US meat production continues to rise

Recently released data from the United States Department of Agriculture (USDA) indicates the world’s largest beef producer continues to record growth across all major livestock proteins.

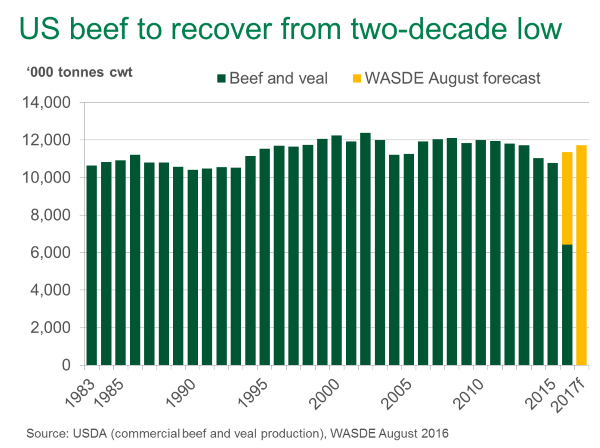

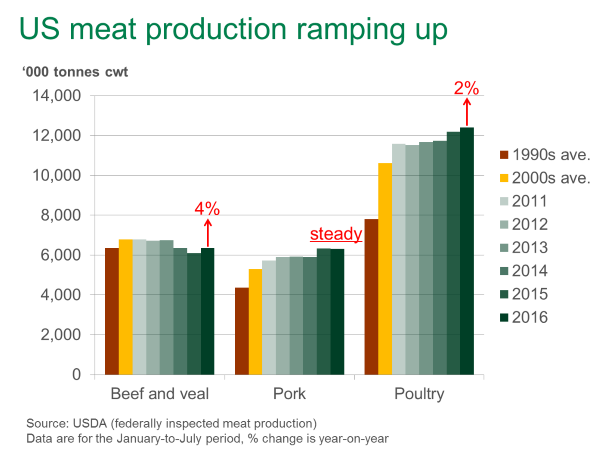

During the first seven months of 2016 (January-July), US beef production was up 4% year-on-year – from what was a two-decade low in 2015. The increase in beef production was the result of two consecutive years of herd growth and lower feed grain prices encouraging heavier fed cattle carcase weights. In addition, as illustrated in the figure below, US beef expansion is expected to continue, with the August edition of the USDA’s World Agricultural Supply and Demand Estimates (WASDE) forecasting a 5% and 3% annual rise in 2016 and 2017 beef production, respectively.

Pork production during the first seven months of 2016 was back marginally (0.3%) year-on-year, but this is off a record high base and volumes so far this year are 6% above the five-year average.

Chicken production is up 2% so far in 2016, with this year on track to mark the fourth consecutive year of new production records.

Sheepmeat was the exception, with supplies reflecting the continued decline in the US sheep flock. Less than 1% the size of US beef production, sheepmeat production declined 2% in the first seven months of 2016.

The weight of increasing beef supplies is bearing down on prices in the US. While the WASDE forecast of 5% growth in US beef production does not present itself as a significant volume, the increase equates to roughly the entire (or 91% based on carcase weight equivalent export estimates) beef trade from Australia to the US in 2015. While Australia exports a product which is mostly dissimilar – lean manufacturing or chilled grassfed beef – to what the US produces, growth in US production has resulted in import prices easing from the highs of 2014 and 2015.

Cold storage inventories are painting a similar picture. Beef in US cold storage at the end of July was up 2%, while poultry was up 8% year-on-year. Pork was back 5% at the end of July but, as pointed out by Steiner Consulting Group’s Daily Livestock Report (23 August), pork stocks rose unseasonably on the previous month and ahead of the usual increase going into the US Autumn.

The US was Australia’s largest beef export customer, on a volume basis, in 2015 and remains the greatest competition in Japan and Korea, Australia’s second and third largest export markets, respectively.