Cow to beef price differential precariously close

The Australian cattle market edged lower again this week, bearing the weight of the seasonal rise in supplies. As widely reported though, the seasonal flush is, and will continue to be, at a much lower degree than in previous years, on the back of pasture availability and the significantly eroded national herd.

At the same time, imported 90CL (90% Chemical Lean) beef prices to the US remained subdued, on the back of thin trading and many US importers taking a wait-and-see approach.

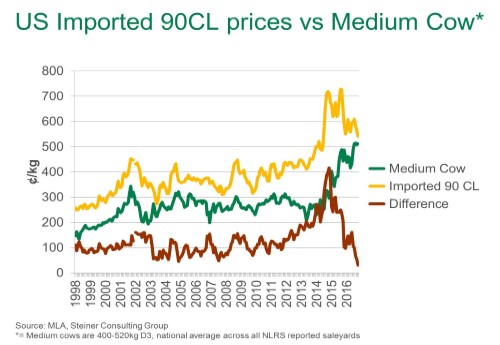

However, when imported 90CL prices are overlaid with Australia’s national medium cow indicator, the difference between the two has never been so close.

In fact, the downward trajectory of imported 90CL prices continues to be the result of greater US beef production, increased competition from other meat proteins on the market, and an appreciation of the A$. All these factors have led to imported manufacturing cow meat prices to the US averaging 16% below year-ago levels, at 541A¢/kg for October.

Australia’s saleyard medium cow indicator has actually appreciated 16% over the same time frame, on the back of the extremely tight cattle availability and widespread feed and water causing restockers to inflate the market.

The result is the two indicators lying just 30¢ apart for October – easily the narrowest the imported 90CL relative to medium cows have ever been. The previous time the two were somewhere as close as they currently lie was October 2004, when there was a 45A¢/kg difference.

The reason we monitor the relationship between these two indicators is because manufacturing beef to the US is one of the largest traded beef items to the largest market, providing a good indication of what future market trends may be. Similarly, cows are typically used for manufacturing beef purposes, hence providing a good indication of how cattle are performing relative to beef prices. It’s also important to note, that due to Australia presently exporting 70% of the beef produced, international markets are extremely important to monitor.

Nevertheless, conclusions that can be drawn from the current situation are:

- The two indicators have never converged, and considering the operating costs involved to convert cows to beef, it seems highly unlikely that the two will.

- The current proximity of the two indicators demonstrates that the Australian cattle market is extremely strong in comparison to that elsewhere, and in particular, the US.

- From 2012 to 2016, there were extreme drought events. First in the US, then here in Australia, causing an uncoupling of a previously close relationship. However, prior to 2012, the average difference between the two indicators was 102¢, meaning for the two markets to return to normal trading differentials, either imported US beef prices need to rise, or Australian cattle prices ease. Despite the production momentum in the US, Steiner Consulting Group are actually forecasting imported 90CL prices to stabilise at 200US¢/lb (579A¢/kg). While this limits the upside potential for Australian cattle prices, a major factor that will keep the market buoyant is the expectation of the lowest cattle slaughter in 20 years during 2017. However, once production levels do eventually build in Australia again, it is more than likely Australia will realign with global markets.