US lamb market drifts lower with major proteins

Lamb consumption in the US is very low on a per capita basis, and tends to be concentrated in certain areas and among certain ethnic groups. This does not mean, however, that the wholesale and import market for lamb is completely insulated from wider meat industry trends. While much of the focus in the US tends to be on the big three meat proteins (beef, pork and chicken), it is worth also looking at the movements in lamb markets over the past few years, when Australian exports of lamb to the US have been higher than ever before.

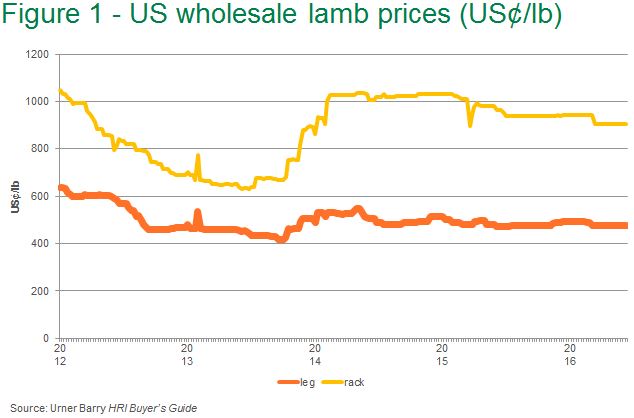

Like the US beef market, wholesale lamb prices in the US peaked in 2014, before moving lower through 2015 and 2016. Unlike the US beef market, however, the wholesale lamb market is notable for its relative lack of volatility over this time. Figure 1 shows the wholesale price movements for lamb legs and racks, as published by Urner Barry in its weekly HRI Buyer’s Guide report.

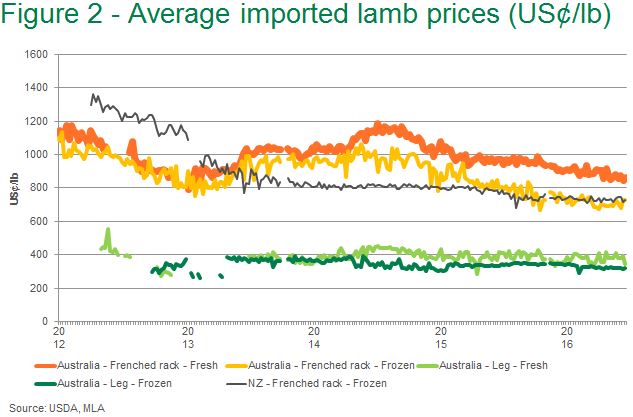

The US lamb market is also notable for the large proportion of retail and foodservice that is supplied with imported lamb – predominantly from Australia and New Zealand. A large volume of the imported lamb is traded under long-term contracts, but there is also a significant part traded under negotiated sales for delivery in the following few weeks, which is reported weekly by the USDA. This section of the market has followed a similar overall trend to the wholesale market, but with much greater week-to-week volatility.

Figure 2 shows average imported lamb prices for fresh and frozen frenched racks and legs (among the most commonly exported lamb cuts) from Australia and New Zealand over the past few years, with the most notable changes in frenched rack prices, which have been moving lower since mid-2014 (USDA). It is interesting to note the prices of Australian lamb racks relative to New Zealand lamb racks, which tend to be much lighter in weight than Australian.

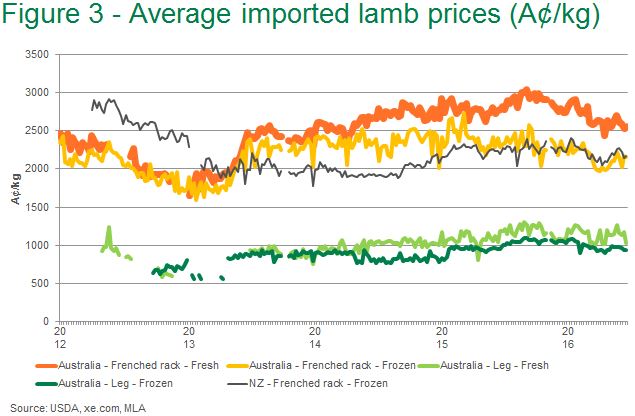

Figure 3 shows the same products as in Figure 2, but with the imported prices converted into A$ terms. This reflects the compensatory effect of the depreciating A$ relative to the US$ through late 2014 and 2015 assisting returns to Australian exporters. The decline in prices in A$ terms began much later, in late 2015, as the A$ settled into the low US70¢ range.

In 2015, Australia exported 49,904 tonnes shipped weight (swt) of lamb to the US, the largest calendar year volume on record. After five months in 2016, Australia had exported 24,205 tonnes swt to the US, indicating it will be another very large year this year, although the normally slower winter months are still to come.