Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

July increases in beef exports to China in context

20 August 2015

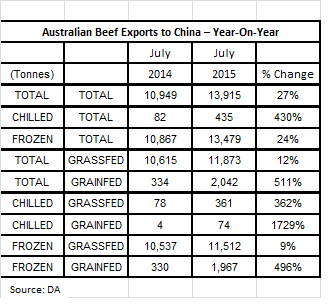

The strong year-on-year increase in Australian beef exports to China in July is positive news for Australian exporters, but needs to be understood in the context of changes in market access and policy changes in China.

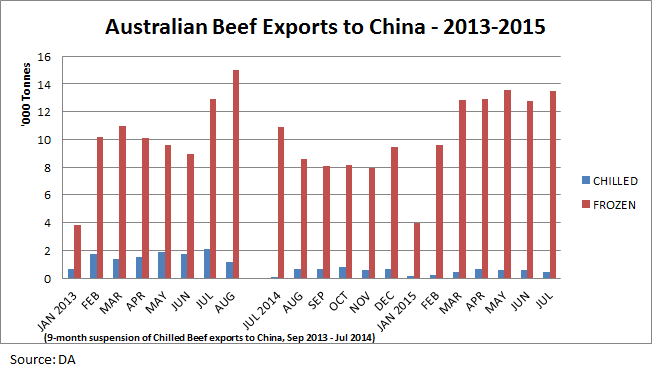

Chilled beef exports to China from all eligible export countries, including Australia, were suspended in September 2013 for nine months. In early July 2014, 10 plants were approved in Australia for chilled beef processing for export to China. Chilled beef exports have not yet recovered to the levels seen prior to the 2013 suspension, though frozen beef has seen growth over the past 12 months.

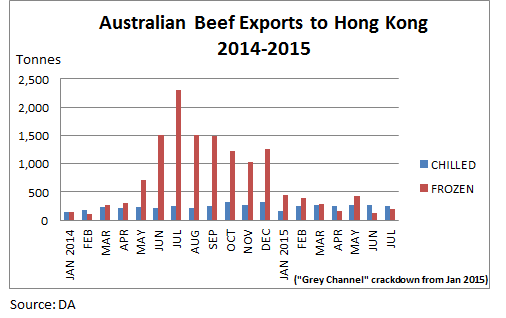

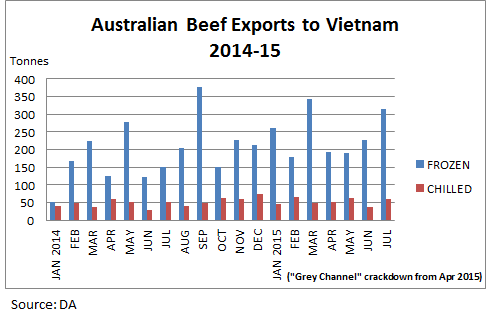

The “grey channel” crackdown by Chinese authorities this year has also positively impacted Australian beef exports (which do not need to use “grey channels”). The “grey channels” are those by which unauthorised and often inferior beef imports enter China illegally, mostly through Hong Kong and Vietnam but also Cambodia and Myanmar. Industry sources estimate that about 750,000 tonnes of beef enters China through these channels each year.

This year, there have been two waves of crackdown – one in January, which focused on Hong Kong, and another in April, aimed at Vietnam. The volume of frozen beef imported into Hong Kong has seen a 13% YTD decline overall this year compared to 2014, which has also impacted Australian exports.

In addition, Australian beef exports to Vietnam also saw a decrease in April this year, but have since recovered. US and Brazilian beef exports to Vietnam also dropped this year.

China’s direct official imports of frozen beef have been increasing this year. Official China import statistics record a 26% increase in frozen beef imports overall YTD up to June this year. Although Australia remains China’s number one source of frozen beef, our percentage share YTD has fallen slightly, whilst other countries such as Argentina, New Zealand and Uruguay have seen significant increases.

China’s “grey channel” crackdowns, seen by industry experts as the most intense and longest-running in memory, are part of a general tightening around food safety. A new Food Safety Law will come into effect in China in October 2015, the first update of its food safety law since 2009. Many consider it will be the harshest food safety regulation to date, and will have a significant impact on both domestic and foreign firms involved in food business in China. The new law grants regulatory bodies more authority, sets harsher penalties for violations and introduces more guidelines for consumer product manufacturing and production. Whilst food scandals in China have effectively benefited foreign firms, as the Chinese middle class often trusts foreign imports over local products, the new law is designed in part to improve domestic food production standards and consumer confidence in Chinese produce. This will increase competition for foreign firms over the medium to long term.

While these developments highlight some of the challenges of trade with China, it also underscores the potential opportunities to grow export volumes and value through official, direct channels. The Australian red meat industry is currently working to grow the number of approved exporters to meet the large and growing Chinese consumer demand for safe meat and is focusing on leveraging the competitive advantages of Australian red meat, in order to successfully differentiate and compete globally in the medium to long term.