Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Retail prices continue upward trend in 2016

17 May 2016

According to the Australian Bureau of Statistics (ABS) and Australian Bureau of Agricultural and Resource Economics (ABARES) data, indicative retail beef and, to a lesser extent, lamb prices continued to trend higher during the first quarter of 2016.

Cattle prices have remained well above year-ago levels for almost eighteen consecutive months and with beef and veal production during the first quarter back 17% year-on-year, at 532,683 tonnes carcase weight, retail have prices have been under upward pressure. The indicative retail beef price was a record $19.16/kg retail weight (rwt) in the first quarter of 2016, up 13% from the same time last year.

Lamb followed a similar trend, with the indicative price up 8% year-on-year but only marginally higher than the previous quarter, at $14.29/kg rwt.

Coinciding with these upward movements was the continued stability of cheaper proteins, such as chicken. In the first quarter of 2016, the indicative chicken retail price was $5.44/kg rwt, back 3% year-on-year and just 14% above where it averaged in 2000. In comparison, both beef and lamb are roughly double the price of where they were in 2000.

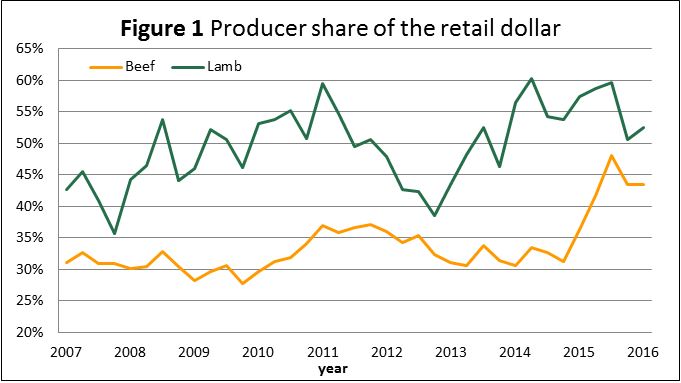

Back at the farm gate (given certain assumptions listed below), the beef producer share of the retail dollar was 43% in the first quarter of 2016, up seven percentage points on where it averaged last year but steady with final quarter of 2015. With the seasonal lift in lamb prices only beginning to occur in recent weeks, the lamb producer share of the retail dollar in the first quarter was actually back five points from last year, at 53%. Figure 1 illustrates recent trends in the two indicators. Both the beef and lamb producer shares are well above the ten-year average of 33% and 49%, respectively.

-

The beef and lamb producer shares of the retail dollar are calculated using a range of assumptions. The national saleyard trade steer and trade lamb indicators are used as the benchmark livestock prices, representing animals suited for the domestic market. Livestock prices are collected by Meat and Livestock Australia (MLA). Converting the carcase weight (cwt) price to an estimated retail weight (rwt) equivalent price is achieved using a retail meat yield for beef and lamb of 68.7% and 70%, respectively.

-

The indicative retail meat prices are calculated by indexing forward from actual average prices of beef and lamb prices during December quarter 1973, based on meat subgroup indices of the Consumer Price Index (CPI), provided by the Australian Bureau of Statistics (ABS). These indices are based on average retail prices of selected cuts (weighted by expenditure) in state capitals. The retail price calculation has principally been made by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES); however, in some instances, the most recent calculation has been made by MLA.

-

The producer share is calculated by dividing the estimated retail weight equivalent livestock price by the indicative retail price.