Aussie beef shipments in 2015-16 recede with production

Australia’s beef exports for the 2015-16 financial year reached a total of 1.17 million tonnes shipped weight (swt), down 13% from 2014-15 – which was the largest financial year on record (Department of Agriculture and Water Resources).

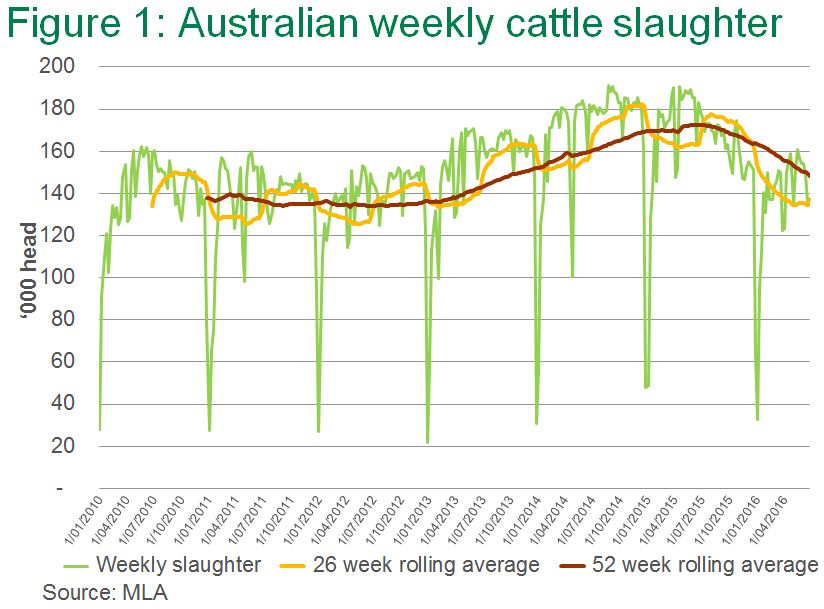

While a 13% decline in beef exports seems like a large change, 2015-16 was still the third largest beef export financial year Australia has ever had. The decline in trade was largely supply driven, with weekly cattle slaughter dropping significantly in the latter stages of the year, averaging 14% lower than 2014-15 (MLA) at just under 150,000 head, as shown in Figure 1.

As would be expected with such a large decline in beef exports, a number of major markets recorded smaller volumes than the previous year, including the US and Japan, Australia’s two largest export beef destinations. Additionally, Saudi Arabia faced extremely strong price competition from Brazilian beef exporters, however despite the increase competition, Australian exports to Saudi Arabia was significantly above levels previous to Brazil being denied market access.

In contrast there were also bright spots, with higher volumes of beef exported to Korea, China and Indonesia, while a number of other markets, including Taiwan, Philippines, Malaysia and the EU remained relatively steady.

Further to the reasonably positive trade spread, the volume of chilled beef exported in 2015-16 dropped just 6%, to 308,571 tonnes swt. This suggests that exporters were able to maintain customers in higher value areas, with average unit values for beef exports remaining well above historic levels, despite a decline beginning in late 2015 (Global Trade Atlas). Figure 2 shows the sharp upward movement in export beef prices through 2014, where they remain (latest figures available are for April 2016).

For Australia’s major beef markets, exports to:

-

- The US were down 29%, to 334,431 tonnes swt – with the chilled grassfed component making up 19% at 64,034 tonnes swt, while frozen grassfed component was 77% of total volume. The average unit price to this market for the year-to-May was $7.38/kg swt, up 45% on the five-year average.

- Japan were down 12%, to 268,404 tonnes swt – exports consisted mostly of grassfed beef (57%) which were 13% lower year-on-year while grainfed shipments were 133,284 tonnes swt, down 7%. The average chilled price jumped 59% to $13.28/kg FOB. Competition within the Japanese market for grainfed beef is heightening, with reports of greater volumes of US product in the market.

- Korea were up 10%, to 173,189 tonnes swt – encouragingly with higher valued chilled product, aiding to lift in the value exported to Korea, up 26% for year-to-May. Aiding demand over the past year was tight supply of local Hanwoo product.

- China were up 2%, to 127,951 tonnes swt – after a relatively slow 2014-15, and despite Brazil gaining access and exporting very large volumes of beef, Australian trade to China was relatively strong.

- Indonesia were up 24%, to 53,867 tonnes swt – largely due to a significant increase in beef exports during the June quarter, with the Indonesian government relaxing import restrictions in order to keep wholesale beef prices down.

- Taiwan were down 1%, to 30,802 tonnes swt

- The EU were steady, at 23,968 tonnes swt

- Philippines were steady, at 29,482 tonnes swt

- Saudi Arabia were down 31%, to 20,367 tonnes swt. As mentioned above, the re-entry of Brazilian beef was a significant headwind for Australian trade, as the price competitions becomes to great to bear for many customers. By way of comparison, Australia exported 18,944 tonnes swt of beef to Saudi Arabia in 2012-13, the year the Brazilian ban commenced, and just 4,662 tonnes swt in 2011-12.

For the year ahead, exports are likely to continue struggling meeting the levels of the past two years, all on the back of supplies. For cattle producers watching potential implications to farm gate returns, monitoring the volume of chilled product and values provides strong clues as to what price potentials would be.

For a further breakdown to grainfed exports please click here.