Australian cattle finish 2017 realigned to US market

Key points

- 2017 young cattle prices have been reflective of seasonal conditions

- Finished cattle have realigned with the US market

- Supplies are expected to increase in 2018 but will hinge on the Queensland wet season.

With only one full week of saleyard trading left (see detailed list of year ending and opening dates) and most plant kill sheets booked out for the remainder the year, there will be little movement in the cattle market for the rest 2017.

So how did prices and supply track in 2017 and what will next year hold?

Production up on the back of rising carcase weights

Beef production has risen in 2017, largely due to a significant lift in carcase weights. In the first 10 months of the year, average male carcase weights were up 10kg year-on-year at a record 329kg, while females were up 7kg at 256kg.

Weights were underpinned by three consecutive quarters of over one million head of cattle on feed, and female slaughter remained in rebuild territory at around the 45% mark.

Beef production is forecast to finish this year at 2.16 million tonnes cwt, up 3% year-on-year.

Young cattle finish on a high

As discussed in MLA’s Prices and Markets e-newsletter last week, the Eastern Young Cattle Indicator (EYCI) enjoyed a 65.25¢ rally throughout October before stabilising in November. This was due to good falls across Queensland and northern NSW, driving strong restocker demand.

However, the strong finish to 2017 was not enough to offset the falls recorded mid-year, as dry conditions set in across most of the eastern states. This trend was the complete opposite to 2016, when a wet winter across much of the country sparked a solid rally in the EYCI before it was confronted with another failed Queensland wet season.

For now, restockers remain in the driver’s seat. At the close of Monday’s markets, the national restocker steer indicator tracked at a 63¢/kg live weight and 51¢/kg live weight premium to its processor and feeder counterparts, respectively.

Finished cattle realign to US

Finished cattle prices have largely eased in recent weeks as seasonal plant closures loomed, kill sheets filled up and the US imported beef market softened.

While the national heavy steer and medium cow indicators remain below where they tracked this time in 2016 and 2015, finished cattle prices are still historically high – above any level prior to mid-2015.

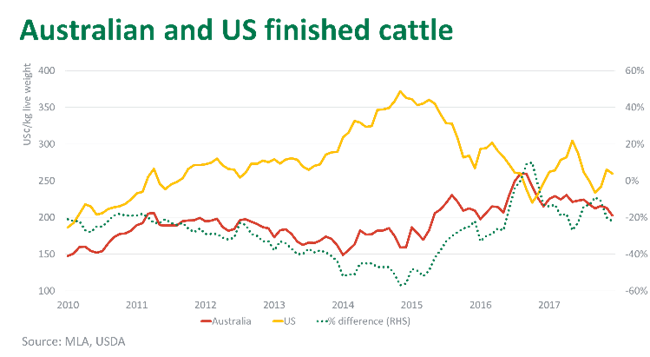

Furthermore, Australian cattle prices appear to have realigned themselves through 2017 to the historical ratio to the US market. The figure below illustrates the relative price difference between finished cattle in both countries in US$ – Australia has returned to a 20% discount, after hitting a massive 57% discount in the grip of drought (and record US prices) and a historic premium when both indicators crossed over for the first time in 2016.

While Australia appears to be back in sync with the US, currency movements and the growth in Australian cattle prices over the past three years have made South America a more competitive supplier to the global market. Up until 2015, Australia tracked relatively closely to Brazil, Uruguay, Paraguay and Argentina. However, steers in Australia are now tracking close to a 50% premium to those in Brazil.

The US remains Australia’s principle competitor but Brazil and other South American producers are supplying increasing volumes into some Asian markets, namely China.

So what may 2018 hold for Australian cattle prices? One guide could be the US futures market, which has cattle prices next year pegged close to the spot market, albeit softer in the second half after the grilling season. If the US market can maintain gains from recent months, this will provide some support to Australian prices in 2018.

Supplies to rise but Queensland wet season will weigh in

Slaughter cattle supplies are forecast to increase in 2018 – in fact, supplies have arguably improved since mid-2017. Nevertheless, the amount of cattle that came through to slaughter between 2013 and 2015 will not occur for a number of years because the herd is not there to liquidate and numbers will continue to be limited by the ongoing rebuild.

However, the success of the Queensland wet season will set the stage for the year ahead and will heavily influence supply and price expectations. The state, which hosts about half the beef herd, has not had a substantial wet season since 2011–12 and will be thirsty for cattle if this summer is successful. While late in the year, the Bureau of Meteorology have recently declared a La Niña and the three-month rainfall outlook is largely neutral.

The Queensland restockers may enter the market in force in 2018 if feed supplies allow them; however, young cattle are already close to the historical maximum premium to finished cattle. A widespread break in Queensland may pull both young and finished cattle higher, again potentially placing Australia out of whack with global competitors.

MLA releases its full cattle projections for 2018 in January – more news to follow in the new year.