Back to Prices & Markets

Profile of Taiwan: an important market for Australian red meat exports

With a comparatively wealthy population (at US$21,874 GDP per capita in 2014) of just over 23 million people, Taiwanese are among the highest per capita meat consumers in Asia. Although red meat comprises a comparatively small proportion of the protein consumed, it is growing and will remain an important market for Australian red meat.

Taiwan’s Australian red meat imports

- Taiwanese are big consumers of meat, consuming an average 75kg per capita, with the bulk of it fish, pork and poultry (Euromonitor International). Red meat comprises a comparatively small proportion of the meat diet, but has been growing, with Taiwanese consuming around 3.4 kg of beef per capita per year (USDA), compared to 25.7 kg in Australia (MLA).

- Taiwan is Australia’s second largest market for goat meat (after the US), where shipments were 4,129 tonnes swt, worth A$20,781,075 in the 2014-15 fiscal year. This is all frozen carcase and mainly skin-on product.

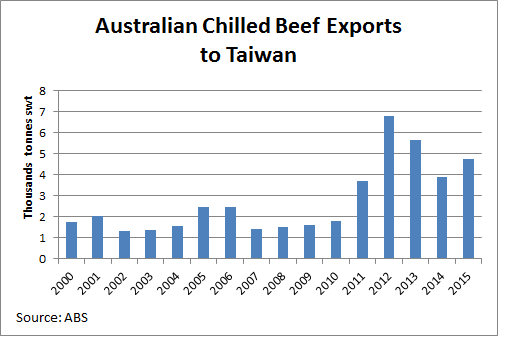

- Taiwan is our seventh largest market for beef and veal, at 30,983 tonnes swt and worth A$210,831,423 for the fiscal year 2014-15. Some 85% is frozen product, but chilled volumes have increased in recent years, quadrupling between 2000 and 2012. Popular cuts are shin/shank, blade, intercostals, manufacturing and thick flank/knuckle.

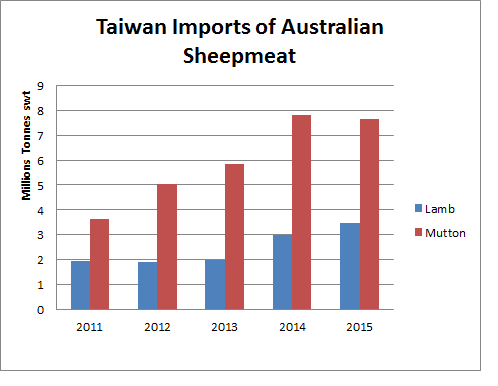

- In terms of Australian sheepmeat exports, Taiwan is our twelfth largest customer, at 11,104 tonnes swt and worth A$55,120,113 for the 2014-15 fiscal year.

- It is the sixteenth largest lamb importer (3,454 tonnes swt), of which most is frozen product, but there is a growing volume of chilled lamb. Cuts are mostly frozen manufacturing product, followed by breast & flap and shank. Chilled lamb is mostly shoulder.

- Seventh largest mutton importer (7,650 tonnes swt) of mostly frozen manufacturing product.

- Australian lamb exports to Taiwan have increased significantly over recent years, with lamb chops prepared in western style growing in popularity.

- Interestingly, many Taiwanese consumers are unaware of the difference between sheep meat and goat. In Chinese, the single character for “yang” covers goat and sheep. Indeed, goat is often mixed with mutton for Chinese herbal hot-pot.

- The unit price of Australian goat to Taiwan for the 2014-15 fiscal year was A$5.03 per kilogram, compared to A$5.68 for lamb.

- Taiwan is our fourteenth largest market for beef offal, at 3,176 tonnes swt and valued at A$17,217,736 for the 2014-15 fiscal year, of which most is frozen tripe and tendon.

E-commerce and grocery retail trends in Taiwan

- E-commerce in Taiwan has grown strongly with the rise of smartphones and social network platforms, recording double-digit sales growth in recent years. E-commerce sales are expected to surpass NT$1 trillion (US$33.6 billion) in 2015, up from NT$767 billion (US$25.7 billion) in 2013 (Taiwan Ministry of Economic Affairs).

- Food safety and quality are top priorities for Taiwanese consumers and retailers have responded by focusing on improving quality control.

- Taiwan has an ageing population and small family sizes, increasing demand for healthy and fresh food products as well as ready-to-eat food in smaller pack sizes.

- In the grocery and food sector, traditional trade (such as wet markets and small independent stores) still plays an important role in Taiwan but is changing as hypermarkets and supermarkets position themselves as fresh food providers and focus on improving shopper experience by enhancing ranges and services.

- Taiwan has the highest number of convenience stores per capita in the world.

- Some retailers are beginning to take advantage of increasing cross-border trading to strengthen connections between stores in Taiwan, Hong Kong and mainland China (IGD).

Taiwan’s economic outlook

- Taiwan has been one of the most robust, high growth economies in Asia and is highly dependent on international trade. In 2012, Taiwan’s trade was valued at over US$650 billion, making it the world’s 19th largest trader even though it is only the 28th largest economy in the world. In terms of imports, over 77% of Taiwan imports are of agricultural goods and raw materials, reflecting the country’s limited arable land and lack of indigenous natural resources (The Brookings Institution).

- Taiwan is facing similar economic challenges to other developed economies. Taiwan's future development will be aimed at continuing the diversification of its trade markets and accelerating its transformation into a high technology and service-oriented economy, fulfilling its desire to become an Asia-Pacific "regional operations center".

- Taiwan’s economic growth slowed sharply in the second quarter of 2015 with GDP growth at 0.5% annually. This downturn has been driven chiefly by slumping exports due to declining foreign demand for electronics and machinery, the bulk of Taiwan’s export goods, as well as falling growth in the country’s main export destinations, China and Hong Kong (Focus Economics). The growth forecast for Taiwan for 2016 is expected to be around 2.2% (IMA Asia).

- By contrast, real consumer demand growth was considered surprisingly firm for the first half of 2015, rising by 3.2% year-on-year but is expected to drop to 1.5-2.0% for 2016, as stagnating incomes and rising living costs add pressure on consumer spending (IMA Asia).