Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Finished cattle offerings through Queensland saleyards decline

25 November 2015

Slaughter cattle purchases through Australian saleyards have been in decline in recent years, as a greater proportion of finished cattle are destined for direct-to-works programs. The decrease is largely influenced by Queensland, while NSW has declined slightly, and Victoria and SA are unchanged.

However, this certainly does not mean the saleyard selling option is becoming irrelevant, due to the large number of store cattle transactions, feedlot purchases and, while declining, still very large number of processor acquisitions. During the 2014-15 financial year, MLA saleyard survey results indicate 5.21 million head went through Australian saleyards, almost half a million head more than during 2011-12.

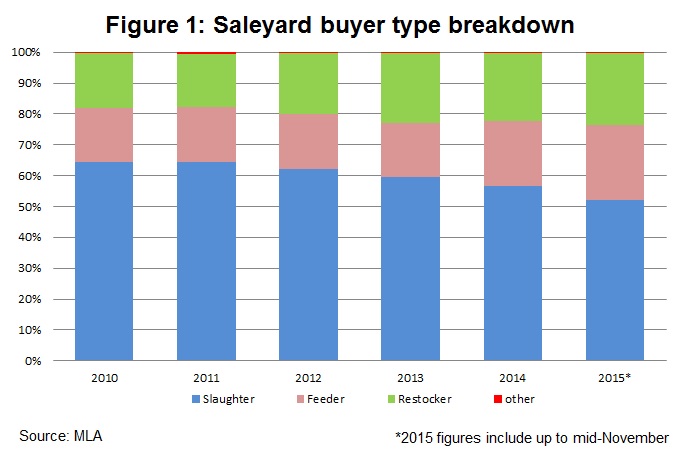

Figure 1 illustrates the breakdown of saleyard purchases by buyer type at MLA reported saleyards (sale data excludes store markets, with the exception of Roma Store). As illustrated, processors make up the majority of overall saleyard purchases, however this has been in gradual decline. In 2010, slaughter cattle made up 64% of saleyard throughput while, so far in 2015, they have made up 52%. The decline in slaughter cattle has been offset by an equal increase in market share by restockers and feeder buyers, both of which have accounted for 24% of purchases this year-to-November.

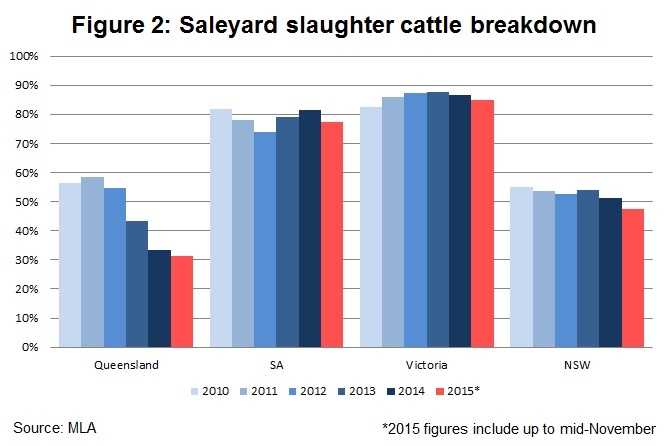

Figure 2 breaks down the proportion of slaughter cattle purchased through saleyards at the state level. Clearly, Queensland and, to a lesser degree, NSW have driven this trend.

Part of this trend can be explained by the transition towards MSA grading. While still possible to go through the saleyard system, almost all MSA cattle are sold direct-to-works. In 2014-15, 3.2 million cattle went through the MSA program, more than double the volume recorded in 2010-11. Similarly, other farm assurance programs restrict cattle to be sold over-the-hook.

A second major trend reducing the presence of processor buyers at saleyards has been the transition to increased numbers of cattle on feed. Numbers released this week from the ALFA/MLA feedlot survey indicate cattle on feed in the September quarter remained close to a record high, at 961,328 head. Year-to-September grainfed cattle turnoff was 2.2 million head, up 12% year-on-year and accounting for 32% of total adult cattle slaughter. While processors have more cattle available from feedlots, this trend also explains the increased presence of feeder buyers in the physical market.

The increased MSA grading and the number of cattle on feed has predominantly been located in Queensland and NSW, explaining why these states have recorded the decreased presence of processor purchases through saleyards.