New Zealand, and to a lesser extent with the UK and EU countries.

MLA’s MENA team are focused on growing demand for Australian lamb by building meaningful differentiation from the local and international competitors, and establishing a preference for True Aussie Lamb among trade and consumer audiences. The team is also working with industry and government to remove the numerous technical barriers to trade within the region in order to improve market access and ease of doing business and developing the challenging and new markets, such as Jordan, Israel, Egypt and Iran.

[1]The Middle East is defined here as including the following 18 countries: Bahrain, Afghanistan, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Pakistan, Palestinian Auto Zone, Qatar, Saudi Arabia, Syrian Arab Republic, Turkey, United Arab Emirates and Yemen.

[2]The Gulf Cooperation Council (GCC) six member countries are: Kuwait, Oman, United Arab Emirates, Qatar, Saudi Arabia and Bahrain.

For more information, please click here for: