Retail beef exceeds $17/kg

For the fifth consecutive quarter, average retail beef prices have seen a year-on-year increase, as the impacts of rising cattle prices and a competitive export market take effect.

According to Australian Bureau of Statistics (ABS) and Australian Bureau of Agricultural & Resource Economics (ABARES) data, during the three months ending June, retail beef prices averaged $17.27/kg retail weight, up 8% year-on-year.

Breaching the $17/kg retail weight mark for the first time on record, current retail beef prices are the highest they have ever been. However, converting prices into real terms (removing the effects of inflation), current levels are on par, if not below, what they have averaged since 1990.

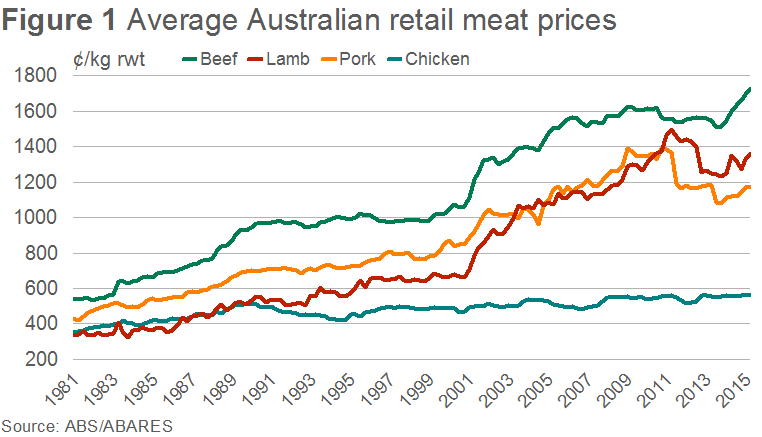

While real prices can be used to measure affordability, it is the change in the price of beef relative to other proteins that explains the slow decline in domestic beef consumption over time. As illustrated in Figure 1, while beef prices have gradually increased over the past thirty years, chicken has seen a much smaller appreciation. In fact, in the mid-1980s beef was about one and a half times more expensive than chicken, now it is in excess of three times more expensive. Interestingly, while currently at a discount, pork has also increased in price over time in line with other meats – beef has consistently been priced on par to one and a half times the price of pork.

And where does lamb fit? With strong saleyard and over-the-hook prices, retail lamb prices also saw some upward movement. At $13.60/kg retail weight during the June quarter, lamb prices were up 1% year-on-year but were still below the high of almost $15.00/kg retail weight recorded in 2011, when saleyard lamb prices started the year above 600¢/kg cwt.

Interestingly, the increase in beef prices has not been enough to outstrip the rise in the cost of cattle. During the June quarter, the beef producer share of the retail dollar increased again, to almost 42% – the highest value since 2001. Likewise, the lamb producer share of the retail dollar increased to 59% – well above the 48% average since 2000.

For a full description of how the producer share is calculated, please click here.