Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Back to Prices & Markets

Greater China red meat export update for September 2015

15 October 2015

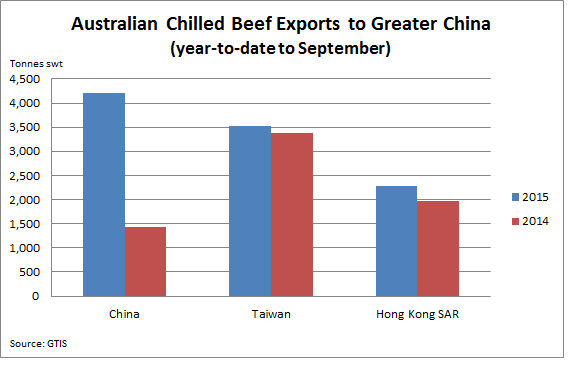

Australian exports of chilled beef to China, Hong Kong and Taiwan were up for the year to September this year compared with 2014. Other positive news includes growth in chilled lamb and chilled beef offal exports to Taiwan.

CHINA

- Australia’s total beef exports to China were up 10% for the year to September in 2015, compared with 2014. Frozen beef exports were up 7% year-to-date, with carcase down somewhat but increases seen in short ribs, manufacturing beef and blade. Australian beef offal (frozen) to China was steady.

- Australia remains the sole official supplier of chilled beef to China. The volume of Australia’s chilled beef to China is up almost 200% year-to-date to September for both grassfed and grainfed product. However, volumes are still recovering from the 9-month suspension which ended in July 2014, with just 10 plants approved to export chilled beef to China. In terms of cuts, short ribs and ribs are up year-on-year, while striploin and brisket are down somewhat.

- China Customs data recorded China’s first shipment of frozen beef from Brazil (since December 2012) in August 2015 at 3,006 tonnes swt at a unit price of USD5.25 per kilogram almost identical to Australia's beef unit price of USD5.29 per kilogram for the same month.

- Frozen lamb exports were down 23% year-to-date 2015 compared to 2014, as were frozen mutton shipments (-39%) with the biggest falls seen in frozen lamb carcase and shank, frozen mutton manufacturing and carcase. In 2015, neck has become a relatively more popular cut for frozen lamb and leg has grown for frozen mutton.

- Australian sheepmeat exports to China remain subdued as China's domestic supply remains plentiful and the wholesale price for mutton continued its downward trajectory - from RMB53.14 per kilogram for the first week of January 2015 to RMB46.99 in mid-September.

- Australia’s exports of goat meat to China are down somewhat (-31%) year-to-date 2015 compared to 2014 – largely a result of lower slaughter and production.

HONG KONG

- Whilst Australian frozen beef exports to Hong Kong were down significantly year-to-date in 2015 compared to 2014, Australia’s chilled beef exports were up 17%, and up somewhat more for grainfed than grassfed. Australia is exporting more chilled blade, rump and chuck roll as well as more frozen ribs, chuck and striploin to Hong Kong this year.

- Brazil has significantly increased its share of Hong Kong chilled beef imports from 8% to 21% so far in 2015, with their lower priced product. Japan has also increased their smaller share (2.8%-5%) with their high value product (USD51.88 per kg) for the same period.

- While the overall volume of Australian beef offal to Hong Kong is fairly steady year-to-date, the volume of frozen tendon alone is up from 650 tonnes swt in the first nine months of 2014 to 793 tonnes swt in 2015, which has contributed to the significant increase in the value of offal exports to Hong Kong this year.

- Australian frozen lamb and frozen mutton exports to Hong Kong are both down substantially year-to-date for 2015 compared to 2014 (-85%), as they are for most countries. Imported volumes are down most for breast and flap, manufacturing, carcase and neck.

- On the positive side, Australia’s export of chilled lamb to Hong Kong is relatively steady. However, New Zealand sent its first shipment of chilled lamb (1.5 tonnes swt) to Hong Kong in August at a competitive price (USD10.97 per kilogram compared to USD13.80 for Australia’s product the same month).

- Another positive is that Hong Kong imported more goat meat from Australia this year-to-date to September compared to 2014 (up 33%).

TAIWAN

- Australian frozen beef exports to Taiwan are down somewhat for the year to September 2015 compared with 2014, especially for frozen chuck roll, manufacturing and thick flank/knuckle. However, the volume of frozen brisket is up 123% for the same period.

- In contrast, the volume of chilled beef (grassfed) has grown a little (+5%), particularly for chuck roll and silverside/outside.

- Although Australian frozen beef offal exports to Taiwan are down year-to-date, chilled offal has grown this year so far (+50%), with notable growth seen in chilled cheek and skirt volumes, though the total volume of chilled offal is comparatively small (48 tonnes swt year-to-date to September 2015).

- Australian chilled lamb exports to Taiwan are up slightly year-to-date for chilled product (+9%), especially for shoulder and rack. The year-to-date volume of frozen lamb exports is steady but up for rack, breast and flap and shoulder.

- The volume of frozen mutton to Taiwan is down year-to-date compared to 2014 (-19%), particularly for neck, leg and bone-in loin but steady for rack and manufacturing.

- Australian goat meat exports to Taiwan are also down year-to-date (-32%).