Three things for Aussie cattle producers to watch

Supply, the US beef market and currency – the three major variables that move daily and are sure to have a significant impact on Australian cattle prices in 2016.

Supply is rather obvious, with the number of cattle on the market dictated largely by seasonal conditions and movement in the national herd, with any undersupply generally supporting prices, and vice versa.

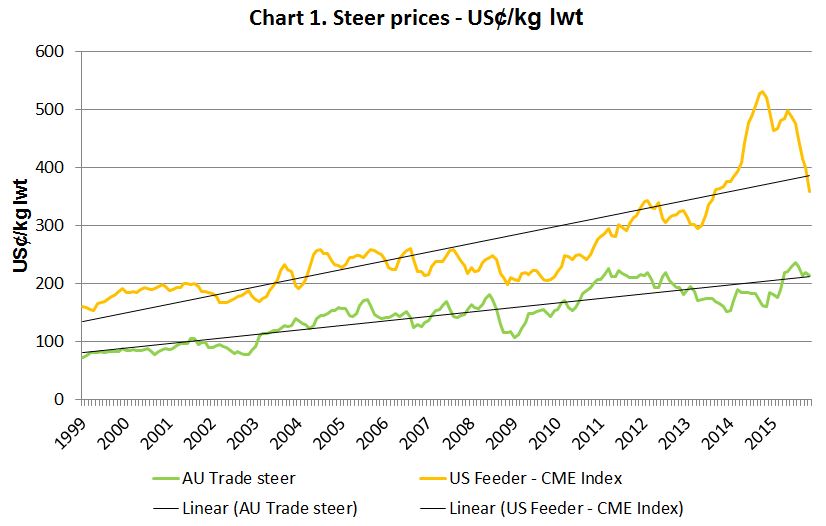

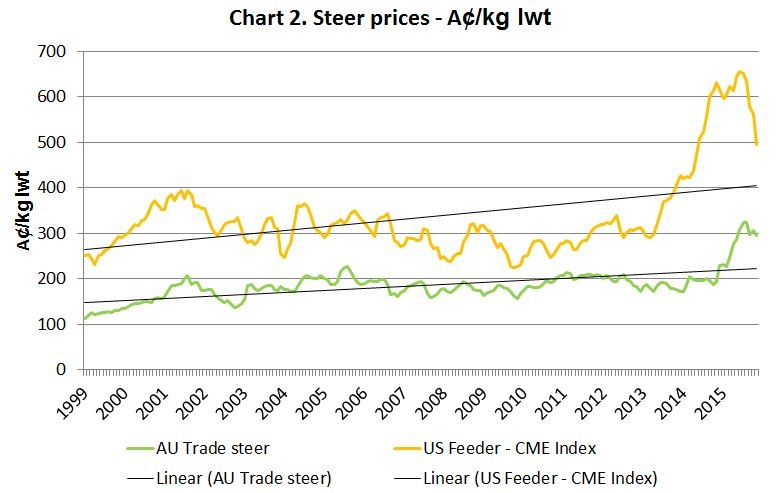

The US beef market, being the world’s largest beef producer and consistently one of Australia’s largest beef export destinations, has a very strong influence on the Australian cattle market. How closely the Australian cattle market follows the US can clearly be seen in the two charts below, and like low supply, a strong US beef market will indeed improve price potential for Australian producers.

Currency, as Australia exports more than 70% of the beef it produces each year, any movement in the strength of the A$ influences cattle prices. This is also clearly illustrated through the two charts below.

Chart 1 displays Australian and US cattle prices in US$ terms, and in 2012, Australian trade steers hit just over 200US¢/kg lwt – influenced by low Australian cattle supplies. In 2015, the price of Australian trade steers returned above 200US¢/kg lwt – influenced by high US beef prices.

However, when both markets are converted to A$ terms (Chart 2), the weaker currency in 2015 (average 75US¢), compared to 2012 (average 105US¢) meant the price lift was far greater for Australian producers in 2015.

A weaker Australian currency also works to offset any falls in the US beef market, which is displayed in Chart 2, where for the final months of 2015, the decline in US prices was far greater than Australian prices.

In 2012, the lift in Australian prices, in A$ terms (Chart 2), could have been higher if the A$ was weaker, but would have been capped by where the US market was.

From 2013 to 2015, the number of cattle on the Australian market was the limitation for price potential, causing a rare disconnect between movements in both US prices and the A$ and Australian cattle prices.

Considering the Australian cattle herd is expected to hit a 20 year low in 2016 (forecast to be 26.2 million head by June), and the A$ is forecast to average between 66-69US¢, it may be the US market capping upward price potential in 2016, if that market continues to decline.

There are of course a whole range of other factors for producers to monitor, like changes in the global trade environment, but the primary influences for producers to keep an eye on, as always, are supply, the US beef market and currency.