Northern indicators ease as cattle supplies lift

Highlighted in the latest North of the Tropic Beef Report, ‘above-average’ rainfall across many major producing regions in October didn’t deter cattle coming forward – with greater availability placing downward pressure on indicators across the northern markets.

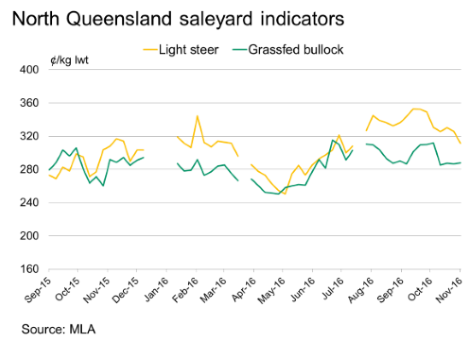

In line with the seasonal trend in October, the rise in cattle supplies in the physical market saw all major categories trend lower on the month prior. Increased availability of lighter weight lines spurred restocker buyer activity during the month. In October, the medium cow and restocker steer saleyard indicators eased 5¢ and 6¢ on the month prior, averaging 236¢ and 364¢, respectively – while light steers averaged 19¢ lower, at 328¢/kg lwt.

North Queensland average weekly cattle slaughter reached 18,566 head in October – back 16% on what was recorded the same time last year. Although marginally lower than September levels, North Queensland over-the-hook indicators were higher year-on-year across most categories in October.

This week (ending 11th November), however, compared to the same time last year:

- The north Queensland over-the-hook trade steer indicator averaged 527¢/kg lwt – firm

- The north Queensland over-the-hook heavy steer indicator averaged 537¢/kg lwt – firm

- The north Queensland over-the-hook medium cow indicator averaged 457¢ – down 16¢/kg lwt

January to October total live feeder and slaughter cattle exports to Indonesia eased 23% on the same time last year – with just over 802,300 head shipped (ABS, DAWR). Recent reports suggest that further clarification around the new ‘dual purpose’ decree is still being sought after by Indonesian importers. Although not yet officially confirmed, it is anticipated T3 imports (October-December) could amount to around 130,000 head of feeder cattle.

To read the latest North of the Tropic Beef Report, please click here.

Also, to read the latest edition of Livelink, please click here.

To subscribe to either of these monthly reports, email marketinfo@mla.com.au