Beef, lamb and Brexit

The implications of the United Kingdom’s (UK) vote last week to leave the European Union (EU) are not yet clear, as technical negotiations between the two parties will not begin until the UK triggers Article 50 of the Lisbon Treaty. After which, the UK has a two-year deadline to come to an agreement on the future relationship with the EU, but until then, in theory, it will be business as usual.

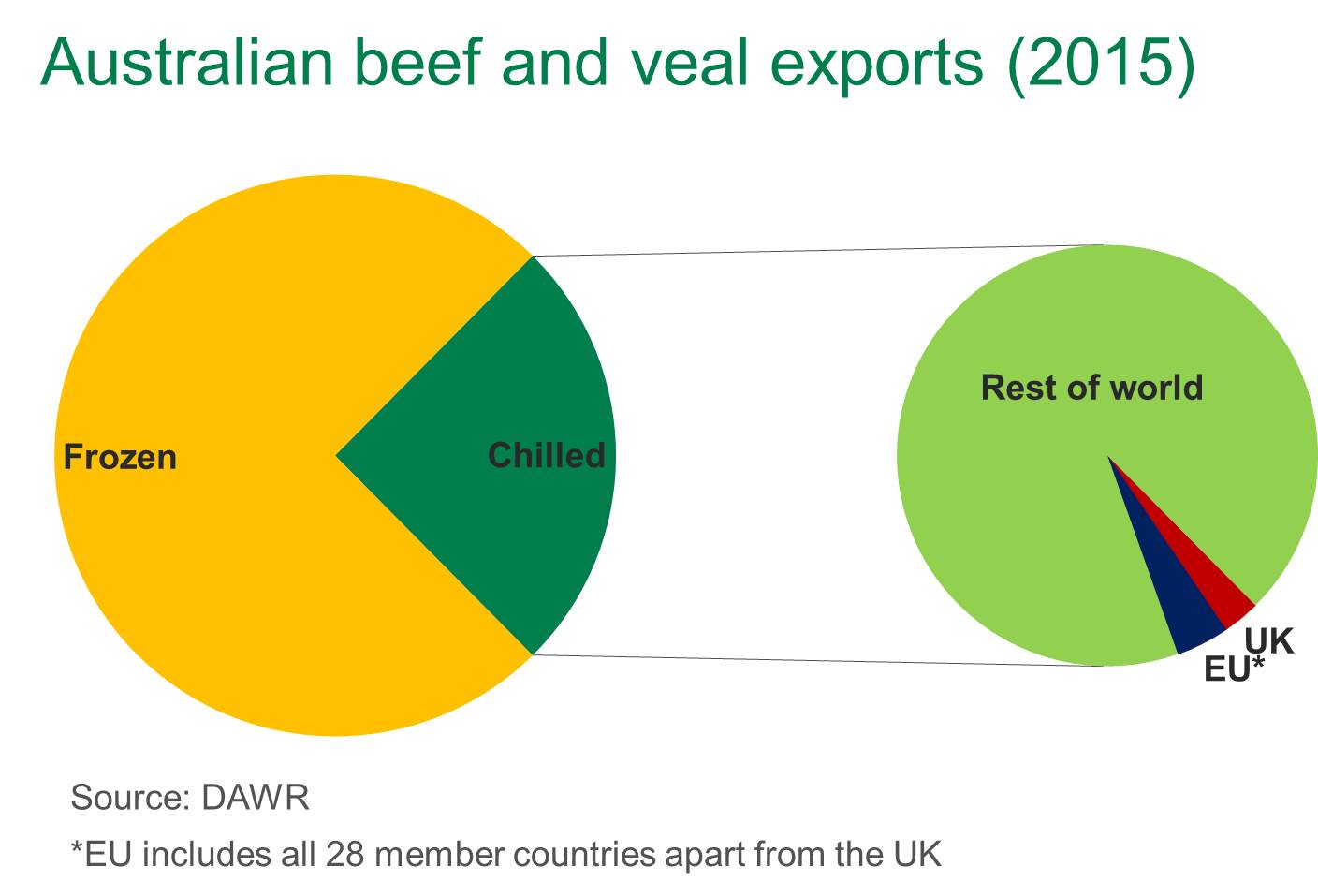

Australian red meat trade with the EU is currently restricted by low volume import quotas and high above-quota import tariffs, with beef and sheepmeat exports to the EU accounting for just 2% (23,445 tonnes swt of beef and 16,195 tonnes swt of sheepmeat) of the total volume in 2015. Just over half of that trade (9,460 tonnes swt of beef and 12,921 tonnes swt of sheepmeat) was destined for the UK, making it the single largest country in the EU for Australian product.

While limited by quotas in recent years, Australia and the UK have a rich trading history. The result of post-war agreements, during the 1950s the UK accounted for 50-80% of Australian beef and veal exports and the majority of sheepmeat shipments. This trade diminished once the UK joined the EU, they recovered from post-war supply shortages and Australia diversified into other markets, notably the US and Japan.

This article provides a snapshot of Australia’s current red meat trade with the EU and the UK.

Beef

Australia was the fourth largest external supplier of beef to the EU in 2015, behind Brazil, Uruguay and Argentina, and accounted for 11% (or 23,603 tonnes swt) of imported beef.

Australian beef exports to the EU are primarily limited by two quotas; the High Quality Beef (HQB) Hilton quota of 7,150 tonnes swt per year with an in-quota 20% tariff; and the first-come first-serve 48,200 tonnes swt per year global HQB grainfed quota with a zero in-quota tariff. Australia has consistently been a high user of the available quotas.

