How did 2015 fare for Australian lamb exports?

Australian lamb exports reached 233,999 tonnes swt in 2015 – back slightly (1%) from 2014’s record volume, but 23% higher than the five-year average (Department of Agriculture and Water Resources).

Encouragingly, there was a 4% lift in higher valued chilled product shipped during the year, at 99,661 tonnes swt, while, despite still making up the majority, frozen shipments declined 5% year-on-year, to 134,338 tonnes swt.

On a cut-by-cut basis for 2015, compared to last year:

- Carcase exports were up 6%, at 52,242 tonnes swt

- Breast & Flap exports were up 2%, at 43,247 tonnes swt

- Leg exports declined 6%, to 36,126 tonnes swt

- Shoulder exports declined 2%, to 34,165 tonnes swt

- Manufacturing exports declined 19%, to 14,683 tonnes swt

- Rack exports declined 6%, to 10,840 tonnes swt

Lamb shipments to the Middle East in 2015 increased 6% on the previous year, to 68,255 tonnes swt. Furthermore, this was 38% higher than the five-year average. The rise in shipments to the market is attributed to continued consumer demand and population growth, lower availability of Australian mutton for export, and a decline in New Zealand exports.

Lamb exports to the US lifted 8% in 2015 and 31% on the five-year average, to 49,904 tonnes swt. In fact, 2015 is now the largest year on record for Australian lamb exports to the US. The growth in shipments is supported by strong relationships between Australian exporters and the US trade, fast growing immigrant populations who traditionally use lamb in their cooking, as well the expansion of international cuisines and new fast food concepts.

Volumes to China registered a considerable decline last year, totalling 31,326 tonnes swt – down 19% year-on-year, although still 8% above the five-year average. The decline in shipments was largely due to high domestic lamb inventories in China. Additionally, domestic Chinese lamb is lower in price and has an advantage of freshness over Australian frozen product – reportedly the most important purchasing factor for Chinese consumers.

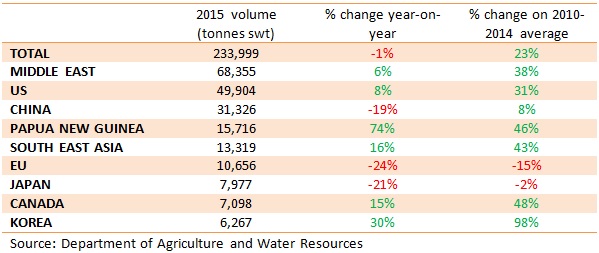

Australian lamb export volumes to other markets are presented in the table below.

The outlook for 2016 is for Australian lamb shipments to decline slightly from 2015 levels – underpinned by lower production, rather than lower demand. The US and the Middle East are expected to remain Australia’s major lamb export markets in 2016.