Back to Prices & Markets

Taiwan beef market becoming increasingly competitive

Australian beef export volumes to Taiwan in the first quarter (January to March) of 2016 were generally steady year-on-year, but Australia’s market share has recently come under increasing pressure from key competitors – NZ and the US.

- Taiwan has long been an important market for Australian beef products. From 1997 to 2007 it was consistently among Australia’s top five markets by volume. Despite the diversification of Australia’s beef markets, the rapid increase in demand from China and slowing economic growth in Taiwan, Taiwan remained Australia’s eighth largest export destination in 2015 by volume and value.

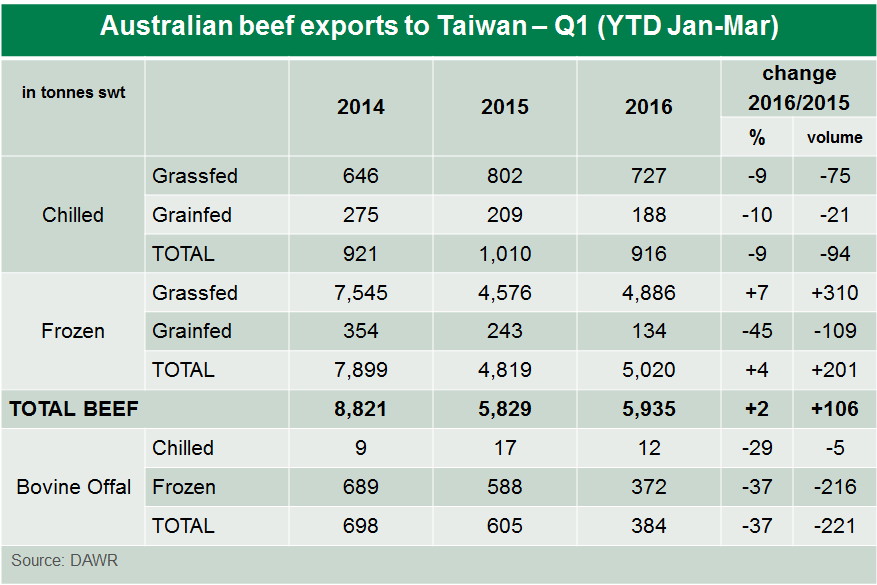

- For January to March 2016, Australia’s total beef exports to Taiwan were steady compared to the same period in 2015, at 5,935 tonnes swt (DAWR). However, Taiwan’s total beef import volumes for the first quarter of 2016 (the latest statistics available) increased 5% year-on-year, to 23,787 tonnes swt, with the total import value up 4%, at A$227 million.

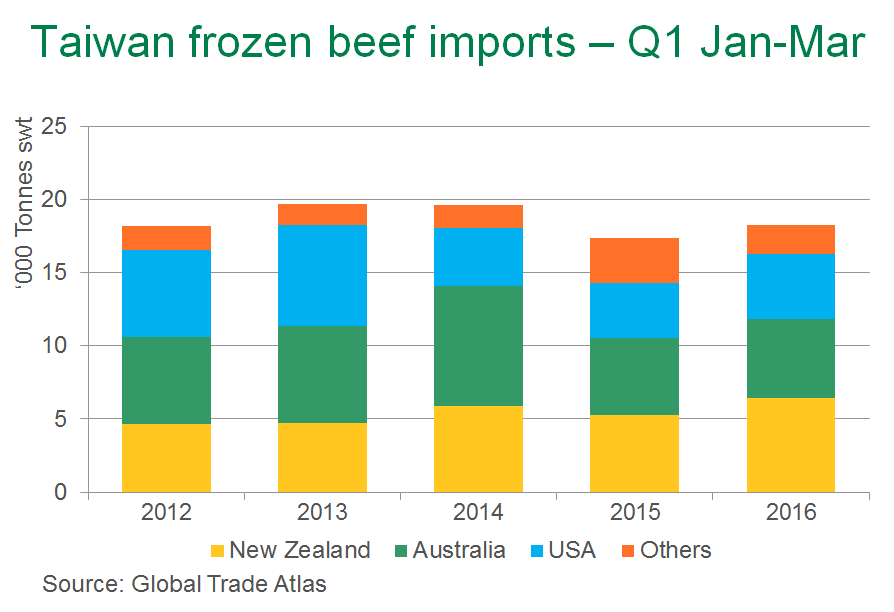

- Over three-quarters (77%) of the beef Taiwan has imported this year was frozen product, and the total volume of frozen beef imported was up 6% year-on-year for the first quarter, totalling 18,277 tonnes swt. While Australia’s supply of frozen beef to Taiwan was steady year-on-year for the January to March period of 2016, Taiwan increased its volume and value imported from both NZ (volume up 22%, value up 19%) and the US (volume up 20%, value up 12%). Due to the Free Trade Agreement between Taiwan and NZ (ANZTEC & ECA), NZ beef exports to Taiwan are tariff free.

- The total volume of chilled beef Taiwan imported for the first quarter of 2016 was up 4% on year-ago levels, to 5,511 tonnes swt, with value up 5%, compared to 2015. However, the volume of chilled beef Australia exported to Taiwan was down 9% for the same period, to 916 tonnes swt. Over this period, the US significantly increased its chilled beef supply to the market, with Taiwan import volumes of US beef up 21% (totalling 3,837 tonnes swt) on 2015.

- The volume of Australian bovine offal exports to Taiwan was down 37% for the January to March period of 2016 compared to the previous year, to 384 tonnes swt. The bulk, just over 90%, of this product is frozen tendon and tripe (DAWR). Industry analysts suggest that this is partly due to lower cattle slaughter in Australia, coupled with strong demand from other markets including China, raising prices in Taiwan.

- As a consequence, NZ significantly increased (up 211%) its supply of bovine offal to Taiwan for the first three months of 2016, to 609 (GTA). As a result, NZ market share grew from 15% to 33%. NZ offal exports to Taiwan are tariff free.

- Key year-on-year changes in the beef cuts Australia has exported to Taiwan for the first quarter this year include increases in popular cuts such as shin/shank (up 28%) and thick flank/knuckle (up 254%), but also an increase in silverside. Although the price of Australian shin/shank has been rising, the alternative heel muscle from the US has been priced even higher, so demand for Australian product has been maintained.

- For the same period, Taiwan has imported less Australian manufacturing beef (down 37%) as well as less intercostals and cube roll/rib-eye roll. It has been reported that McDonald’s, one of the largest users of manufacturing beef, have promoted more chicken products on their menu in recent months.