Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Cattle market in good stead to begin winter

02 June 2016

The dry start to autumn kept the cattle market subdued but over the past month most indicators have improved, supported by rain and a softening dollar. Furthermore, with the Bureau of Meteorology (BOM) declaring the El Niño over, the three month rainfall outlook is forecasting above median rainfall for much of the country.

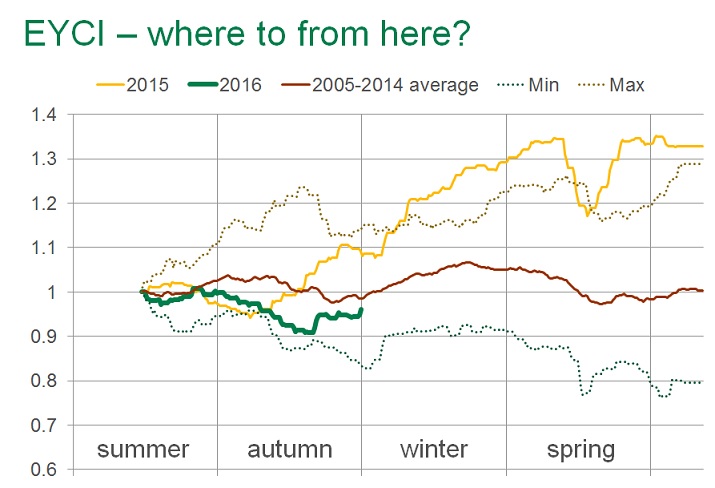

The figure below illustrates the seasonality of the Eastern Young Cattle Indicator (EYCI) over the past twelve years. The beginning of each year is indexed back to a value of 1, meaning seasonality can be measured by how far the EYCI departs from where it started.

Throughout autumn 2016 the EYCI underperformed compared to the historical average (ten-year average up to 2014). However, the indicator was starting at the highest base on record and the A$ lifted 7¢ from the beginning of March to where it peaked in April. May registered a price improvement, back towards the seasonal average, but the indicator is still below where it has historically trended for this time of year.

Looking ahead, despite the indicator still being at historically high levels, with recent rain and a favourable weather outlook, there is potential for the store cattle market to move with the seasonal average over coming months. Further supporting the market will be the constant supply pressure over the rest of the year and into 2017 as the cattle herd drops to a 20-year low.

As illustrated above, winter usually records a lift in prices, particularly in June and July. With the EYCI starting the year close to 600¢/kg cwt and greeting winter at 582¢/kg cwt, such a seasonal upward trend would potentially put the winter peak at 630-640¢/kg cwt. Roma Store on Tuesday demonstrated the seasonal upward price potential, with the very good quality yarding of weaners lifting the EYCI eligible cattle average 18¢/kg cwt week-on-week, to 594¢/kg cwt.

However, many other factors feed into the price equation, such as the A$ and export demand, and as also illustrated above prices have softened in the winter months in the past. Furthermore, the EYCI is just one indicator and other classes of cattle needed to be considered, as different regions – which experience a range of seasonal conditions over the winter months – will trend in contrasting ways.

For example, finished cattle in Victoria generally trend dearer over the next three months, following a contraction in slaughter, while their counterparts in Queensland have historically eased in June before lifting in July and August. Finished cattle in NSW have historically recorded a steady to slightly dearer trend through the winter months.