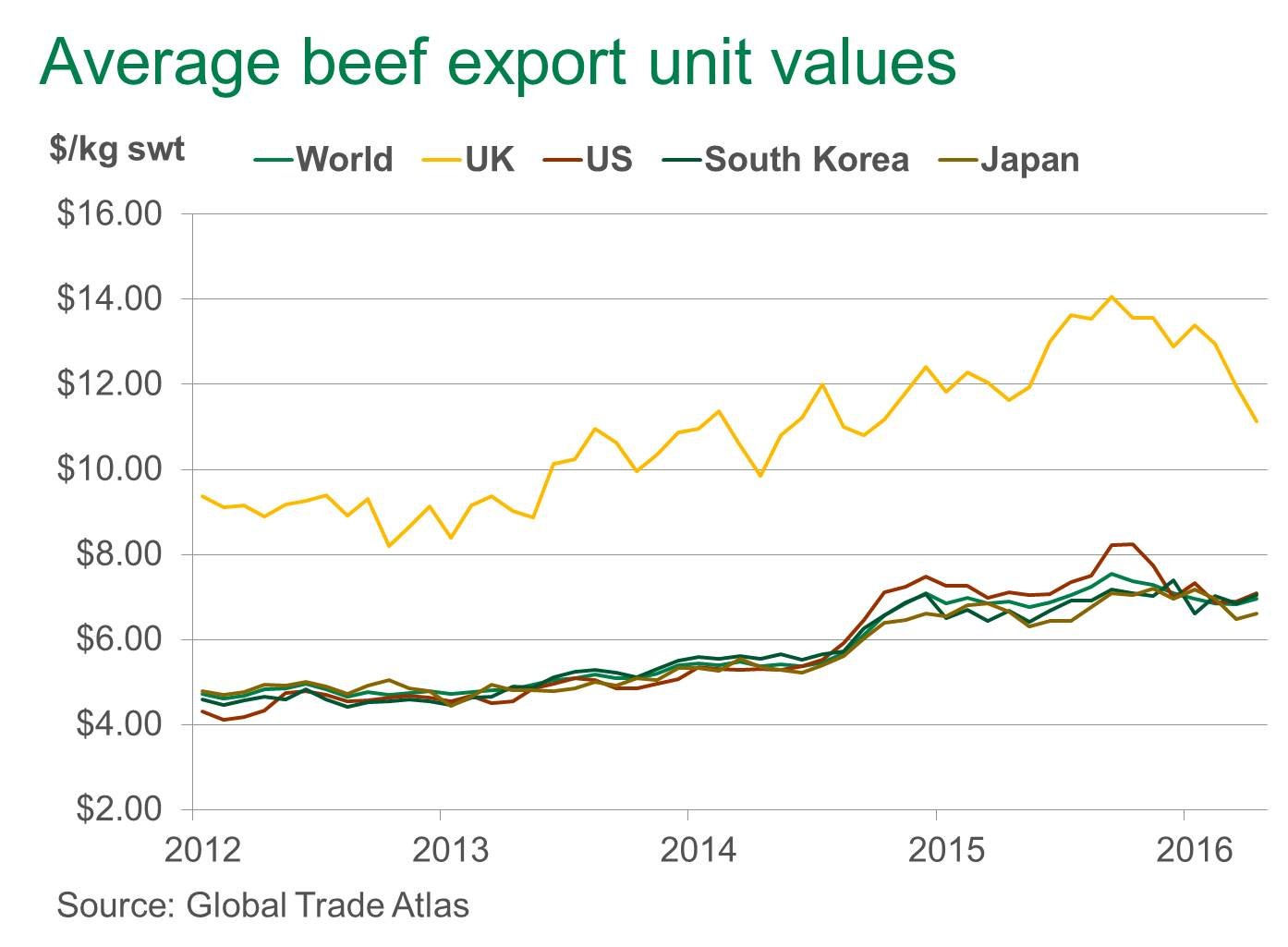

While limited by allocation, the EU, and particularly the UK, commands a high price premium over Australia’s other export market destinations, as illustrated below.

The strong premium is due to the high proportion of chilled high quality product traded – in 2015, 41% of Australian exports were rump and loin cuts, with higher valued secondary cuts accounting for the remainder.

While limited by volume, the strong premiums available in the EU are reflected back home, with the Queensland over-the-hook EU grassfed steer indicator averaging 14% (or 65¢/kg cwt) above the non-EU counterpart in 2015. It should be noted that due to the disproportionate ratio of secondary cuts versus high valued cuts, the EU cattle premium is not as great as the EU export unit value premium.

Much is still unknown about the full repercussions post-Brexit, however there is the possibility that the strong premium for EU-certified cattle comes under pressure if demand from the EU is weakened as a result.

