Excellent pasture conditions aid US cattle herd expansion

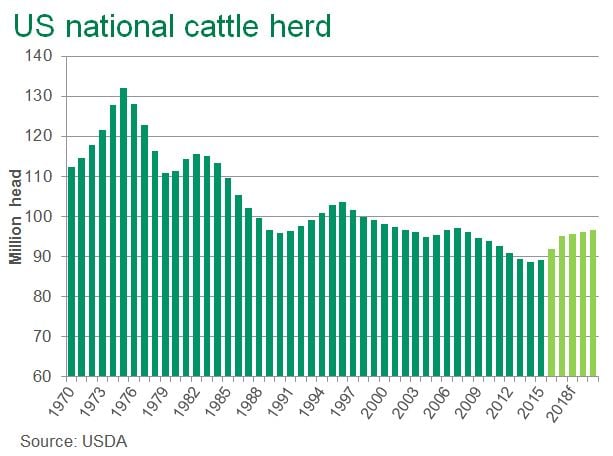

Drought from 2011 to 2014 caused massive liquidation of the US cattle herd, which dropped to a six-decade low of 88.53 million head at the beginning of 2014. However over 2014 and 2015, conditions across much of the Southern Plains – where a large proportion of cattle production occurs – improved and saw well above average pasture conditions. This allowed the rebuilding phase of national herd numbers to begin and resulted in 2015 seeing the first lift in national herd estimates since 2007 (up 1% year-on-year).

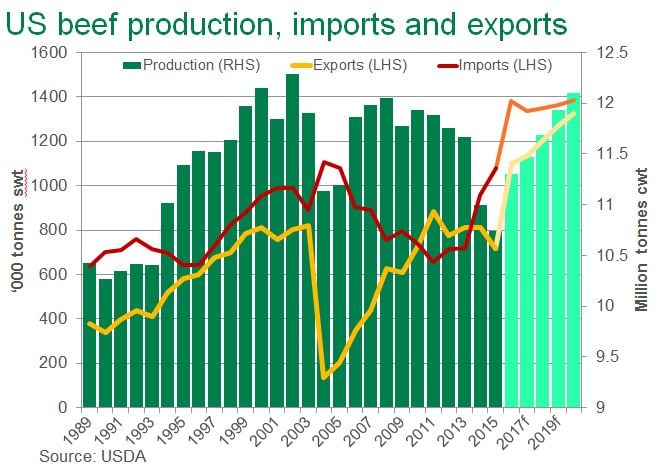

The continuation of the good seasonal conditions in 2016 has resulted in 66% of pasture across the US estimated to be in good or excellent condition, up from 61% during 2015 and the 10 year average of 53%. This is expected to further support calf production. Furthermore, massive corn crops planted in the US are expected to maintain downward pressure on grain prices, a key input in US beef (and pork and poultry) production. The improved ability to breed and finish cattle is expected to result in higher slaughter numbers and production through 2017-2019.

Because of the better growing conditions, the percentage of females slaughtered in the US last year dropped to 44%, down from the 47% that was being processed in 2014, as cattle producers retained cows and heifers for breeding. This resulted in 3% growth in herd numbers, to 92.9 million head and, considering the season and the incentive that producers now have to retain females, strong cattle herd growth is likely to be maintained in the coming years. USDA estimates of the US cattle herd are 95.2 million head at the beginning of 2017 and 95.7 million head by 2018.

Higher slaughter and production increases the US presence in Australia’s key export markets, including the US itself, Japan and Korea. In some cases, US beef competes directly with Australian product, but the overall higher volume of beef in global markets will put downward pressure on beef – and by extension, cattle – prices. Australia has some advantages that will aid in competing with US product – most notably through direct access to China, and ongoing reductions in tariffs in Japan, through the JAEPA.