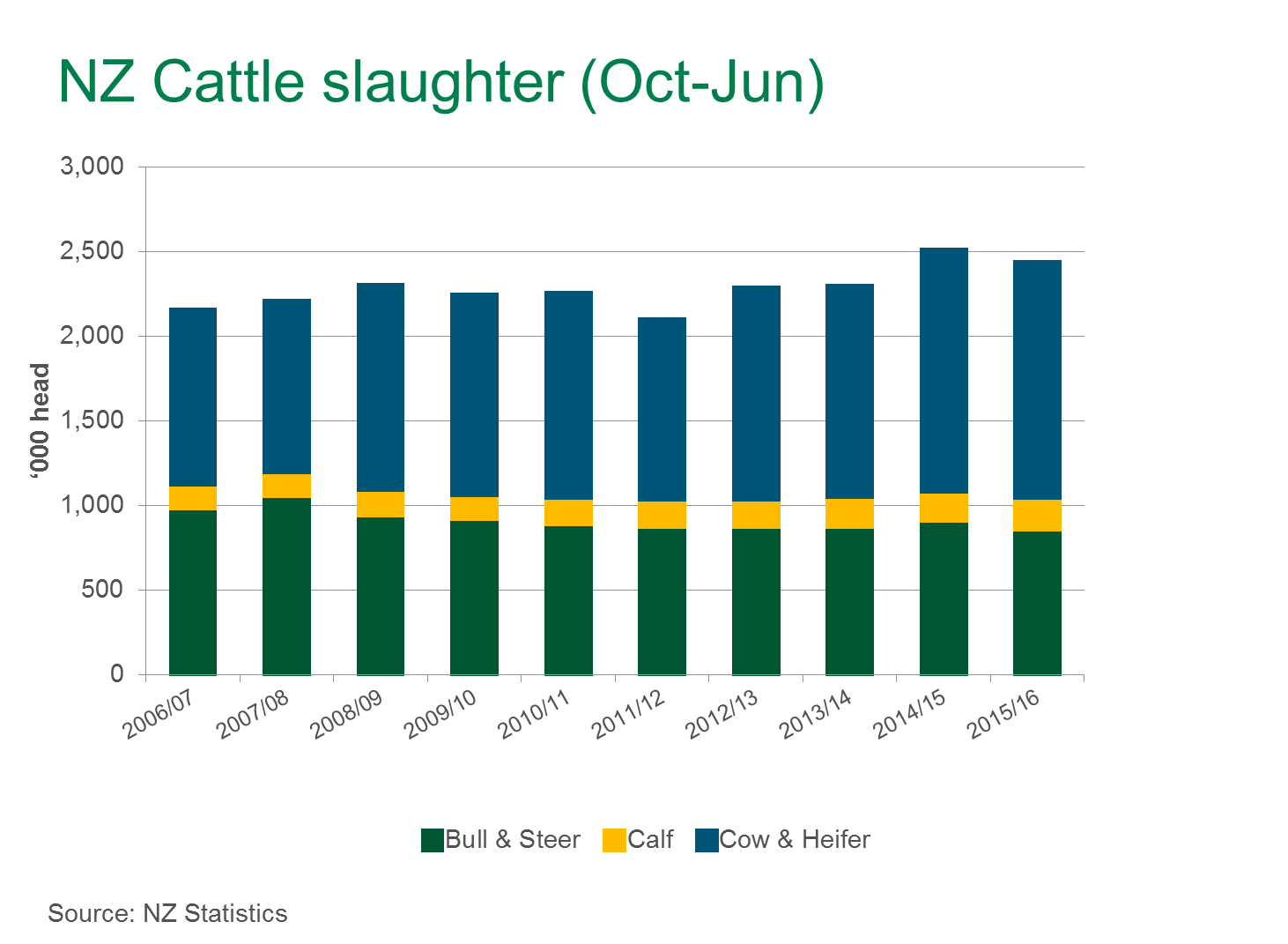

NZ cattle slaughter on seasonal downward trend

So far this season (October to June), New Zealand (NZ) adult cattle slaughter has declined 4% on the corresponding period the year prior – with just shy of 2.23 million head processed (Statistics NZ). It should be noted, however, that this was off-the-back of high slaughter levels in 2014-15, and the season-to-June this year remains 6% above the five-year average for the nine-month period.

The female portion of total slaughter has declined 2% year-on-year for the season-to-date, to 1.35 million head – although remains 13% higher than the five year average for the period. AgriHQ report that steers are currently accounting for the majority of processing numbers, as the dairy cow kill has all but finished for the season, and bull slaughter has also wound down.

In line with lower slaughter, NZ beef production is 4% lower for the season-to-date, at just over 546,300 tonnes cwt.

Bucking the trend for the October to June period was NZ beef exports – increasing marginally so far this season to 348,423 tonnes swt. Compared to the previous year, shipments to:

- the US declined 10%, to 173,019 tonnes swt

- China increased 36%, to 61,598 tonnes swt

- South East Asia increased 8%, to 21,025 tonnes swt

- Taiwan increased 26%, to 21,236 tonnes swt

- Canada increased 25%, to 16,157 tonnes swt

- Japan declined 24%, to 11,701 tonnes swt

According to AgriHQ, despite the decline in cattle availability as the production season winds down, some processing plants have opted to close for maintenance, easing the competitive pressure on the market. Furthermore, the strength of the NZ$ has outweighed the tighter supplies – offsetting potential increases in NZ farmgate returns. Lower export volumes from NZ and Australia has provided some support for the US imported beef market, although domestic US beef prices have eased, keeping the market fairly stable. US beef production, along with pork and poultry availability, is expected to increase in the coming months – which is anticipated to place pressure on grinding beef prices through late 2016.