Financial performance of lamb producing farms improve - ABARES

Financial performance is major driver of change on lamb producing farms. ABARES have recently released a report which presents the results from their annual Australian Agricultural and Grazing Industries Survey, with the main focus on estimating farm financial performance of slaughter lamb producers from 2013-14 to 2015-16.

Producers and industry stakeholders can use this information and data to benchmark and monitor changes in broadacre farm businesses. The three main measures of farm profitability outlined in the report are farm cash income, farm business profit and rate of return. ABARES results include broadacre slaughter lamb producing farms that sold, on average, 200 or more lambs per year over the three years ending 2015-16.

To read the full ABARES Financial performance of lamb producers 2013-14 to 2015-16 report, please visit the MLA website here.

Farm costs

The average total farm cash costs (payments made by the farm business for materials and services, and for permanent and casual hired labour – excluding owner-manager, partner and other family labour) of lamb producing farms were relatively stable from 2013-14 to 2015-16. Fertiliser, repairs and maintenance, interest payments, sprays, fuel, oil and lubricants were the predominant cash costs for lamb producers over the period. For large and very large-scale farms*, sheep and lamb purchases accounted for a large proportion of total costs.

In 2015-16, ABARES estimated average total cash costs of small and medium-scale farms decreased slightly, while large and very-large scale farms increased their cash costs.

Farm cash income

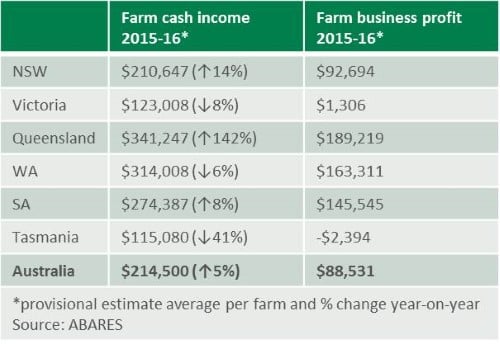

As illustrated in the table below, average incomes of slaughter lamb producing farms in NSW, Queensland and SA was estimated to have increased between 2014-15 and 2015-16, and, while receipts from the sale of lambs were higher year-on-year, the rise in farm incomes was largely driven by improved cropping receipts.

In Victoria, WA and Tasmania, however, average incomes were estimated to have declined in 2015-16, compared to the previous year. In Victoria and WA, the falls were mostly underpinned by lower cropping receipts – however the impact was somewhat lessened by higher receipts from wool and beef cattle. Dry seasonal conditions in Tasmania saw receipts decline overall.

For small-scale producers, the average farm cash income in 2015-16 is estimated to have been fairly steady year-on-year. The farm cash income of medium and very-large scale farms are estimated to have risen due mainly to increased crop, wool and beef receipts – driven by higher prices and beef cattle turn-off.

For large-scale farms, on the other hand, the average farm cash income decreased. This was attributed to greater expenditure on fertiliser and sprays, with the expansion of area sown to crops – offsetting higher receipts from crops and wool.

Farm business profit

As a measure of long-term profitability, farm business profit accounts for capital depreciation, payments to family labour and changes in inventories of livestock, fodder and grain stored on-farm. Changes in farm business profit are largely reflective of changes in farm cash income.

Negative farm business profit indicates that a farm has not covered the costs of unpaid family labour or allowed for funds to replace depreciating farm assets. Many farms record negative farm business profits from time-to-time due to fluctuating incomes. However, if negative profits are ongoing or remain very low, it can affect the long-term viability of the business as the capacity for investment is reduced.

For the 10 years to 2014-15, on average, 55% of slaughter lamb producing farms registered negative farm business profits in a given year. In 2015-16, however, this fell to 45% – following improved financial performance for Australia on average.

Next week MLA will cover farm investment results captured by the ABARES survey.

*Size of lamb producing farms:

Small-scale farms: 200 to 500 lambs

Medium-scale farms: 500 to 2000 lambs

Large-scale farms: 2000 to 4000 lambs

Very large-scale farms: more than 4000 lambs