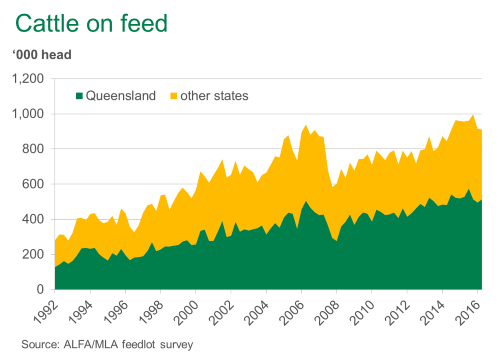

Cattle on feed drift lower but still historically high

Unsurprisingly, the latest ALFA/MLA feedlot survey results largely reflect the tightening pool of feeder cattle available and the record high prices being paid. As of June 2016, survey results indicate there were almost 911,000 cattle on feed, back from the 998,000 peak at the end of 2015 but still 60,000 head above the June quarter five-year average.

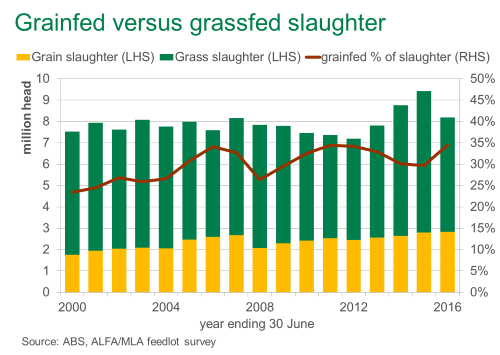

Despite the record number of cattle on feed at the end of 2015, it appears many of these remained in the supply chain through to the second quarter. In the first three months of 2016, grainfed turnoff actually declined 13% year-on-year – particularly impacted by a fall in Queensland – but last quarter results reflect a June quarter record turnoff of 712,500 head, up 3% year-on-year.

Furthermore, at a time when grassfed cattle slaughter had been in decline, during the 2015/16 financial year grainfed cattle turnoff totalled a record 2.82 million head, accounting for 35% of the national cattle slaughter.

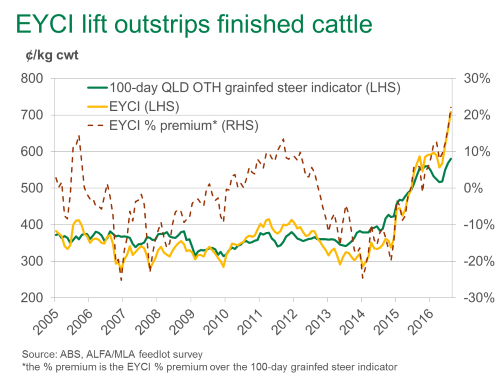

Feeder price rises outstrip finished cattle

While feedlots have enjoyed ample cattle numbers in recent years, the current and forecast supply of cattle – and the impact this is having on feeder prices – will continue to be a major challenge for the industry. Unfortunately for feeder buyers, cattle are expensive across the country and prices throughout the eastern states have continued to rally since May on the back of rain, a neutral-to-favourable seasonal outlook and reinvigorated restocker demand.

Out the other end, grain finished cattle prices largely improved in 2016 but have been unable to keep pace with the surging feeder cattle market. In fact, as illustrated in the figure below, the current premium of the Eastern Young Cattle Indicator (EYCI) over the Queensland 100-day over-the-hook grainfed steer indicator is as high as any time over the past ten years (and as far back as the grainfed cattle indicator goes).

Some relief for feedlots may come from the possibility that spring will bring greater numbers of feeder cattle onto the market – albeit off an already low base. Looking over the past ten years, the EYCI has typically eased 4% between the start and finish of spring; the largest fall was 23% in 2006 while the biggest increase was 5% in 2010. From current levels (705.00¢/kg cwt on 1 September 2016), a typical seasonal price fall would put the EYCI back closer to 677¢/kg cwt by the close of spring.

Furthermore, global feed grain prices will also remain under pressure, with the United States Department of Agriculture (USDA) recently forecasting the 2016 US corn crop to be a record breaking 15.2 billion bushels and the soybean crop a record 4.06 billion bushels.

However, headwinds may present themselves at the finished end of the market. After hitting a six decade low in 2014, the US cattle herd has recorded two consecutive years of growth and beef production is finally on the rise. With more affordable grain and cattle, US feedlot inventories are currently slightly above where they were the same time last year, although the number of cattle that have been on feed for more than 120 days is lower than year-ago levels.

Greater product out of the US is presenting increased competition in Japan and South Korea (Australia’s largest and second largest grainfed beef markets) – a force that will likely continue and will limit the upward potential of the finished end of the market.

In the first half of this year, exports from the US to Japan and South Korea were up 9% and 18% year-on-year, respectively (US Department of Commerce). Meanwhile, grainfed beef exports out of Australia to Japan were back 9% over the same period. In contrast, shipments to South Korea have been less affected, up 39% year-on-year, but competition from the US has been increasing – imported US beef unit values in South Korea have averaged just a 15% premium to Australian product so far this year, well below the average 25% and 22% in 2014 and 2015, respectively (KCTDI).

While the lower A$, compared with 2011 and 2012, has provided some buffer, competitive US imported beef prices in Japan and South Korea are challenging Australia’s market share.

China may present itself as one case where Australia may be sheltered from increased US beef production. With no direct US access into the market and an emerging middle class driving demand, grainfed beef exports from Australia to China in the first half of 2016 were up 28% year-on-year and accounted for 8% of total grainfed exports (DAWR). So far this year, increased competition from Brazil in China has been limited to frozen grassfed commodity beef.

- Click here for the June quarter edition of MLA’s Lot feeding brief

- To subscribe to the quarterly Lot feeding brief or any of MLA’s market information publications, email marketinfo@mla.com.au