Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Restockers driving young cattle market disconnect

19 September 2016

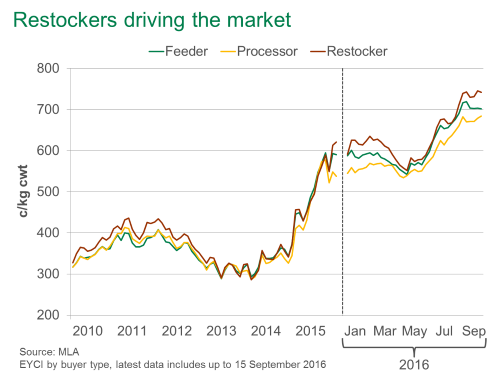

The Australian young cattle market is well and truly being driven by strong restocker demand and tight supplies as a result of "above-average" winter rainfall across large swathes of the country (BOM). As illustrated in the figure below, restockers have continued to pay a premium over feeder and processor buyers so far this year – 45 consecutive weeks, in fact.

At the close of last week's markets, the EYCI finished at 713.00¢/kg cwt. Of the EYCI eligible cattle that made up the benchmark indicator, restockers paid, on average, 742¢/kg cwt – well above the 702¢/kg cwt and 684¢/kg cwt paid by feeder and processor buyers, respectively.

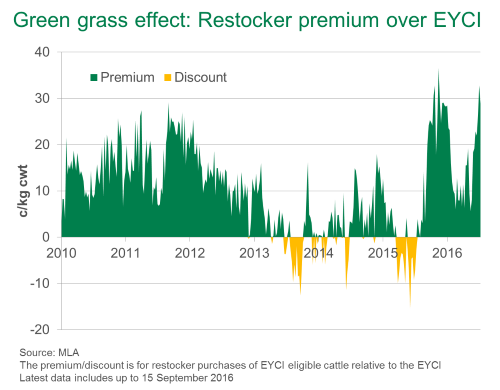

Strong premiums have been paid by restockers in the past five years. However, as illustrated below, the current market and the surge late last year far exceed the previous peaks of 2010 and 2011.

Of the 11,412 head included in the EYCI last week (out of a total 35,272 head through MLA reported eastern states saleyards), 38% went to both restockers and feedlots while processors accounted for the remaining 24%. While the feeder share of the EYCI in September is back from where it was in recent years (46% in 2014 and 47% in 2015), it is still in-line with the five-year average and feedlots continue to account for a large portion of purchases.

However, restockers are driving a disconnect between local young cattle markets and the global beef market. As reported last week, the 12-month rolling average imported 90CL price into the US has been in decline for 11 consecutive months and finished cattle prices are finding it continually difficult to match the price increases of the store market. At the end of last week, the EYCI tracked at a 13% premium to the national saleyard heavy steer indicator (up from 4% this time a year-ago), and was a 22% premium to the Queensland 100-day grainfed steer indicator (up from 7% this time last year).

The improvement in seasonal conditions is underpinning the Australian cattle market, however given Australia exported 74% of beef produced last fiscal year, buying decisions should be weighed up with what is happening on the global beef market.