Aussie beef exports slow, but still fourth largest

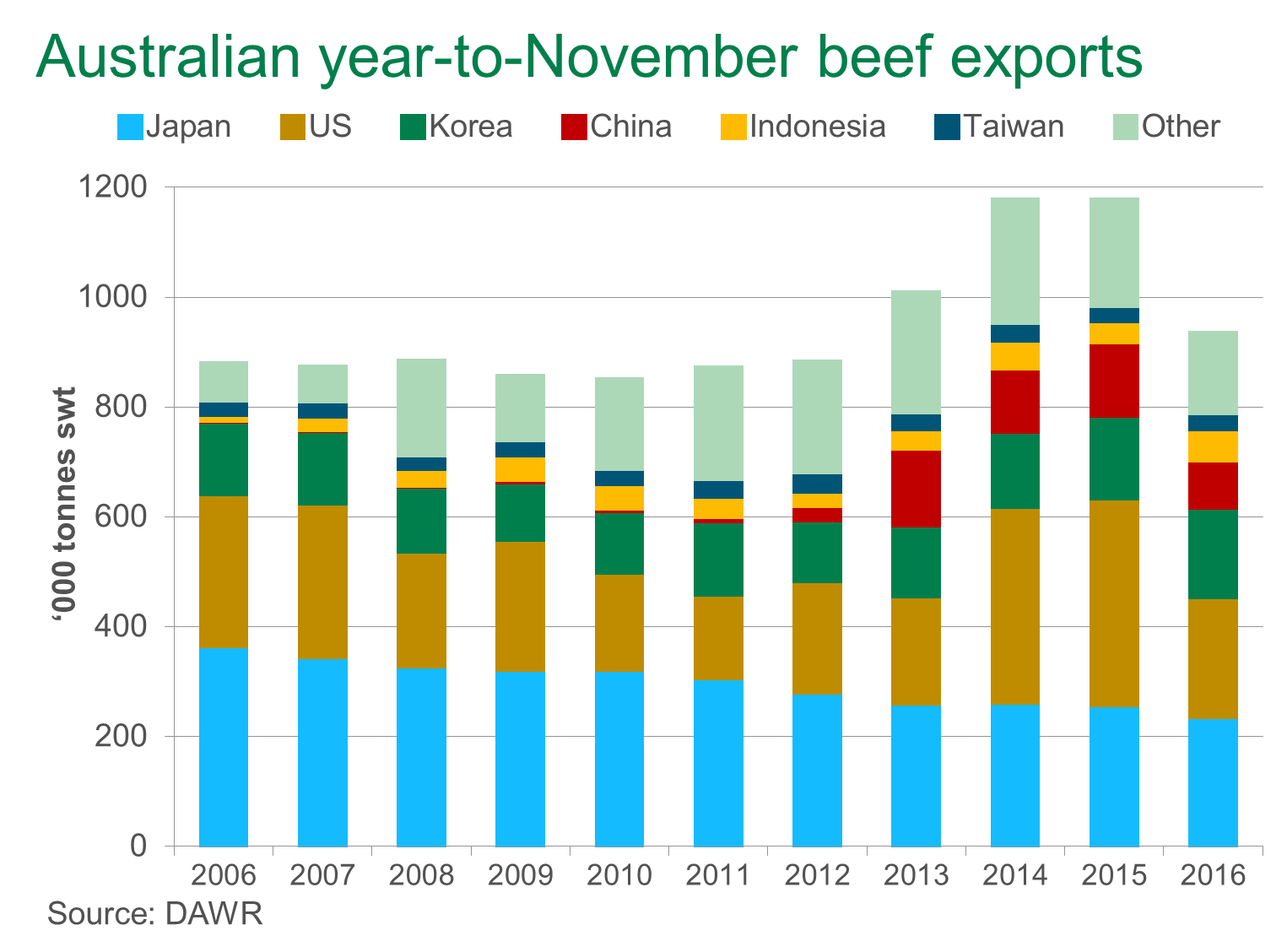

Despite dropping significantly from the enormous volumes shipped in 2015, Australian beef exports for the year-to-November were the fourth largest on record, at 928,754 tonnes swt.

As widely reported, constrained Australian beef production in the wake of widespread herd liquidation is the primary reason behind the fall in overall exports, but shifting dynamics in each country have resulted in the impact varying to different degrees.

Beef production increased significantly in the US during 2016 and consequently, the market dropped from Australia’s largest destination last year, to second this year. Reflecting the greater US production, import 90CL prices for the month of November were back 3% from year-ago levels and 21% lower from the peak in August 2015, at 573A¢/kg. As a result, Australian exports to the US for the year-to-November declined 42% from the corresponding period to 218,705 tonnes swt.

Meanwhile, the presence of US beef globally has increased, with US exports growing 9% for the year-to-September, to 578,000 tonnes swt. There has been a particularly strong focus on Japan and Korea where US exports lifted 15% and 31% year-on-year, respectively. In contrast, Australian shipments to Japan for the year-to-November are down 8%, however Australia retains the largest market share of the Japanese market, at 54%, while the US accounts for 38%. Interestingly, as a result of lower volumes shipped to the US, Japan has returned to being Australia’s largest destination.

Korea, on the other hand, has continued to import increased volumes of Australian beef throughout the year – despite being restricted by above safeguard tariffs. Year-to-November volumes increased 9% year-on-year and 29% on the 10-year average to 162,663 tonnes swt and are set to be a record high for the second consecutive year.

While there have been some challenges, assisting the demand for Australian beef in Japan and Korea has been extremely high domestically produced beef prices, and this is likely to remain the case again in 2017, along with tariff reductions and a more affordable exchange rate compared to the US.

Shipments to the Middle East almost halved with only one trade month remaining in the year, to 28,605 tonnes swt – with volumes to both Saudi Arabia and the UAE declining by a similar proportion. Brazilian beef presence has grown immensely in the region, while at the same time, subdued oil prices and reduced tourism have further impacted beef imports.

Australian beef exports for the year-to-November 2016 to;

- China eased 36% year-on-year to 85,522 tonnes swt, however are still double the 10-year average

- Indonesia grew to record highs of 57,065 tonnes swt, up 51% year-on-year, which consisted predominantly of manufacturing cuts

- Taiwan increase by 6% year-on-year, however remained 2% lower than the ten-year average, reflecting the high volumes exported to Taiwan over recent years

Going forward, 2017 is likely to see slightly lower beef exports again as Australia recovers from one of the greatest herd liquidations in recent history.