Sheepmeat

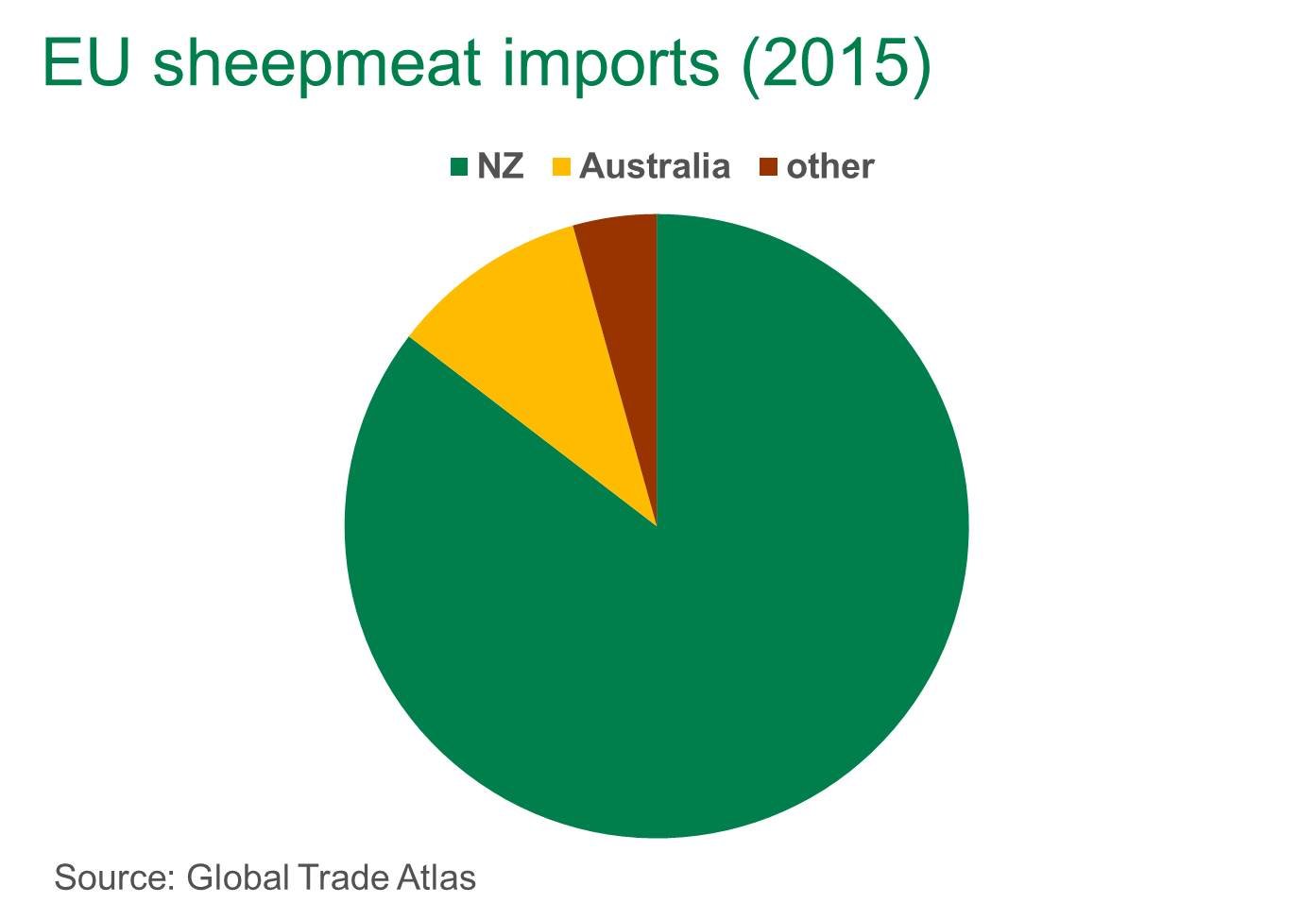

Australia is the second largest external supplier of sheepmeat to the EU, behind New Zealand (NZ). In 2015, the EU accounted for 36% (or 144,741 tonnes swt) of NZ sheepmeat exports, which was 85% of EU imports. Despite Australia and NZ being the two leading global sheepmeat exporters, the chart below illustrates the dominance of NZ in the market. Furthermore, nearly half of NZ exports to the EU in 2015 were destined for the UK.

NZ’s leading position is underpinned by more favourable market access into the EU. In 2015, NZ had a 228,254 tonnes carcase weight equivalent quota allocation, while Australia had just 19,186 tonnes carcase weight equivalent.

