Imported 90CL feels supply pressure throughout 2016

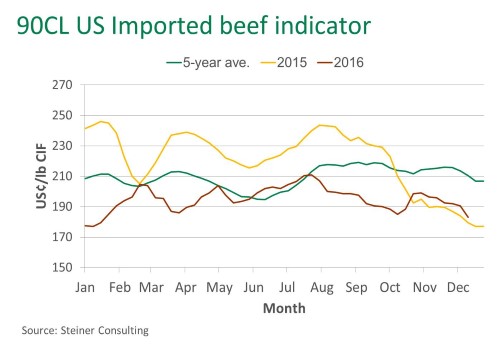

Following a period of high volatility during 2015, US imported beef prices stabilised somewhat in 2016 and are now much closer to the long-term average.

In fact, in their weekly report commissioned by MLA, the Steiner Consulting Group reports that the imported 90CL beef indicator eased 7.5US¢ from week-ago levels, to 183.0US¢/lb CIF (down 22.45A¢, to 540.44A¢/kg CIF). Despite coming under supply pressure for the majority of the year, compared to the same time last year, prices are 3.5US¢ higher.

Throughout 2016, Australian beef trade and imported prices have been heavily impacted by Australian beef production being 23% below year-ago levels, at 1.77 million tonnes cwt for the year-to-October, while in contrast US beef production increased 6% for the year-to-October. As a result, Australian beef exports to the US for the year-to-November are down 53% year-on-year – albeit off a high base having reached quota for the first time the previous year.

On top of the diverging beef production trends between the two countries, there are a number of seasonal trends that influence US imported beef trade throughout the year, including:

- Increased New Zealand slaughter at the beginning of the new production season, combined with the seasonal lift in Australian cattle supplies. Interestingly, Steiner Consulting Group reports that Australian and New Zealand (NZ) Slaughter are currently at the highest point since June 2015.

- Demand typically strengthens throughout the summer months (June to August), with the Independence Day holiday falling during this period, and along with tighter supplies from NZ during this period, generally results in a spike in prices – as illustrated in the figure below.

- And the US production cycle, with calving typically occurring during the US spring (April to May) and weaning during the US autumn (September to November) – when domestic supplies increase and prices fall.

During these times, and largely as a result of the greater US production, imported prices only reached a peak of 211US¢ in July this year, compared to 243.5US¢ in 2015. Looking forward, Steiner Consulting Group anticipates the imported 90CL indicator to decline 2% from the 2016 average.