Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Behind the surge in lamb carcase exports

08 August 2016

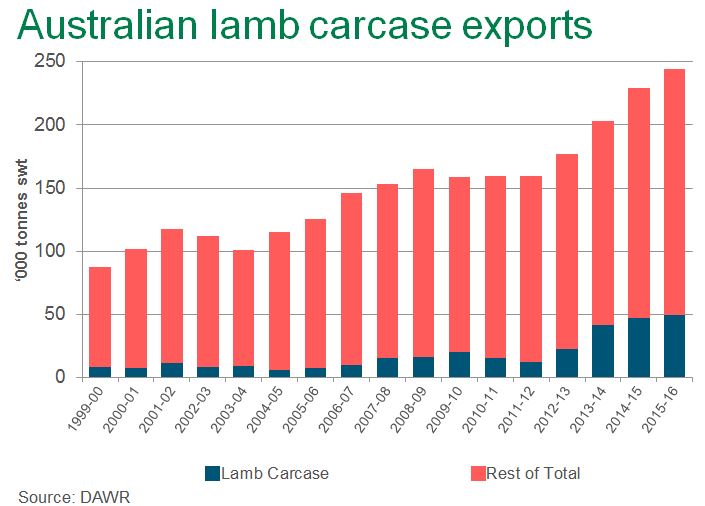

Since 2012-13, Australia has exported more lamb carcases than ever before.

Over these last four years, lamb carcase shipments have averaged close to 50,000 tonnes shipped weight (swt) each financial year – a huge jump from the average of 14,400 tonnes swt for the 15 years prior (Department of Agriculture and Water Resources).

Looking at it a different way, converted to the number of 16kg carcase weight lambs this would be, there has been a jump from 0.9 million, to 3.13 million lambs dedicated to the carcase trade.

So, why has the lamb carcase trade been so strong?

There was significant growth in 2012-13 at the time of Australia’s suspension of live sheep exports to Bahrain (August 2012). In the five fiscal years prior to 2012-13, Australia was shipping in excess of 500,000 head of live sheep to Bahrain each year (ABS). When the live trade was suspended, the market turned to lamb carcase exports – which were virtually non-existent in 2011-12 (105 tonnes swt), but jumped to 9,577 tonnes swt in 2012-13. Following this catalyst, carcase exports remained historically high for the next two years (13,253 tonnes swt in 2013-14 and 9,332 tonnes swt in 2014-15), before shipments dropped 59% year-on-year (to 3,859 tonnes swt in 2015-16) due to the Bahrain government’s decision to remove subsidies on imported Australian sheepmeat and live sheep.

Australia’s total lamb carcase exports to the Middle East remain robust though and in 2015-16 accounted for 47,227 tonnes swt of the total 51,384 tonnes swt exported.

The largest lamb carcase markets in the Middle East are now Qatar (14,815 tonnes swt), the UAE (13,077 tonnes swt) and Jordan (10,197 tonnes swt), where volumes increased 23%, 15% and 2% year-on-year, respectively.

The Qatar trade for chilled whole carcase is underpinned by government subsidies that apply to the whole carcase but not to vacuum chilled primals. Although there have been significant increases in whole carcase, there have been decreases in whole leg and shoulder, which some of this carcase trade has replaced. The whole carcase trade services all segments of the market including food service, mainly in the traditional catering and restaurant segment. There have also been considerable increases in the higher valued cuts, such as rack, rump, boneless loin and shortloin, as well as shank – which is a great indication that the higher end food service market is developing. This correlates with the development of more 4 and 5 star hotels and higher end dining.

Similarly in the UAE, there has been strong growth in rack, boneless loin and rump, as lamb works its way into more affluent dining facilities, but the carcase trade is where there has been the biggest growth. This product goes into all segments of the market and would be more an indication of urbanisation and the development of the retail sector over many years. There has also been a shift from mutton to lamb in this market, which we can see in the slower mutton trade. The UAE is the most developed market in terms of purchasing and cooking methods, and the greatest cross section of ethnic backgrounds that have a preference for fresh lamb.

The majority of carcases destined for the Middle East in 2015-16 were loaded in Victoria (34,554 tonnes swt), followed by WA (8,731 tonnes swt) and NSW (3,881 tonnes swt). The bulk of this trade is in chilled product, which is airfreighted to destinations across the Middle East daily.

The other two main markets for Australian lamb carcases, albeit considerably smaller volumes than the Middle East, are the US and Malaysia.

Lamb carcase volumes to the US were down 26% in 2015-16, to 1,951 tonnes swt, although this was not a reflection of a slow-down in trade to the US – in fact, total lamb exports to the US recorded 12% year-on-year growth in 2015-16, to 53,757 tonnes swt. Largely offsetting the declines in carcase, shoulder, rack and shortloin volumes in 2015-16, was an 82% jump in ‘assorted cuts’ and a 20% increase in shanks during the fiscal year. Lamb carcases destined for the US were primarily shipped from Victoria (1,653 tonnes swt) in 2015-16, with most of the remainder loaded in WA (288 tonnes swt).

Malaysia is a growing market for Australian lamb carcases, with volumes in 2015-16 reaching 1,153 tonnes swt – up 9% on year-ago levels and up 47% on the five-year average. Victoria was the main state of loading for lamb carcases to Malaysia, at 1,039 tonnes swt for the year.

Since 2012-13, lamb carcases have consistently accounted for 21-22% of total Australian lamb exports, compared with the 15 years before then, when the proportion averaged only 11%. It seems carcases have emerged as a fairly significant and stable portion of the Australian lamb export cut composition, meeting specifications and cultural requirements of customers around the world.