Lamb saleyard indicators higher for fourth consecutive year

The Australian lamb market has gone from strength to strength over the last few years, and 2016 has been no exception. In fact, 2016 (to 24 November) marks the fourth consecutive year of all national lamb saleyard indicators moving higher year-on-year. Further to this, the 2016-to-date averages for most of these indicators have also exceeded the previous record levels set in 2011.

It is interesting to look at the market forces at play since 2011, when lamb prices reached their previous peak, and compare them to context of the market this year.

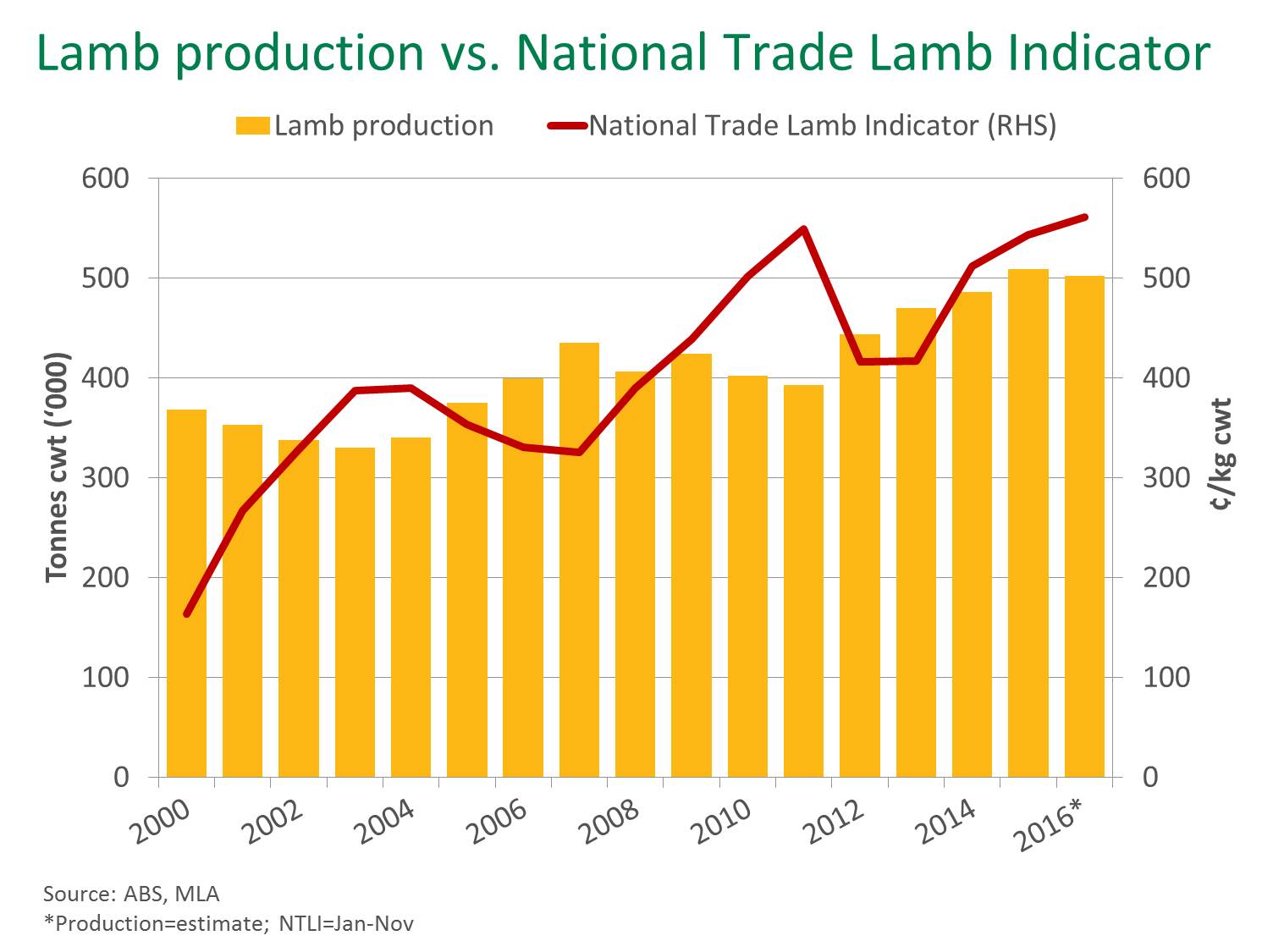

A La Niña event in 2010-11 saw the end of a major drought across the country, and after a decade of poor seasonal conditions the Australian sheep flock bottomed out in 2010, at 68.1 million head. As a result, national lamb production in 2011 was reduced to its lowest level in six years, at 393,012 tonnes carcase weight (cwt). Since then, Australian lamb production has continuously lifted an average of around 29,000 tonnes cwt each year, until reaching a new high in 2015 at 508,570 tonnes cwt. While lamb production in 2016 (375,656 tonnes cwt for year-to-September) has contracted from recent years, what is a very positive indication of the strength of the market over this time has been the continual increase in lamb prices despite the rising supplies between 2012 and 2015 – as illustrated in the chart below.

With only three weeks left of saleyards operating for 2016, the national light lamb (12-18kg) saleyard indicator averaged 540¢/kg cwt for the year-to-date – up 24¢ year-on-year, and on par with 2011 levels. The national trade lamb (18-22kg) indicator for 2016 is 17¢ higher than last year, and 11¢ above the previous calendar year record set in 2011, averaging 561¢/kg cwt for the year-to-date. Heavy lambs (over 22kg) averaged 565¢/kg cwt – up 17¢ year-on-year, and up 36¢ from 2011 levels. Merino lambs (16-22kg) for the year-to-date have increased 27¢ from last year and 20¢ from 2011, while the national restocker lamb (0-18kg) indicator was 33¢ higher year-on-year, although down 19¢ from where it averaged in 2011.

Restocker lambs are the only category to average lower in 2016 than in 2011. This is likely attributed to the very tight availability of lambs in 2011 combined with improved seasonal conditions – a scenario resulting in strong competition between restockers for a considerably reduced pool of lambs.

While supplies have been increasing since 2011, the export segment of Australia’s lamb industry has also become increasingly prominent – providing solid support for the market. In fact, the proportion of lamb produced that is exported has risen from 49% in 2011, to 55% for 2016-to-date. Over the same period, the depreciating A$ has provided a favourable trading environment for Australian lamb. For the year-to-date, the A$ has traded at an average of 75US¢ – 29¢ lower than where it averaged in 2011.

Australia’s major competitor on the global lamb export market is New Zealand (NZ). Beef + Lamb NZ have recently reported that the NZ lamb crop in spring 2016 is the smallest since 1953 – at 23.7 million head. Australian lamb supplies are expected to remain relatively low in 2017 and combined with reduced offerings out of NZ, should see demand remain strong in overseas markets. AgriHQ report that market participants are therefore keen to secure product for early 2017, and asking prices are expected to remain high for the coming months.

For further analysis, keep an eye out for MLA’s Sheep Industry Projections, released 6 December 2016.