Consistency in live-export to slaughter ratio

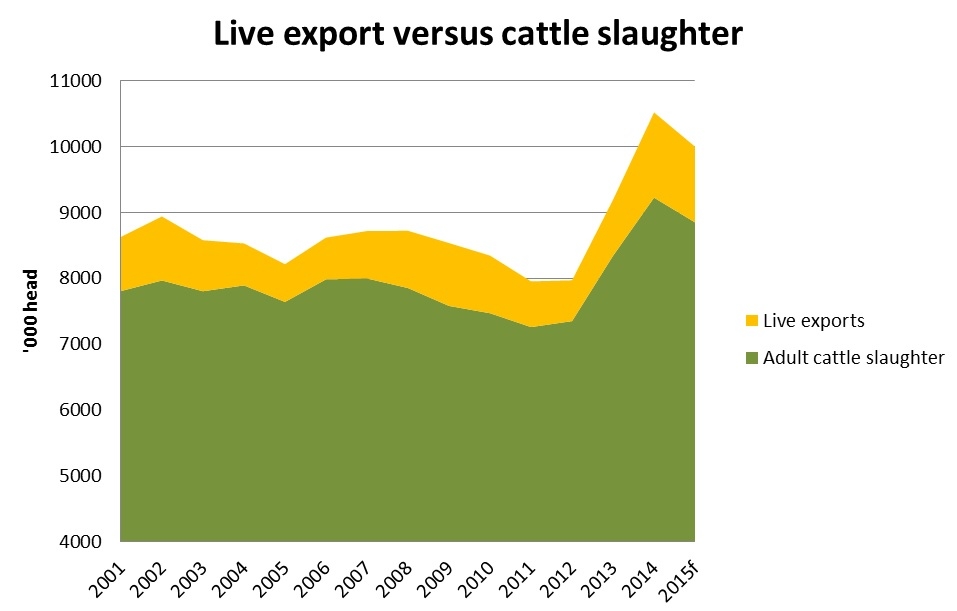

The contribution of live exports to total adult cattle turn-off for the past 15 years has consistently only ranged between 7% and 12% – a remarkably tight range considering trade disturbance, seasonal variances and fluctuations in prices.

Interestingly, the lowest year for live export contribution (7%) to turn-off was in 2005, when there was strong feedlot and processor demand in southern markets for cattle as a result of exclusive Japan and Korean market access. Perhaps even more interestingly, during 2011 and 2012 when the live trade to Indonesia was limited, live cattle exports still accounted for 9% and 8% of turn-off, respectively.

The year when live exports contributed the largest proportion (12%) was 2014 – the same year live exports hit a record – while at the same time, meat works were booked to capacity and many reportedly had three month waiting lists for cattle.

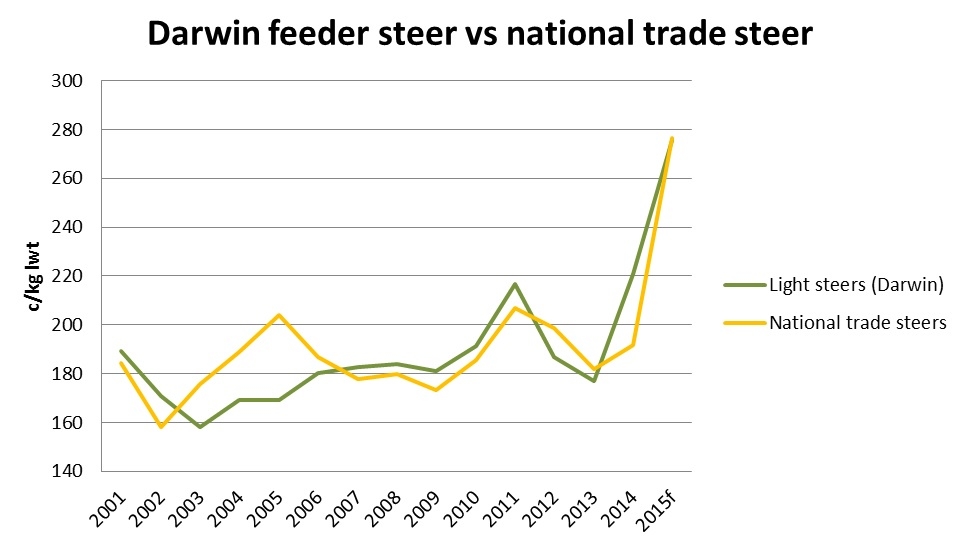

When comparing the light steer indicator from Darwin to the national saleyard trade steer indicator, since 2000, the live export indicator is at a premium when live exports exceed 10% of turn-off and vice versa. So basically, if there is premium on offer, the greater the contribution of live exports to turn-off will be. And it is the producers with the option to sell to either market that cause the sway, which are predominantly in Queensland.

The most obvious limitation to breaking beyond 12% is shipping capacity, meaning regardless of how great the premium for live cattle is over southern markets, only a limited number can be exported.

Further limiting live exports in 2016 will be the relative strength of southern markets, potentially drawing northern cattle that might otherwise be destined for live exports south.

In terms of a base to the contribution of live export to Australian cattle turn-off, live dairy cattle combined with the range of markets Australia exports live cattle to will more than likely form a 7% base each year.

Next year in particular will be an interesting one to monitor, because as evidenced in 2014, it is possible to export 1.3 million head of live cattle. Hypothetically, if this were to eventuate again and the cattle were substituted from processing, live exports will break outside any long term trends and account for 16% - but this is unlikely due to the expected southern market strength. Furthermore, as seen in the past, the markets tend to cause live export contributions to cattle turn-off to be limited to a range between 7% and 12%.