Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Investment in lamb pays off – ABARES

27 September 2016

Following on from last’s week article on farm costs, cash income and business profit of slaughter lamb producers in Australia – based on the recent ABARES Financial Performance of lamb producers 2013-14 to 2015-16 report – is an outline of the farm investment results also captured by the annual ABARES Australian Agricultural and Grazing Industries Survey.

New farm investment

Investment in farm capital – such as land, fixed structures, livestock, plant and equipment – plays an important role across all facets of farm business management, such as financial performance, production efficiency and farm productivity. The majority of investments – particularly in land and on-farm infrastructure – have a long-term outlook and are based on expected returns over the life of the investment.

The capacity for a lamb producer to generate farm income is influenced by past investments. While a fairly small proportion of producers purchase land each year, most invest on an annual basis in plant, vehicles, machinery or infrastructure. For the 10 years to 2014-15, an average of 7% of lamb producers bought land each year, while an average of 56% of lamb producers made additions each year to total capital over the same period.

Return to capital

Return to capital is a key indication of economic performance of a farm business and provides incentive for producers to keep investing.

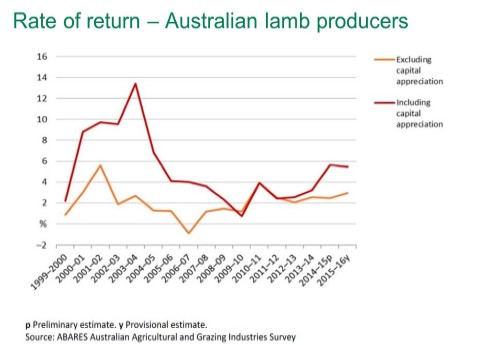

During most of the 2000s, high demand for rural land saw land values increase – subsequently lifting the total capital value of lamb producing farms and, therefore, rates of return when capital appreciation is included. In 2008-09, however, land values started to fall in number of regions, which resulted in considerably lower average rates of return to total farm capital, including capital appreciation.

As illustrated in the figure below, if capital appreciation is excluded, the variations in rates of return have been more modest over the 10 years to 2014-15, with the average rate of return to capital for the 10-year period 1.7%. In 2015-16, the average rate of return (excluding capital appreciation) is estimated to have increased (from 2.4% in 2014-15), to 3%. All states, except for Tasmania, were expected to have a positive rate of return (excluding capital appreciation) in 2015-16, with the highest projected in Queensland, at 5%.

Farm debt

Debt is an important source of funding for farm investment and ongoing capital for many lamb producing farms.

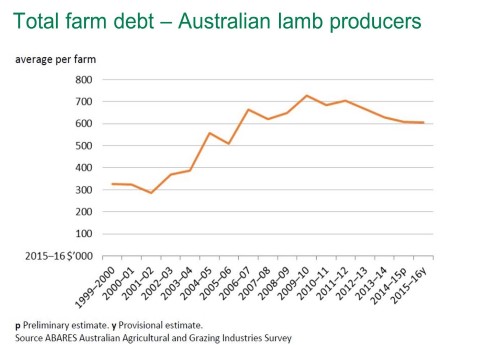

In real terms, the average debt for lamb producers increased from around $323,000 in 2000-01 (in 2015-16 dollar terms) to an estimated $605,000 in 2015-16 (see figure below). The rise in debt has largely been driven by expansion of average farm size and borrowing for buying land and ongoing capital.

The ability to service debt (making principal and interest repayments) is a key part of farm viability. Over the 10 years to 2015-16, around 8% of lamb producers’ farm cash receipts were put towards interest payments, on average. Over the last few years this percentage has declined, due to an increase in farm receipts and lower interest rates. In 2015-16, it was estimated that 6% of farm cash receipts were used to make interest repayments.

Historical data from the ABARES annual Australian Agricultural and Grazing Industries Survey (AAGIS) can be accessed on MLA’s databases webpage. Please note, the 2015-16 preliminary survey results are yet to be made available in the database.