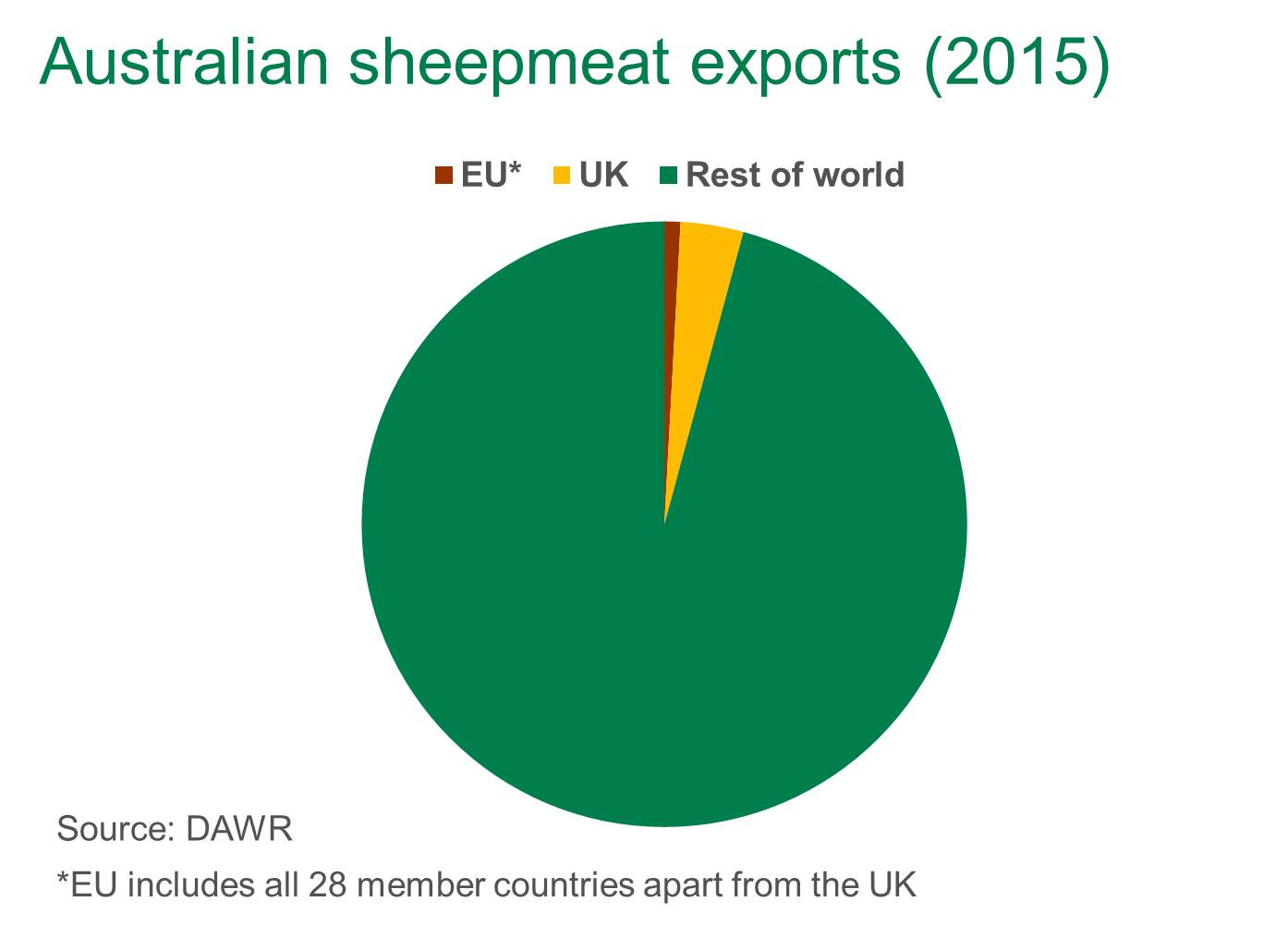

Partly the result of limited EU market access, Australia has a diverse export portfolio, including to the US, China and the Middle East, and the chart below illustrates the size of the EU and UK sheepmeat export markets relative to total trade.

Given the relative size of the EU and the UK for Australian sheepmeat exports, any disruptions in the short term should only have a minor influence on the sheep and lamb markets back home.

What’s next?

For now, one tangible change is reflected in exchange rates, with the pound sterling collapsing to a 30-year low against the greenback. Compared to Australia, the A$ rallied against the sterling and, while not record breaking, it is the strongest it has been against the British currency since late 2014 – leading to weaker purchasing power for the UK and possibly subdued demand for red meat.

Furthermore, disruptions to business and the impact on consumer confidence is yet to be realised and, as speculated prior to the referendum, there is a chance the UK could fall into recession, and any slowdown in the economy could impact consumption.

Moreover, it is very much wait-and-see in terms of how trade agreements between all parties unfold, though given the majority of Australian red meat to the EU ultimately goes to the UK, there are potential gains if Australia is able to reach separate agreements with the UK prior to other countries. However, any potential agreements are some way from being realised and trade talks typically take years to come to completion.

For a detailed overview of Australia’s red meat trade relationship with the EU, click on the links below: