Grainfed beef exports trump previous record

Australian grainfed beef exports trumped the previous high set back in 2006 by more than 6,000 tonnes swt during 2015, at 263,641 tonnes swt (Department of Agriculture and Water Resources).

The annual grainfed beef shipment accounted for 21% of total beef exports and went to 53 different countries. Interestingly, the year that grainfed beef accounted for the greatest proportion of the total beef trade was 2006, yet the number of countries was much fewer, at 41. This illustrates the growing diversity of the Australian grainfed beef export portfolio.

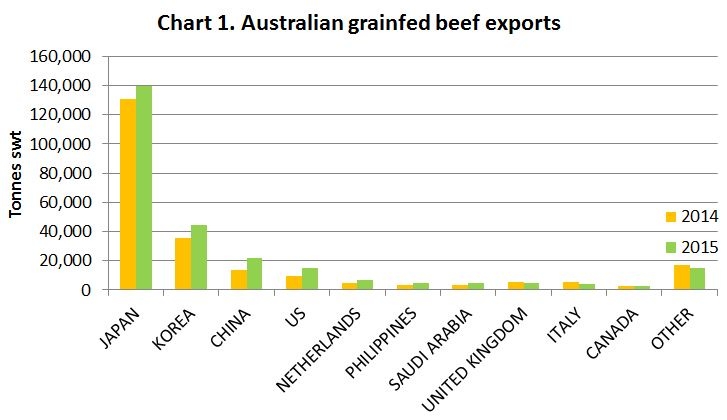

The largest destination in 2015 was Japan, where 139,685 tonnes swt were exported, up 7% year-on-year, assisted by the price competitiveness of Australian product relative to the US. The grainfed trend to Japan bucked that for grassfed, where an 11% year-on-year decline occurred, at 145,540 tonnes swt. The item accounting for the largest grainfed volume was manufacturing (31,469 tonnes swt), followed by brisket (17,610 tonnes swt), chuck roll (15,267 tonnes swt) and fullset (13,335 tonnes swt).

Korea was the second largest destination for 2015, at 44,203 tonnes swt, which was up 7% from the previous year. Australia’s competitiveness was assisted in that market by similar reasons to those for Japan, along with the second year of tariff reductions. The cuts that accounted for the largest contribution were chuck roll (7,075 tonnes swt), blade (6,803 tonnes swt) and brisket (6,386 tonnes swt).

Rounding out the top three was China, where shipments jumped 61% year-on-year, to 21,630 tonnes swt. Grainfed brisket exports were up 18%, at 5,683 tonnes swt, pressuring Japan for what is traditionally an item destined for that market.

Other destinations of significance were the US (15,211 tonnes swt, up 60%), the Netherlands (6,672 tonnes swt, up 45%) and the Philippines (5,020 tonnes swt, up 55%).

The ten largest grainfed beef export destinations are illustrated in chart 1.

A decline in grainfed beef exports is expected for 2016, as a result of the smaller Australian cattle herd. Notwithstanding, the fall is likely to be less significant than that for grassfed, as it is anticipated the processors will look to grain feeding to add weight to the lower number of cattle available.