Australian beef exports to Korea near safeguard

Exports of Australian beef to Korea reached record levels in 2016, underpinned by long-term economic growth, demographic shifts and strong consumer awareness.

However, a combination of domestic supply availability, increased international competition and a variety of short-term factors has challenged Australian exports to Korea during 2017.

Beef Summary

Australian beef exports to Korea for the calendar year-to-September, totalled just over 109,000 tonnes swt – down 15% year-on-year (DAWR).

Grassfed beef exports declined 20% year-on-year, to 71,000 tonnes swt, underpinned by reduced Australian availability and strong demand for grassfed product from both Japan and China. Furthermore, concerns related to import financing and limitations with regards to the new anti-graft legislation have also contributed to the decline.

The upturn in US beef production, and consequently a stronger export focus, has also created robust competition in supplying the Korean market, particularly for grainfed beef. Despite record numbers of cattle on feed supporting Australian grainfed exports, Japan (Australia’s largest grainfed export destination) has absorbed the majority of grainfed product. Australian grainfed exports to Korea declined 4% for the calendar year-to-September, totalling 38,000 tonnes swt.

When looking at customs cleared import data (Korea Customs and Trade Development Institution), the impact of a growing US presence is clear. For the calendar year-to-August (latest available import data) Korean imports of US beef are up 17% – to 117,500 tonnes swt.

Interestingly, in August, Korean imports of frozen US beef increased 50% on the month prior, while Japanese imports of frozen US beef were down 72% for the same period. This is perhaps an indication of US product being diverted from Japan to Korea, following the Japanese imported frozen beef quota being triggered in June.

Safeguard Outlook

Australian beef exports to Korea continue to be supported by the Korea-Australia Free Trade Agreement (KAFTA). Under KAFTA, the current tariff (2017) on beef stands at 29.3% and this will be entirely eliminated by 2028.

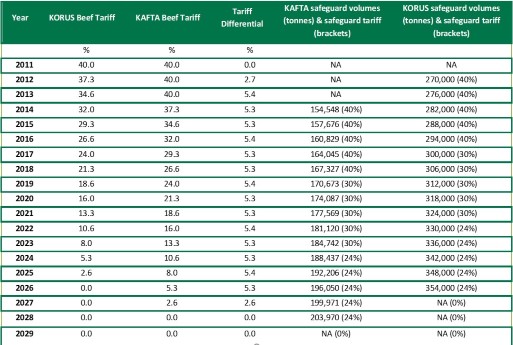

Prior to the implementation of KAFTA, the Korea-US (KORUS) Free Trade Agreement (FTA) came into force in 2012, from which a fifteen-year tariff elimination schedule was implemented on US beef. The US will carry a 5.3% tariff advantage over Australia until 2026, before tariffs on US beef are completely removed. Tariff and safeguard* volumes are illustrated in the table below.

In 2016, the safeguard volume (KAFTA) stood at 160,829 tonnes, with the volume realised in October of the same year. Product on the water at the time of triggering the safeguard was cleared at the tariff rate 32% (2016), however these volumes were carried over and deducted from the 2017 safeguard volume.

Therefore, based on current Korean customs import figures, 97.4% of the 164,045 tonne (2017) beef safeguard has been filled, with the prospect of a tariff increase being implemented in the coming weeks.

Although Australian cattle supplies remain somewhat limited and there is a short time frame in which the 40% safeguard tariff would be applied, the triggering of the safeguard will still be disruptive. It will also provide US beef with a 16% tariff preference until the end of 2017. In addition, there is also the potential for a similar scenario to occur next year, whereby the carryover stocks contribute to the safeguard being triggered.

*Safeguards are measures whereby a country can impose temporary emergency actions in response to increased imports of a particular product.

Click here to read The Korean beef market: Insights and prospects from an Australian perspective