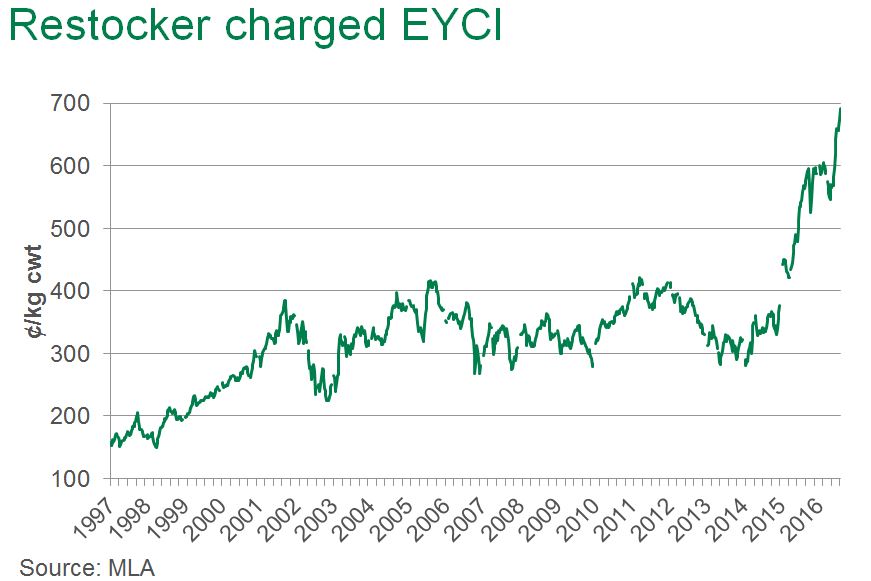

Restockers drive EYCI through the 600’s – 700¢ in reach

Add widespread rain to a country with a 20-year-low national cattle herd. The result?

Numerous saleyards across the eastern states this week registered record individual sale prices yet again. All were at the younger spectrum of the market. In fact, Eastern Young Cattle Indicator (EYCI) eligible cattle (C2 and C3 vealer and yearling steers and heifers) averaged over 700¢/kg cwt at numerous selling centres throughout the week. This included:

- Monday at Wagga (702¢/kg cwt)

- Tuesday at CTLX Carcoar (728¢/kg cwt), Gunnedah (710¢/kg cwt), Roma Store (703¢/kg cwt) and Scone (713¢/kg cwt)

- Wednesday at Singleton (720¢/kg cwt)

- Thursday at Dubbo (725¢/kg cwt)

On top of this, EYCI cattle at TRLX Tamworth and NVLX Wodonga were within 20¢ of the 700¢/kg cwt mark.

As outlined in the recently released MLA July cattle industry projections, restockers have been the driving force behind the EYCI bolting through the 600’s during June and July. This is demonstrated through the proportion of EYCI purchases from restockers in July accounting for 41%, up from 34% in the same month last year. At the same time, lot feeders have held their own, consistently accounting for 44% of EYCI cattle bought for the past four months. Interestingly, processors usually account for 29% of the July EYCI purchases (five-year average), but during July 2016, they collectively only bought 15%. This is the lowest proportion of processor EYCI acquisitions in over six years and truly highlights where the cattle market strength is being generated.

Also representative of the small national herd, saleyard throughput has been tracking well below long-term averages, and for the first week of August offerings were 44,622 head, down 11% from the five-year average (50,067 head). Similarly, weekly eastern states cattle slaughter for the last week of July was 124,630 head – down 14% from the corresponding long-term average.

Looking forward, three things typically happen to the EYCI from August to the end of spring (November).

- Prices ease. In seven out of the past ten years, the EYCI averaged lower in November compared to August – ranging from a decline of 2% to 20%. The only three increases were modest – 1% in 2010, 5% in 2011 and 3% in 2015 – and these were all very wet years.

- Restockers take a step back. 80% of the time, restockers have purchased a lower proportion of EYCI cattle, offset by a rise from feedlots. Interestingly, restockers purchased less in each of three wet years mentioned above.

- Processors purchase fewer EYCI cattle at the end of spring compared to the end of winter.

Whether or not these trends occur in 2016 remain to be seen, but if the average price decline were to be repeated, the EYCI would remain in the mid-600¢/kg cwt territory. The trend least likely to occur, for the first time, is processors taking any further steps back in the number of EYCI cattle purchased – especially considering the very low proportion of acquisitions they are currently making. The biggest unknown though, and the dictator of where the EYCI eventually reaches a maximum price, is the depth of restocker pockets – which continue to surprise.

To subscribe to MLA’s weekly slaughter and cattle market indicator reports, please email marketinfo@mla.com.au