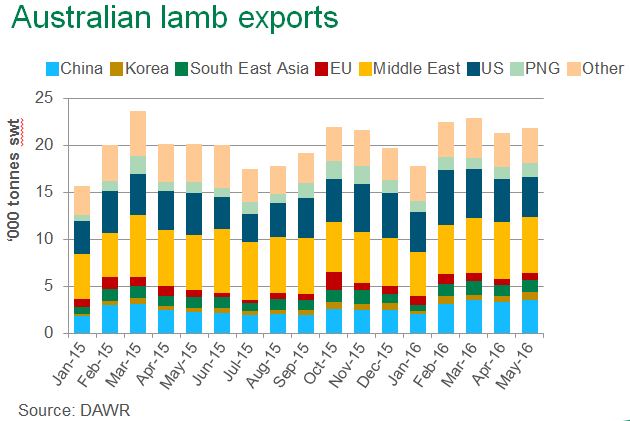

May lamb exports hit new high

Australian lamb exports in May 2016 were up 9% year-on-year and 17% on the five-year (2011-2015) average for the month, at 21,562 tonnes shipped weight (swt) – Department of Agriculture and Water Resources. In fact, this was the largest May lamb shipment since MLA’s records began in 1995. This brings the year-to-date total to 104,859 tonnes swt – up 7% on the corresponding period last year.

Higher lamb production has somewhat contributed to the higher export volumes so far in 2016, with volumes produced during the January to April period (latest available data) 2% above the same time last year. Increased lamb turnoff was driven mostly by prolonged warm and dry conditions across the key eastern lamb producing regions during summer and autumn. In contrast, WA had a particularly wet finish to summer and start to autumn, encouraging producers to retain lambs and graze a little longer. On the back of a late autumn break at the end of May, and in line with a normal season, lamb supplies are anticipated to tighten over the winter months.

Australia’s two largest lamb export destinations (in volume terms), the Middle East and US, were relatively steady in May, compared to last year – as were markets such as Japan and the EU. The big movers in May, out of Australia’s larger markets, were China, Papua New Guinea, South East Asia and Korea.

Volumes to the Middle East in May were very similar to the same time last year, on 5,953 tonnes swt – although 23% higher than the five-year average. A 5% decline in leg shipments (701 tonnes swt) was offset by a 2% increase in lamb carcases (3,982 tonnes swt) during the month. This was quite a large monthly volume in historic terms, with long-term growth in the market accentuated by the need for stocks to be built up ahead of Ramadan (through June).

Shipments to the US eased slightly (3%) year-on-year, to 4,297 tonnes swt in May. Despite the slight downturn, volumes to the US have been particularly high over the past eight months, influenced by a number of factors. Reports from in-market suggest lamb consumption in the US has increased over the last 12 months, supported by a rise in imports, while domestic lamb production remains static. Furthermore, lamb has become more popular in both foodservice and retail sectors – retail sales were up 5.6% (volume) and 6.1% (value) year-on-year for the 12 months to 17 April 2016 (IRI). While leg, rack and shoulder shipments declined year-on-year in May, volumes of assorted cuts (three or more primals packed together) increased 49%, to 1,040 tonnes swt. Despite the average lamb export unit value (per kg) to the US remaining below year-ago levels during the January to April period of 2016, reports suggest the US is still a favourable market at the moment for Australian exporters for cuts such as legs, racks, loins and shoulders.

May was the largest month for lamb exports to China since October 2014, at 3,813 tonnes swt – up 52% year-on-year and 30% higher than the five-year average for the month. Volumes of shoulder jumped from 24 tonnes swt last May to 446 tonnes swt this year, while breast & flap exports increased 30% year-on-year, to 2,353 tonnes swt. Domestic sheepmeat inventories in China are being worked through, and buyers there have been keen to source supplies ahead of the anticipated production slowdown over the winter months in Australia and New Zealand.

Volumes to Papua New Guinea, one of Australia’s lower value lamb markets, in May were up 23% on the same time last year, at 1,453 tonnes swt – primarily due to a 34% increase in breast & flap shipments for the month (1,237 tonnes swt).

Lamb exports to South East Asia were 9% higher year-on-year in May, at 1,269 tonnes swt, with Malaysia (853 tonnes swt) the largest destination.

Shipments to Korea more than doubled in May, to 815 tonnes swt – due to breast & flap exports (236 tonnes swt) more than tripling and shoulder (333 tonnes swt) increasing 66% year-on-year.