Eastern states lamb indicators outperform WA in 2015

National lamb saleyard indicators performed well in 2015, compared to last year, across all states and categories, except in WA – where most categories averaged lower year-on-year.

Restocker lambs (0-18kg cwt) made the most gains in NSW in 2015, up 18% (or 85¢) year-on-year, averaging 544¢/kg cwt. Restockers in Victoria and SA averaged 522¢/kg cwt (up 14%, or 63¢) and 552¢/kg cwt (up12%, or 57¢), respectively. Lambs returning to the paddock in WA eased marginally in 2015, to 464¢/kg cwt, while those in Tasmania were up 5%, or 24¢, on 527¢/kg cwt.

Light lambs (12-18kg cwt) remained within a narrower range across the eastern states in 2015, with NSW up 14% (or 64¢) on 517¢/kg cwt, and Victoria up 10% (or 47¢) on year-ago levels, averaging 515¢/kg cwt. Light lambs in SA averaged 509¢/kg cwt, 18% (or 78¢) higher year-on-year, and those in Tasmania increased 13% (or 58¢), to average 507¢/kg cwt for the year. In contrast, in WA, light lambs averaged 458¢/kg cwt – 16¢ lower year-on-year, and at least a 50¢ discount to the eastern states.

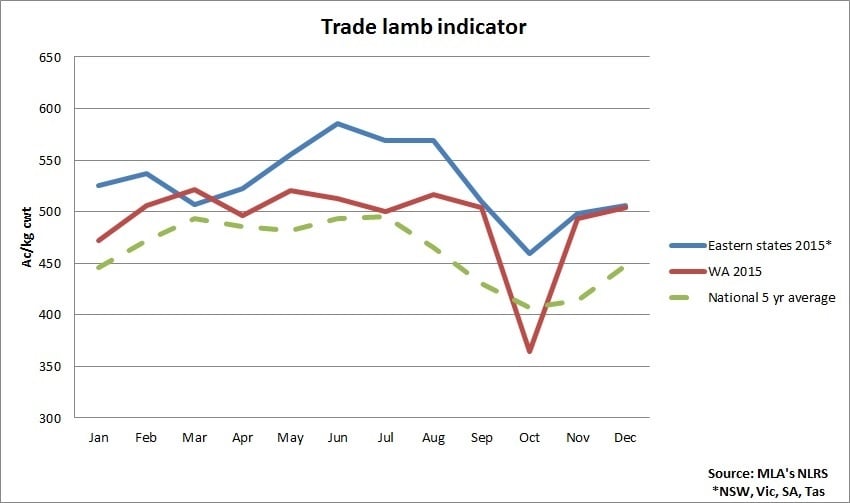

Trade lambs (18-22kg cwt) were dearest, on average, in Tasmania during 2015, at 538¢/kg cwt (up 7%, or 37¢), closely followed by NSW, with an average of 536¢/kg cwt for the year – 10%, or 48¢, dearer than 2014 levels. Victorian and SA trade lambs averaged 525¢/kg cwt (up 11%, or 50¢) and 509¢/kg cwt (up 11%, or 49¢) in 2015, respectively, while equivalent lines in Tasmania were 7% (or 37¢) dearer year-on-year, at 538¢/kg cwt. In WA, trade lambs eased slightly (3¢) from last year, to 489¢/kg cwt.

Heavy lambs (22-30kg cwt) were at premium in NSW, averaging 537¢ in 2015 – 14%, or 67¢, higher than 2014, and a margin of 14¢ to 28¢ dearer than the rest of the eastern states. In WA, however, heavy lambs averaged 3%, or 13¢, below year-ago levels, at 472¢/kg cwt.

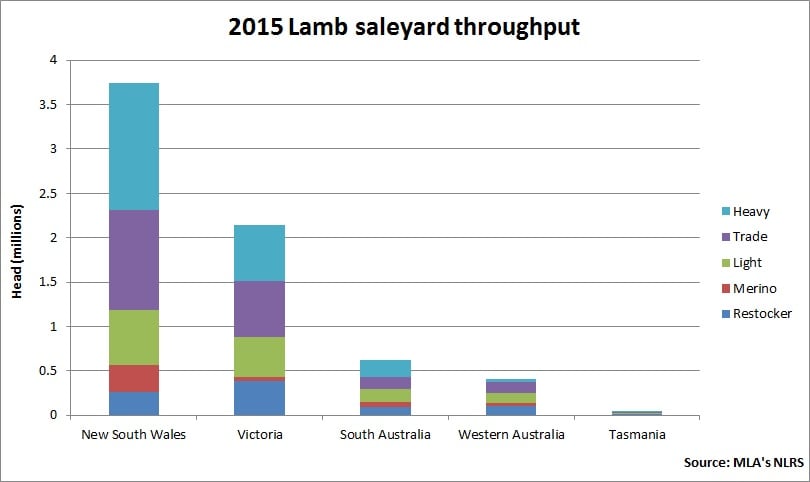

The total number of lambs yarded nationally during 2015 at saleyards reported by MLA was 5%, or 438,760 head, lower year-on-year, at 7.72 million head (week ending 11 December 2015). Lamb saleyard throughput in NSW and Victoria decreased 4% and 2% from year-ago levels, to 4.0 million head and 2.4 million head, respectively. Offerings across SA saleyards were 13% lower, at 719,402 head, while numbers in WA dropped 18% year-on-year, at 533,096 head. Lamb supply in Tasmania was fairly steady with last year, at 53,542 head penned.

The proportion of restocker and Merino lambs of the total number through saleyards remained the same as in 2014, at 11% and 6%, respectively, while light lambs made up 18% (compared to 17% in 2014). The share of trade lambs in saleyards declined from 28% in 2014, to 26% in 2015, while heavy lambs – which accounted for the largest proportion – eased one percentage point year-on-year, to 30% in 2015.

In line with lower numbers through saleyards, eastern states lamb slaughter was down 2% over the same period, at 17.8 million head (week ending 11 December, MLA). Processing in Victoria and NSW was down 3% and 1% in 2015, at 8.6 million head at 4.6 million head, respectively, while SA lamb kill was 4% higher year-on-year, at 3.6 million head. Lamb slaughter in Tasmania declined 7%, to 690,108 head, and Queensland recorded a 22% drop in lambs processed compared to 2014, at 238,585 head.

As the Australian lamb industry becomes increasingly export orientated, with an estimated 56% of production exported this year, demand for lamb will be largely driven by international customers. The expectation of the A$ to hover just under US70¢ throughout 2016, combined with lower lamb production forecast from Australia’s major competitor, New Zealand, should assist the Australian lamb market in the year ahead.